The Freelancer’s Guide to Money Management and Financial Freedom

Published on: 02/15/2019

The life of a freelancer may seem highly appealing. You get to control your income, make your own schedule, work on your own terms, and create your ideal work-life balance. For these reasons and more, 33% of the workforce—or 53 million Americans—are now working as freelancers.

With this freedom, however, comes discipline. Freelancers are required to pay extra attention to their finances, ensuring they maintain good credit and avoid debt. They also need to seek out their own benefits like health insurance and a retirement savings plan that a traditional employer would normally provide. These considerations are what keep many Americans from freelancing.

If you belong to the millions of freelancers in America, you’ll need to pay special attention to managing your income, filing taxes correctly, getting insured, and saving for retirement. Read on to learn how to set yourself up for freelancing financial success.

Table of Contents

Managing Income

Contrary to popular belief, freelancing in America pays well. The average freelancer makes 17% more than a traditional full-time worker. With the ability to control your own income, there’s also more room for error. That’s why it’s especially important to budget carefully and meticulously manage your cash flow.

Setting Competitive Rates

The first thing you’ll need to decide is how much you’ll charge for your work. Figure out what your desired annual income is. Then, do some research on the market to get a general idea of what others charge to ensure you’re not grossly underselling yourself.

Next, estimate how many hours per year you’ll be working. Remember to factor in vacation time and sick days, and decide if you’ll work weekends. Once you have an estimate of how many hours per year you’ll work, factor in the cost of doing business. This could include any supplies or bills necessary to do your job. After this, you should be able to calculate an hourly rate.

Remember that while an hourly rate is a good place to start, it can put a cap on your earning potential. It also affects your perceived value from a client’s perspective. For example, charging $300 for a logo seems like a lot better value than spending 2 hours on a logo at $150/hour. Consider charing on a per-project basis to maximize income.

Tracking Your Income

You’ll likely have multiple invoices from various clients, so it’s important to keep everything organized. Don’t rely on memory—if you overstate your income, you’ve overpaid in taxes, and if you understate your income, the IRS will likely charge you penalties. Likewise, don’t wait for 1099 forms to come in from your clients—often times the number on the 1099 is wrong, and you’ll have no way of knowing unless you’ve kept track of income yourself.

Instead, leverage software to help. It can be something as simple as an excel spreadsheet, or you can opt for a more robust bookkeeping software. Steady is an app that helps freelancers increase and track their income.

Separating Your Accounts

When it comes time to review your budget or pay taxes, you’ll find it so much easier to determine which expenses are business-related and which are personal if they are in separate accounts. Consider the following structure:

- Business Checking: This is your business’s account for client payments and business expenses. Charge anything necessary for doing business to this account.

- Business Savings: This is a place to put aside money for quarterly taxes. Separating these funds will give you a better idea of how much money your business actually has.

- Personal Checking: This is your regular checking account for any personal expenses.

- Personal Savings: This is your emergency fund, which should be considerably larger as a freelancer since income fluctuates. Don’t touch this unless there’s a true emergency.

Building Credit

Applying for loans or credit cards can be trickier as a freelancer, since verifying income isn’t as easy as showing a W-2 form. Ways to show proof of income as a freelancer include previous tax returns and bank statements, given that you’ve saved diligently.

If you’ve certified your business as an LLC or DBA, consider taking out a credit card in your business’s name. There are advantages of taking out a line of business credit versus personal credit—namely, promotional interest rates.

If your income prevents you from getting a loan or line of credit, consider asking a family member or close friend to be a co-signer. Just be absolutely sure to make payments on time, because if you don’t, the other person’s credit will be hurt just as badly as your own.

Filing Taxes

The IRS considers freelancers to be self-employed, so you’ll need to file your taxes as a business owner would. While you’ll likely be able to claim more deductions, you’ll also owe more in the form of self-employment tax.

Since you don’t have an employer to take taxes out of your pay like traditional workers, you’ll need to pay extra attention to taxes. Instead of filing annually, you’ll make estimated quarterly payments every three months. If you’re unsure of how to estimate your income, use last year’s tax return as a starting point.

Deductions

Generally, freelancers can write off any expenses as tax deductions if they are deemed “ordinary and necessary” by the IRS. As a general rule of thumb, if you would still have an item even if you weren’t a freelancer, it’s probably not tax-deductible.

Here are some common categories for tax deductions:

- Equipment and materials

- Office expenses

- Business-related food

- Business travel and lodging

- Licensing, registration, or certifications

- Classes related to your business skill set

1099-MISC Forms

You’ll likely get numerous 1099-MISC forms, one from each of your clients. Your clients are required to send this to you by January 31st, and you’ll use your 1099’s combined with your own records when doing taxes. They’re only necessary if the amount paid to you over the past year was over $600.

Remember that you still need to report income even if you didn’t receive a 1099 for it. You may not receive a 1099 form if your client is from another country, or if they paid you less than $600 over the year. However, the IRS still expects you to report this income.

Self-Employment Tax

If you make more than $400, you’re subject to a self-employment tax of 15.3%. This is broken down into 12.4% for Social Security and 2.9% for Medicare. Traditional employees have this already taken out of their paycheck, so you’ll have to make sure to set aside the proper percentage of your income in your business savings account so that this doesn’t come as a surprise every quarter.

Getting Insured

As a freelancer, it’s your job to find insurance that would have otherwise been a part of a company’s benefit package. Obvious choices include health and life insurance, which can be trickier to shop for when you’re independently working. There are also some additional types of insurance that freelancers specifically should consider.

Liability Insurance

Both general and professional liability insurance protect you and your business from the burden of a lawsuit. It will cover you in the case of a mistake or an accident, whether or not it was your fault. Some clients require freelancers to have liability insurance before hiring them for a job. The difference between general and professional liability insurance lies in the type of risk they cover. Give yourself the peace of mind by choosing the one that’s right for you.

Professional liability insurance covers you against claims of negligent performance of your professional services or advice. It will defend you if you haven’t made a mistake and are faced with unfounded accusations.

General liability insurance covers you against bodily injuries caused to people or damage caused to someone else’s property resulting from your everyday operations.

Home or Renter’s Insurance

The majority of freelancers work from a home office. In the rare case that something unfortunate happens, your losses will be even greater if you operate your business from your home. That’s why it’s crucial to protect your house or apartment and all the belongings in it.

Many people who rent wrongly assume that, in the case of a catastrophe or theft, their belongings will be covered by their landlord’s policy. Many people also wrongly assume that renter’s insurance is too expensive. Both are false. While the building is covered in case of a disaster, your personal belongings are not—and protecting them with renter’s insurance can be as cheap as $17 a month. If you’re renting, consider making the investment for peace of mind.

Similarly, if you work from a home that you own, it’s important to get homeowners insurance. This will be more expensive than renter’s insurance because it protects your home as well as the items inside. And if you think you don’t have enough valuable stuff to make it worth it, think again—the average person owns about $20,000 worth of personal belongings.

Health Insurance

Getting proper health insurance is one of the most important considerations for freelancers as most employers do not offer coverage for these types of employees. It’s especially important to find a good plan because if you become sick, you’ll likely not be earning any income until you’re well enough to work again.

Below are some of the most common health insurance options for freelancers and independent contract workers:

- Affordable Care Act: Find coverage through the healthcare marketplace. Enrollment begins in November and becomes effective in January.

- Spouse or domestic partner’s plan: If applicable, this option may save you money because employer-based plans charge a lower premium for dependents.

- Cobra Coverage: If you recently left your job to venture out as a freelancer, this can help convert your group plan into an individual plan.

- The Freelancer’s Union: This is a good option if you want supplemental dental and life insurance. The website also provides help on picking the right plan for your needs.

- Professional associations: If your profession has associations, you may be able to get group insurance similar to the group insurance through an employer.

Life Insurance

If you have a family or dependent that will be financially affected in the case that anything happens to you, you’ll want to have life insurance. Since most people get life insurance through their employer, freelancers have to shop around for their own plan. Rates can be as cheap as $10/month—you’ll just need to decide if term life insurance or permanent life insurance is more appropriate for you.

Term life insurance is simpler and more affordable than permanent life insurance. You choose an amount of time and pay premiums during that time. Your beneficiaries would receive benefits during this time. For example, if you just had children and wanted them to be protected until they’re old enough to be financially independent, you may set your term for 20 years.

Permanent life insurance lasts your entire life. It often involves more expensive premiums because the insurance company knows they’ll have to pay out at some point. You generally only need permanent life insurance if you are a high net worth individual and want to leave behind a large sum of money.

Saving For Retirement

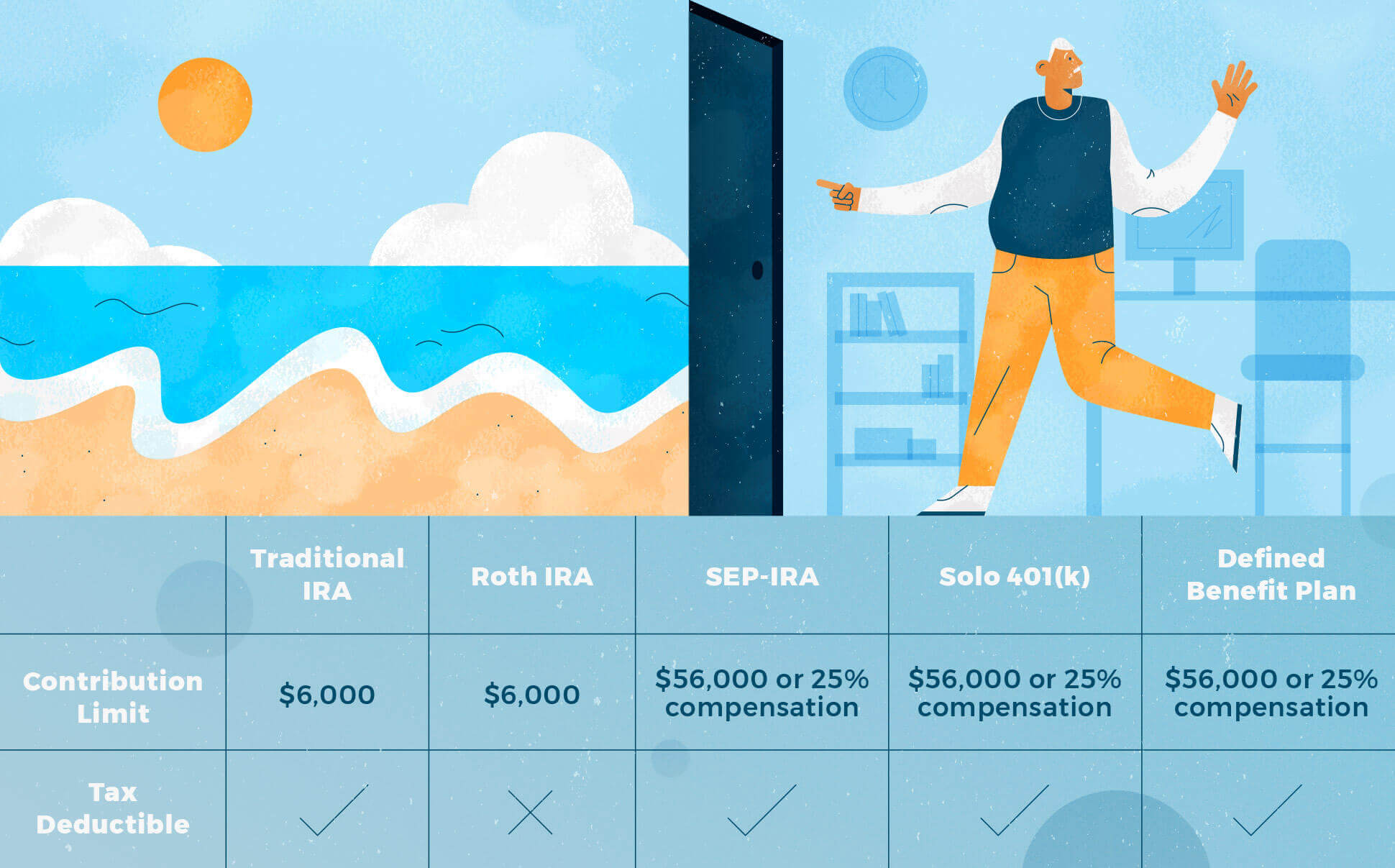

Having a retirement plan is an important and essential part of financial health. As a freelancer, you won’t have access to 401(k) matching from your employer, but there are still other great options to consider. Contributing 15% of your after-tax earnings is a good place to start, but consult your financial advisor if you’re unsure.

Here are some ways to save for retirement as a freelancer:

Traditional or Roth IRA

If you’re just leaving a traditional job, you can roll your 401(k) into an IRA. These are best for those contributing less than $6,000 per year, or $7000 if you’re over 50 (as of 2019). Contributions for traditional IRA’s are tax deductible. For Roth IRA’s, contributions are not tax deductible, but when you can withdraw the funds in retirement tax-free. You set one up fairly easily by visiting an online brokerage.

SEP-IRA

Like a traditional IRA, SEP-IRA contributions are tax-deductible. The difference lies in contribution limits; you can contribute nearly ten times the amount of traditional or Roth IRA’s, with a few limitations. Contributions cannot exceed $56,000 or 25% of your compensation—whichever amount is smallest. You should also consider a SEP-IRA if you have any employees, as traditional and Roth IRA’s offer individual plans only.

Solo 401(k)

You can only contribute to a solo 401(k) if you don’t have any employees, however, a spouse may be included. You make contributions pre-tax, lessening your taxable income, and the withdrawals in retirement are taxed as income. Like a SEP-IRA, the contribution limit is $56,000. However, you must be registered as a business or have an employer identification number.

Defined Benefit Plan

A defined benefit plan is best for those with no employees who want to save aggressively for retirement. Contributions are tax-deductible and taxed as income in retirement. Limits for contributions are calculated based on the benefits you want to receive in retirement, your age, and the expected investment return. The downside is that they’re expensive with high setup and annual fees. The upside is that you can contribute anywhere from $50,000–$80,000 annually.

Working as a freelancer offers freedom, flexibility, and the ability to control your own income and standard of living. However, the added responsibility of managing income, filing taxes, getting insured, and saving for retirement makes freelancing something that many choose to avoid. Ultimately, the choice to work as a freelancer or a traditional worker is up to you. Now that you have the tools under your belt to tackle your finances as a freelancer, you can make good decisions that will boost your credit and carry you into retirement with a solid foundation.

Additional Resources

- About Form 1099-MISC

- Self-Employment Tax

- Self-Employment Tax Calculator

- Affordable Care Act

- Cobra Coverage

- The Freelancer’s Union

- Financial wellness for freelancers from The Simple Dollar

Sources: TurboTax | Freelancers Union | Time | Insurance.com | Esurance | IRS

About the Author

Jeff Smith is the Head of Content and SEO at Self.