What Is a Tradeline & How Does It Impact My Credit Score?

Published on: 01/10/2023

A tradeline is a record of any type of credit you have that appears on your credit report.[1] Credit reporting agencies use this term to describe your credit accounts and the information associated with them, including who the lender is and the amount of debt. Each credit account has its own separate tradeline.

Creditors can use data from your tradelines to establish the bigger picture of your likelihood to pay back loans, or whether you seem like a reliable borrower. The data in tradelines is also used to help calculate your credit score.

Table of Contents

- What is a tradeline?

- Types of tradelines

- How tradelines can affect your credit score

- How long do tradelines stay on your credit report?

- What happens if a tradeline is removed from your credit report?

- Buying tradelines may be risky

What is a tradeline?

A tradeline is a record of activity for any one of your credit accounts. Tradelines show up on your credit report as a line that records the trade between you and your creditor. This credit activity gets compiled into your credit report by the major credit reporting agencies. A tradeline is meant to both identify the credit activity or debt and include information about the account.[1]

Tradelines include both installment tradelines, like auto loans, personal loans and student loans, and revolving tradelines, like credit card accounts and other lines of credit.

Looking through the tradelines on your credit report can help you get a better sense of your personal finances. Not only does it make you aware of the information in your credit file, but it also helps you ensure that the information being reported is accurate, so that you aren’t harmed by incorrect negative information.

A tradeline isn’t just for a lender’s benefit — it can provide a wealth of information for you, too. Some details that are generally included in tradelines are:

- Reporter information

- Account number

- Equal Credit Opportunity Act (ECOA) codes (such as, A for authorized user, I for individual account, and so on)

- Type of account

- Loan amount or credit limit

- Outstanding balance

- Payment status

- Account open and close dates

- Minimum payment

- Recent activity on the account

- Recent balance on credit cards

- Remarks

- Delinquency details

Keep in mind that creditors decide what information is included on tradelines, so some of the above might be different or missing from your tradeline, depending on the creditor.[2]

Types of tradelines

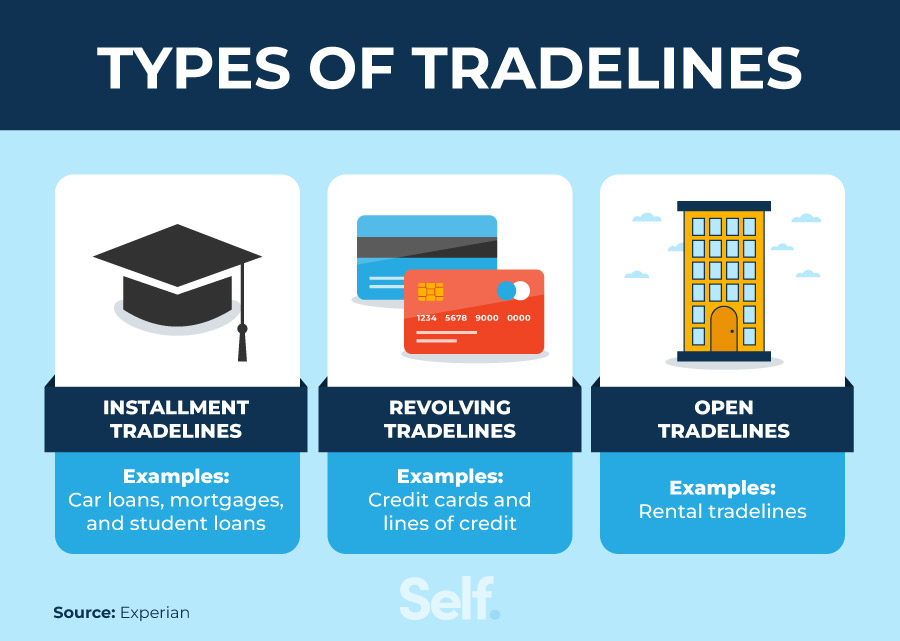

Just as you may obtain different types of accounts and credit, credit tradelines come in different types as well. These sections break down some of the most common types of tradelines.

Installment tradelines

An installment tradeline is a fixed loan that you have to pay back. It’s essentially when an installment loan of yours, like a student loan, auto loan, mortgage or other personal loan, is included on your credit report. If you take out a $10,000 auto loan, for example, your credit report will show an installment tradeline with the same opening balance.

Revolving tradelines

A revolving tradeline is an open-ended account that creditors and consumers can use multiple times without a fixed timeline. Examples include credit cards or lines of credit, which involve fluctuating account balances within a set credit limit, available credit and monthly payments based on use.

Open account tradelines

An open account tradeline refers to the credit activity record for any currently open credit account you use. This can include the other types of tradelines, but can be more broad, extending to anything defined as an obligation that must be paid in full every month. For example, rental tradelines from third-party rent reporting services, like LevelCredit, fall into this category.[3]

How tradelines can affect your credit score

All of your reported credit activity can affect your credit score. Positive information on your credit report helps you achieve good credit; negative information, on the other hand, can hurt your creditworthiness.

Tradelines are part of what makes the information on your credit report. Positive tradelines generally help you build credit, while negative tradelines can lower your credit score. Tradeline information is factored into credit scoring models like FICO® [4] based on the following factors:

- Payment history (35%): A consistent on-time payment history helps establish that you’re a reliable borrower. Missing or late payments hurt your creditworthiness.

- Amounts owed (30%): Having large amounts of debt in relation to your credit limits on your credit report may make you seem like a riskier borrower, especially if any of your credit accounts are reported as delinquent or sent to collections.

- Length of credit history (15%): The longer your credit history, the more time you have to establish a consistent payment history. Maintaining tradelines in good standing over the course of months or years demonstrates that lenders can trust in you.

- Credit mix (10%): A mix of installment tradelines and revolving tradelines in good standing shows potential lenders that you can handle multiple responsibilities and manage different types of credit well.

- New credit (10%): While hard inquiries to open new tradelines can temporarily lower your credit score a bit, opening accounts is important for your credit mix and, ultimately, establishing the length of your credit history.

Accounts in good standing may have a positive impact

Accounts in good standing are what make up the positive information on your credit report. They’re accounts that you manage well through consistent, on-time payments over the length of your credit history. Generally, maintaining these accounts has a positive impact on your credit score.

For fixed accounts like installment loans, paying the amount of your monthly payment each month helps keep you in good standing. For revolving accounts, paying off your account balance, staying within your credit limit and keeping your credit utilization ratio (your balance on revolving credit divided by your credit limit) low are key strategies.

Some examples of accounts in good standing may include:

- Student loans you make regular payments on

- Credit cards that you pay the balance in full monthly

- A mortgage you’ve paid consistently for 10 years

If you’re struggling with your credit score or to open new tradelines, you may want to consider becoming an authorized user. An authorized user is someone who has permission to use another account holder’s credit card to make purchases but is not legally required to pay the debt. If the credit card company reports the authorized user’s account to the three major credit bureaus (Experian, Equifax, and Transunion) it could impact their credit score positively or negatively.

Authorized users should look for a trusted cardholder with a record of on-time payments on their card, a low credit utilization rate (CUR, the total balance divided by the credit limit) and a long account history.[5]

Accounts in bad standing may have a negative impact

Accounts in bad standing make up the negative information on your credit report, and generally hurt your credit score. These are credit accounts that are unpaid, especially to the extent of being considered delinquency or going to collections, that have late or missing payments, high amounts of outstanding debt or high credit utilization ratios.

Some examples of accounts in bad standing may include:

- Credit card debt in collections

- Accounts (loans or credit) with late payments

- Accounts closed due to delinquency

Recent changes in the major credit reporting agencies and major credit scoring models may be more forgiving about some negative information. For example, FICO® 9 scores no longer factor in third-party collection accounts that have been paid off in full, and unpaid medical debt is given less negative weight. However, FICO® 9 isn’t as widely used as FICO® 8.[6]

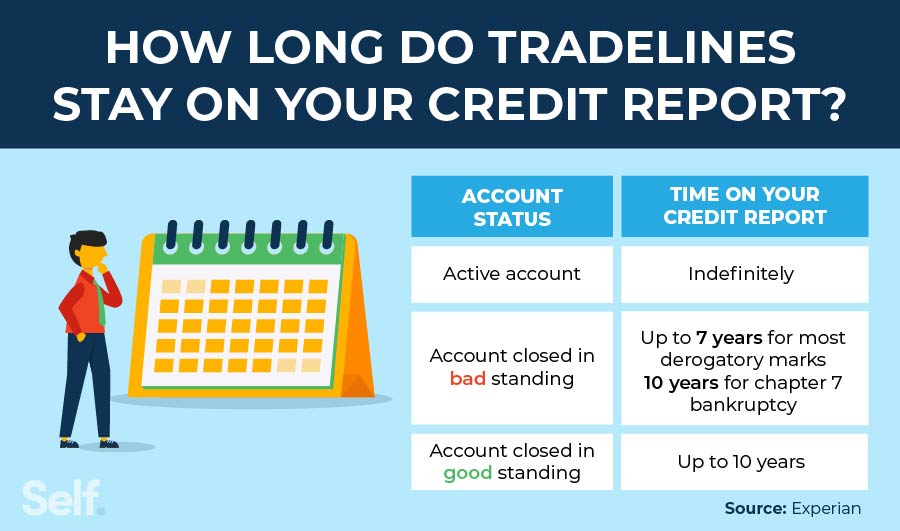

How long do tradelines stay on your credit report?

Typically, a tradeline appears on your credit report when you open a new account. This may have a slight negative impact on your credit score due to a hard inquiry.[7]

Once they’re on your credit report:

- Tradelines stay on your credit reports as long as accounts are active.

- Closed accounts in good standing remain on your report for up to 10 years.

- Tradelines with negative history that are closed remain on credit reports for seven years.[8]

Just as tradelines themselves can be positive or negative, whether or not they stay on your credit report can have a positive or negative impact too.

What happens if a tradeline is removed from your credit report?

Tradelines can be removed from your credit report, though the time it takes for them to be removed and the impact that it has on your credit score varies depending on the specific account.

For example, if you decide to stop being an authorized user on another person’s credit card, the tradeline might fall off of your credit report in as soon as two months.[1] Closing an account of your own, for positive or negative reasons, generally takes 7 to 10 years.

The positive or negative impact of a tradeline's removal from your credit report depends on the information associated with the account. For example, an account in bad standing that falls off after seven years might cause your score to increase because the negative information associated with it is gone as well.

If there’s a negative tradeline on your credit report due to fraud or identity theft, you can have it removed. Be sure to dispute it immediately — the longer fraudulent activity goes unchecked, the more time it takes to repair the impact.

Buying tradelines opens you to unnecessary risk

Buying a tradeline is sometimes presented as a credit repair strategy. It involves paying a third-party service to add you to another person’s tradeline, so that their tradeline information appears on your credit report, represented as your own. These are short-term agreements, so you’re removed from the tradeline after a designated amount of time.[9]

It might seem similar to becoming an authorized user on someone’s account, but there are two key differences:[9]

- You don’t know the person whose account you’re being added to. When you become an authorized user, it’s usually on a line of credit held by a friend or family member, not a stranger.

- You’re paying to be added to the account. Becoming an authorized user, on the other hand, is free.

While it’s technically not illegal, buying a tradeline isn’t exactly ethical either. Many creditors consider it to be misrepresentative, and the practice poses some risks for borrowers, like identity theft. FICO® 8 has made efforts to lessen the impact that bought tradelines have on someone’s credit score, making it even more unclear how helpful a strategy this would be.[9]

Understanding your credit report is key to financial health

Looking at your credit report can be overwhelming, but understanding how tradelines work can help. It makes you more aware of how to read your credit report, what to look for, how to spot inaccuracies and how to make better decisions going forward.

You can check your credit report once per year for free from each of the major credit bureaus, which you can access at AnnualCreditReport.com. You can also check your credit report for a fee any time you like with any of the three major credit bureaus (Experian, Equifax and TransUnion). They cannot charge you more than $13.50 for each report.[10]

If you’re looking for ways to build credit, or want to repair credit and are struggling with where to start, Self’s credit-building tools can help get you oriented on the right path.

Disclaimer: FICO is a registered trademark of Fair Isaac Corporation in the United States and other countries.

Sources

- U.S. News & World Report. “What Is a Tradeline and How Does It Affect My Credit?” https://money.usnews.com/credit-cards/articles/what-is-a-tradeline-and-how-does-it-affect-my-credit. Accessed September 21, 2022.

- TransUnion. “How To Read A Credit Report,” https://www.transunion.com/docs/rev/business/clientResources/HowToReadCreditReport.pdf. Accessed September 21, 2022.

- Experian. “Rental Tradeline Sample,” https://www.experian.com/assets/rentbureau/brochures/experian-rentbureau-rental-tradeline-sample.pdf?SP_MID=2115&SP_RID=559858&elqCampaignId=635. Accessed September 21, 2022.

- FICO®. “How Are FICO® Scores Calculated?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed September 21, 2022.

- Equifax. “What Is an Authorized User on a Credit Card?” https://www.equifax.com/personal/education/credit-cards/authorized-user-on-a-credit-card/. Accessed December 22, 2022.

- FICO®. “FICO® 8 Score and Why There Are Multiple Versions of FICO® Scores,” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed September 21, 2022.

- FICO®. “How Do Credit Inquiries Affect Your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries. Accessed September 21, 2022.

- Experian. “How Long Does It Take For Information To Come Off Your Credit Report?” https://www.experian.com/blogs/ask-experian/how-long-does-it-take-information-to-come-off-your-report/. Accessed September 21, 2022.

- Nasdaq. “Does Buying Tradelines Help Credit Scores?” https://www.nasdaq.com/articles/does-buying-tradelines-help-credit-scores-2021-03-03. Accessed December 22, 2022.

- Consumer Financial Protection Bureau. “How do I get a copy of my credit reports?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-a-copy-of-my-credit-reports-en-5/. Accessed October 3, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).