Can You Reopen a Closed Bank Account?

Published on: 04/19/2022

There are many reasons why a bank may close your account. Whether or not you can reopen it will largely depend on if your account is in good standing. We’ll explain why banks close accounts, what steps you can take if they do, and how you can maintain a new account.

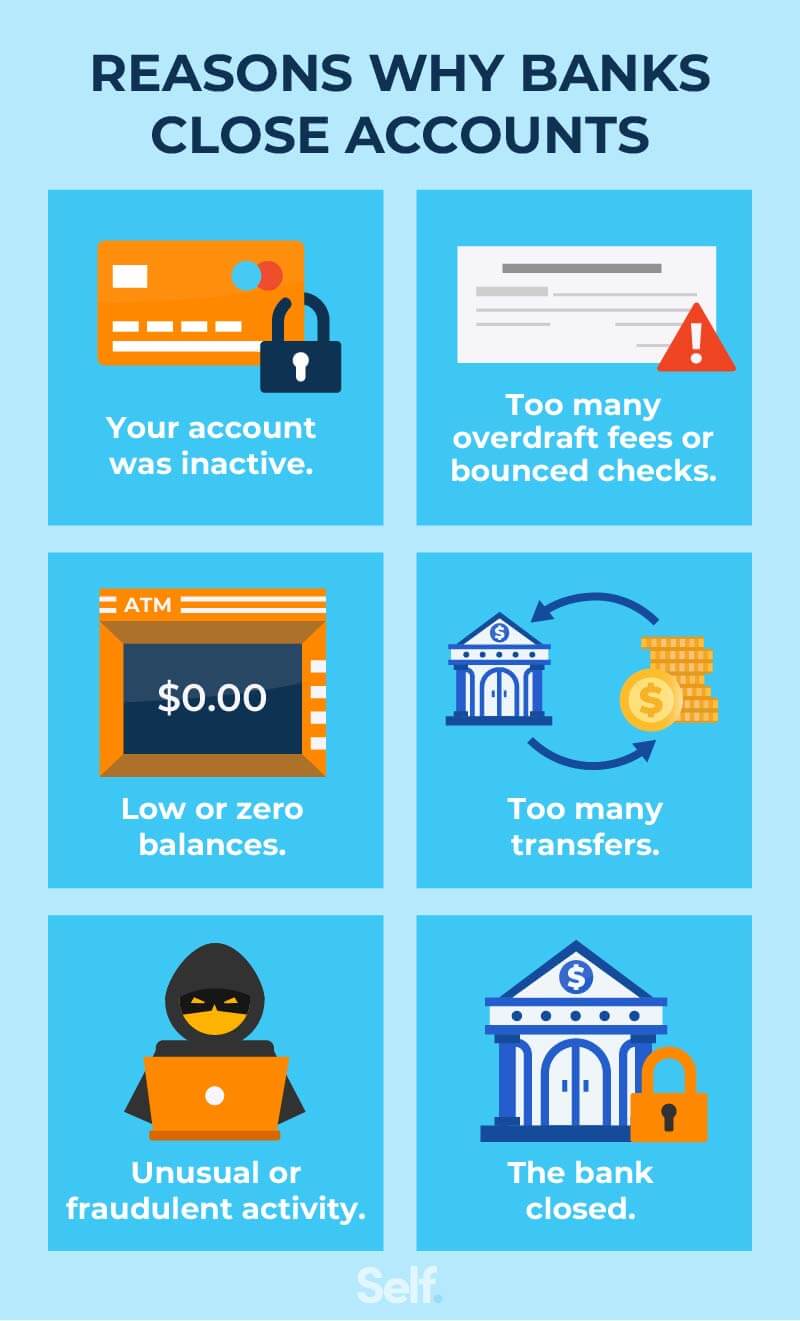

Why banks close accounts

Whether you’re doing business with a bank or credit union, you can close your own account, or your financial institution can close it for you. Why would they want to do so?

There are several possible reasons:

You have a dormant account

Leaving your account untouched for a short period of time won’t typically trigger an account closure. But if you’ve gone three to five years without any activity, a bank may consider your account abandoned and close it. Before taking this step, they’ll usually try to contact the account holder. If they can’t do so, anything in the account may wind up in the state’s unclaimed property system.

The bank suspects fraud

If your account shows suspicious activity and the bank has reason to believe you may have been the victim of identity theft, or you’re engaged in illegal or fraudulent activity yourself (such as money laundering), you may find yourself with a closed account. You might also have your account closed if you’re found guilty of criminal activity that your bank didn’t know about or which occurred after you opened the account.

You have too many overdrafts or bounced checks

A bank may close your account if you write checks that repeatedly bounce because you don’t have enough money in your account to cover them. Being overdrawn repeatedly or having too many overdrafts can lead to an account closure, too, although the bank will probably wait until you have enough money in your account to cover the overdraft amounts and overdraft fees.

You’ve made too many transfers from your savings account to your checking account

Savings accounts are designed to build savings, not to provide frequent access for purchases and bill paying. Under the Federal Reserve’s Regulation D, you’re limited to six such transfers or withdrawals per month.[1]

Your account shows a zero balance

Your financial institution may close an account if there’s no money in it. Some accounts require you to maintain a minimum balance in order to receive certain benefits, avoid fees, or keep the account open. If you’ve got a low balance and those fees take your account down to zero, it could be closed. Even an account with no minimum balance can be closed if it remains empty for a period of time, depending on the bank’s policy.

The bank may also close your account if they go out of business or if they find out that you have a high-risk occupation such as marijuana sales, online gambling or gun sales.

Banks have the discretion to close your account without cause. Under federal law, a bank may close your account without notice or reason.[2]

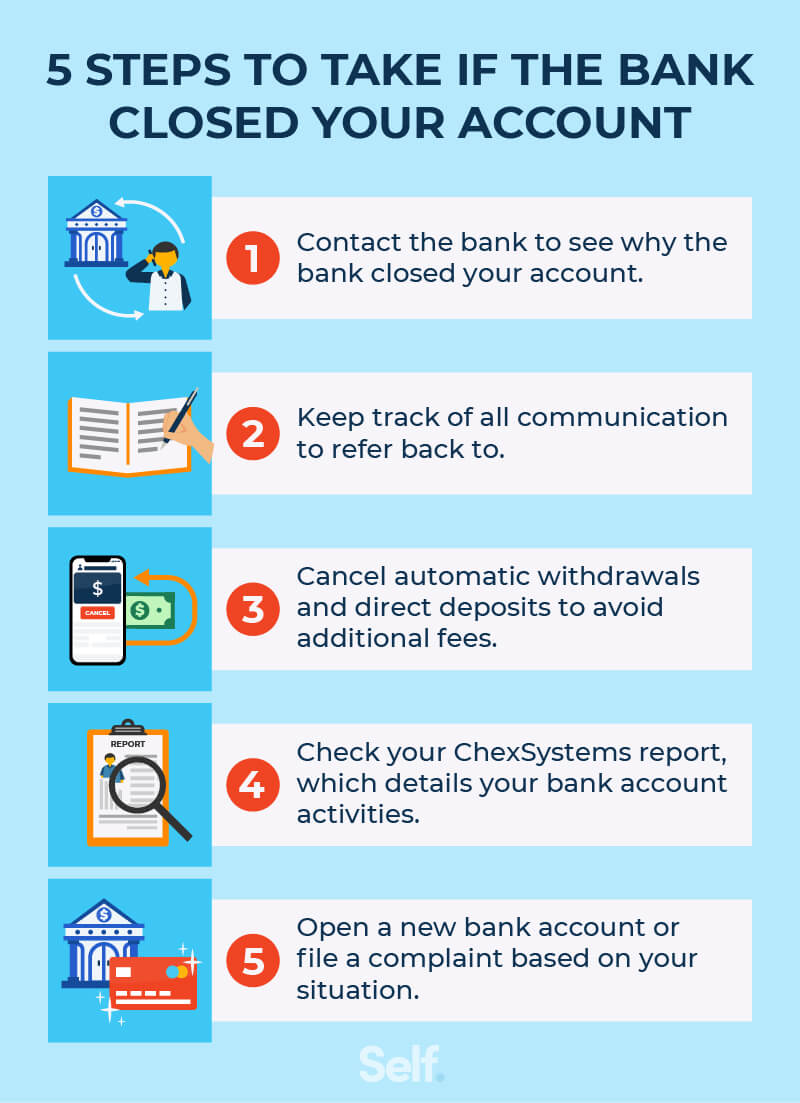

What to do if your account has been closed

You may or may not be able to open a closed bank account, but if your account is closed make sure to do your due diligence:

- Contact your bank representative. If you don’t know why your account was closed, you’ll want to find out in order to avoid a similar situation in the future. If your account was closed with funds still in it, your bank can provide information about how to retrieve your money.

- Keep good records. Keep track of phone calls and written communication with the bank about the closure (including phone calls and names). Note the date and time of each communication along with what was discussed.

- Cancel automatic payments. You don’t want to get behind on payments because companies with which you have payment agreements no longer have access to make withdrawals from the account. If you wind up having late payments on your credit report as a result, it can hurt your credit. If you have any outstanding checks from the account that haven’t been cashed, notify the payees to set up alternative payment plans.

- Halt direct deposits. If you want to continue to have access to money that is directly deposited into your account, set up a new account and give the new information to your employer.

- File a complaint, if applicable. If your account has been closed as a result of identity theft or fraud, you can submit a complaint to the Consumer Financial Protection Bureau.

If you are denied your request to reopen an account, you can ask the bank or credit union that has denied your application about the information they used to make their decision. You can request that information from the reporting companies that track your bank activity (see below).[2]

If you know why your account has been closed, you can use that information to help you as you look to open a new one. Make sure all the information the bank used to deny your application is accurate, and dispute any inaccuracies.

Even if everything’s accurate and your application has been denied because of previous problems, such as frequent overdrafts, bounced checks, or too many transfers, you still have options. Many banks and credit unions offer prepaid accounts, which are designed to limit risks for both banks and account holders. You may be able to qualify for such an account even if your application for another account has been denied.[2]

Can a bank close your account without warning?

Banks can close your account without warning or reason. They might do so because you have an inactive account or for low usage. Even though they do not have to have a reason, you can file your complaint with the Customer Assistance Group at the Office of the Comptroller (OCC).[3]

The OCC recommends that you attempt to resolve the issue with your bank directly before doing so. The office can’t give legal advice, engage in a matter that’s being litigated, partake in the court process, offer support for either party or seek monetary compensation.[4]

If the OCC does not regulate your bank, you can still file your complaint with the Consumer Financial Protection Bureau (CFPB), National Credit Union Administration (NCUA), Federal Reserve Board (FRB), Federal Deposit Insurance Corporation (FDIC), or Conference of State Bank Supervisors, as appropriate.[3]

Once a bank has closed your account, it must return any money in the account after subtracting any unpaid charges and fees.

Consequences of a closed bank account

If your account has been closed because of suspected fraudulent activity or an unpaid negative balance, you could have a difficult time opening a new account in the future. Debts from negative balances may be passed on to debt collection agencies, and this could show up on your credit report.

However, closed bank accounts generally won’t hurt your credit because banks don’t send banking history information to the three major credit bureaus. They will inform checking account reporting companies such as Early Warning Services, Telecheck, Certegy and ChexSystems about such closures.

Banks and credit unions can use this information to determine whether to let you open a new checking account, and they may also use information from your credit report in making this decision.[5]

If you’re curious about what is on your ChexSystems report, you have the right under the Fair Credit Reporting Act to access it once every 12 months for free, or if you were denied a checking or savings account in the past 60 days. You can access your report through the ChexSystems website (chexsystems.com), by phone at 800-428-9623, or by downloading and mailing or faxing a request form to the company.[6]

Tips for opening and maintaining a new bank account

If your account has been closed, you always have the option of opening a new bank account, but it’s important to choose one that serves your needs and that you can qualify for. You might consider low-risk bank accounts or accounts with free overdraft protection. (Overdraft fees, which can be as high as $35 per transaction, or even more, can add up quickly.)[7]

Second-chance checking accounts are an option you can consider. As their name indicates, they offer people who’ve had financial challenges in the past a second chance to prove they can use an account responsibly.

Once you’ve opened your account, be sure you check your balance regularly to avoid overdrafts and negative balances. Many banks offer accounts that don’t allow overdrafts, and these can keep you from overspending and incurring fees.

You can also sign up to receive email or text alerts if your balance drops below a certain level, and check your bank’s policy so you know when the money you deposit will be available to be accessed.[8]

Moving forward

You may not be able to reopen a closed bank account, but that doesn’t mean you need to give up on banking. You can open a new account, even with bad credit or a less-than-perfect banking history, and if you are diligent about monitoring and maintaining your new account, it can serve you well into the future.

Sources

- Federal Reserve. “Regulation D Reserve Requirements,” https://www.federalreserve.gov/boarddocs/supmanual/cch/int_depos.pdf. Accessed January 27, 2022.

- Consumer Financial Protection Bureau. “Consumer guide to checking account denials,” https://files.consumerfinance.gov/f/documents/cfpb_adult-fin-ed_consumer-guide-to-being-denied-a-checking-account.pdf. Accessed January 27, 2022.

- Office of the Comptroller of the Currency. “The bank closed my checking account and did not notify me. Is this legal?” https://www.helpwithmybank.gov/help-topics/bank-accounts/opening-closing-inactive-bank-accounts/closing-a-bank-account/closing-notification.html. Accessed January 27, 2022.

- Office of the Comptroller of the Currency. “File a Complaint,” https://www.helpwithmybank.gov/file-a-complaint/index-file-a-complaint.html. Accessed January 27, 2022.

- Consumer Financial Protection Bureau. “My bank or credit union closed my checking account. Will this hurt my credit?” https://www.consumerfinance.gov/ask-cfpb/my-bank-or-credit-union-closed-my-checking-account-will-this-hurt-my-credit-en-1819/. Accessed January 27, 2022.

- Experian. “What is ChexSystems?” https://www.experian.com/blogs/ask-experian/what-is-chexsystems/. Accessed January 27, 2022.

- Consumer Financial Protection Bureau. “Selecting a lower-risk account,” https://files.consumerfinance.gov/f/201602_cfpb_consumer-guide-to-selecting-a-lower-risk-account.pdf. Accessed January 27, 2022.

- Business Insider. “Why your bank is holding your check, and what you can do about it,” https://www.businessinsider.com/personal-finance/why-is-the-bank-holding-my-check. Accessed January 27, 2022

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.