8 Common Bank Fees and How to Avoid Them

Published on: 04/08/2022

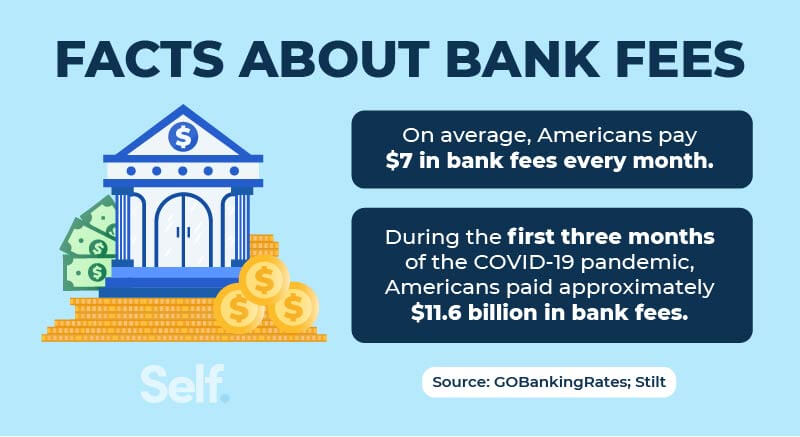

Bank fees can come as an unpleasant surprise. Per a 2021 survey,[1] $7 in bank fees every month. While this might not seem like a high cost, small fees can easily add up. Another survey found that Americans paid approximately $11.6 billion in bank fees during the first three months of the COVID-19 pandemic.

Fortunately, bank fees are relatively easy to avoid. Here are some of the most common bank fees and how to avoid them.[1] [2]

Table of contents

- Overdraft Fees

- Insufficient funds fees

- Minimum balance fees

- Excessive withdrawal fees

- ATM fees

- Checking account maintenance and service fees

- Wire transfer fees

- Account closure fees

- Other checking account fees

Overdraft fees

If a transaction is charged to your account without sufficient funds available to cover it, the account can become overdrawn. If that happens, you can be charged an overdraft fee as a penalty.

Pending deposits can lead to overdraft fees. When a deposit is pending, the money is not available to the account holder. As such, those funds won’t be able to cover transactions. Automatic payments can also lead to overdraft fees when they’re made without enough funds in the account.

The cost of an overdraft fee varies by bank, and often by state. The average fee for an overdraft is $35. Chase Bank has one of the lowest overdraft fees of $34.[1] Financial institutions with notable overdraft fees include:

- Alliance Credit Union: $0 (all overdraft fees are waived)

- Discover Bank: $0

- Navy Federal Credit Union: $20

- KeyBank: $38.50

- M&T Bank: $38.50

Of course, this list is far from conclusive. Check with your bank for specific fee amounts.

There are several financial institutions that have no overdraft fees. Many of these banks are online only.

How to avoid paying overdraft fees

The best way to avoid paying overdraft fees is to stay on top of your bank account balance. Understanding where, when, and how your money is used is crucial to avoid extra fees, including overdraft fees.

You may also consider:

- Opting-out of overdraft protection: This protects your account from overdraft fees by blocking transactions that would take it into the negative.

- Linkages to other accounts: This allows money to be taken from a secondary checking, savings, or line of credit to cover any overages.

If an overdraft fee has been charged to your account, the first step is to contact your financial institution. Explain what happened that caused the overdraft and see if the bank will refund it, especially if you’ve never had an overdraft happen before.

Insufficient funds fees

Insufficient funds fees are also known as non-sufficient fund fees or NSF fees. Like the name implies, these fees occur when there is not enough money to cover the transaction. NSF fees are assessed when the bank declines the transaction from the merchant. Because of this, the merchant might also charge a fee of their own.[3]

Insufficient funds fees are different from overdraft fees in that they are charged when transactions are declined due to a lack of funds. Overdraft fees occur when the transaction is allowed, causing the account to become negative. Therefore, your bank should never charge an NSF fee and an overdraft charge on the same transaction.[3]

Banks earn billions each year from non-sufficient funds fees. The average cost of NSF fee is $29.67. Typically, banks charge between $25 and $37 per NSF fee. Each bank can set its own fees, but they must always disclose these fees when the account is opened.[3]

How to avoid paying insufficient funds fees

As with overdraft fees, tracking your finances is the best way to avoid insufficient funds fees. Checking your accounts each day will let you know what your daily balances are and what transactions are pending to occur.[3]

You should also:

- Follow your budget to ensure your accounts are sound.

- Use apps and online banking to create balance alerts.

- Set up automatic transfers between your other accounts to cover low balances.

NSF fees can add up, and they can occur for each transaction that is refused. Avoid these costly fees by keeping a close watch on your accounts.[3]

Minimum balance fees

A minimum balance fee is a charge that occurs when your account balance goes below a certain amount. Not every bank charges this fee. Many banks have free checking accounts that have no balance requirements. In fact, 48% of non-interest-earning checking accounts don’t have minimum balance requirements.[4]

Usually, accounts that earn interest will have minimum balance requirements. On average, these accounts should have a minimum balance of at least $9,896.81 to avoid maintenance and minimum balance charges. However, different types of bank accounts may have specific balance requirements. Be sure you understand your account. If you don’t, speak to a bank advisor to ensure you avoid unnecessary fees.[4]

How to avoid paying minimum balance fees

The only way to avoid a fee is to maintain the minimum balance. If you find yourself constantly charged a minimum balance fee, that account may not suit your financial needs.

There are many banks and credit unions that don’t have minimum balance fees. Free accounts lack most maintenance and minimum balance fees. However, they typically cannot earn interest.[2]

Some banks and accounts that have no minimum balance fees include:

- Capital One 360 Checking

- Ally Interest Checking

- Discover Cashback Debit Account

- Alliant Credit Union High-Rate Checking

These accounts require no minimum deposit to open and no minimum monthly balance. They also have no monthly maintenance fees, making these accounts truly free. And some even earn interest.[5]

Excessive withdrawal fees

Another common bank fee is an excessive withdrawal fee. Typically, these fees are caused by frequent withdrawals from a savings account. Until April 2020, the Reserve Requirements of Depository Institutions Regulation D law indicated that customers could make up to six withdrawals per month from a savings account without penalty.[6]

Since then, that law has been changed, allowing banks to suspend that requirement. If they do, customers can make unlimited withdrawals from their savings accounts without penalties.[7]

The average cost of transfer and withdrawal fees is between $10 and $12.50, but individual financial institutions can charge anything they want.[1]

Online and mobile bill pay from a savings account counts as a withdrawal, as do online transfers or transfers by phone. However, the following charges do not count as withdrawals:

- In-person transfers at the bank

- ATM transactions

- Mailed checks

Check with your bank as to whether it has suspended Reg D requirements. Even if it has, continue to keep withdrawals from your savings account to a minimum. Savings accounts are intended to save money.[1]

How to avoid paying excessive withdrawal fees

The easiest way to avoid excessive withdrawal fees is to not withdraw from your savings accounts. With the current laws, many banks have done away with these fees altogether, but some have not. If your bank still charges excessive withdrawal penalties, be sure to:

- Limit savings withdrawals and transfers to six or fewer each month.

- Avoid setting up automatic payments through your savings accounts.

- Use mobile and other alerts to notify you of low balances that would require a transfer.

- Make prudent transfers that cover all potential needs.

By following these steps, you should avoid paying excessive withdrawal fees.[6]

ATM fees

ATM fees occur when transactions are conducted outside of your bank’s network. If you use an out-of-network ATM, you can expect to see fees from your bank. You may also be charged a fee by the ATM provider.

If you’re using an international ATM, you may be charged a 3% foreign transaction fee. On top of that, you can still be charged for the normal out-of-network fees from your bank and the ATM provider.[8]

The average out-of-network ATM withdrawal fee costs $4.59. Non-customer surcharges make up $3.08, with the other $1.51 coming from personal bank charges.[4]

Many regional banks have more lenient ATM fees. Often, their fees are less than $2, with many charging nothing at all.[8]

How to avoid paying ATM fees

The best way to avoid ATM fees is to choose a bank with no ATM fees or only withdraw from an in-network ATM. Sometimes, a bank may reimburse a certain number of ATM fees for free.

Most online banks have eliminated ATM fees due to their lack of physical locations. Many even offer refunds on out-of-network ATM provider fees. Online banks often partner with widespread ATM networks. Choosing a bank with convenient ATM locations may help you avoid ATM fees.[8]

Checking account maintenance and service fees

A monthly maintenance (or service) fee is a charge for the existence of the account. In other words, the bank charges you to use their services.[9]

Banks typically charge between $10 and $12 as a basic maintenance fee.[10] Accounts may have certain requirements to avoid these fees, such as meeting a minimum account balance.[11]

How to avoid paying monthly maintenance fees

Like other fees, many financial institutions don’t have monthly maintenance fees. Online banks rarely have monthly fees.[11]

Most banks also have accounts that waive these fees. Typically, this is achieved by meeting certain account criteria, including:

- Maintaining a minimum balance

- Direct deposits surpassing a certain monthly amount

- Minimum debit card usage

If you find yourself paying a monthly maintenance fee, consider finding a financial institution that doesn’t charge such fees.[11]

Wire transfer fees

Wire transfers are electronic money transfers between banks. Wire transfers use special networks to exchange financial information, such as Fedwire or SWIFT.[12]

Almost every wire transfer will have processing fees for both sender and recipient. Domestic wires can cost more than $45 ($15 for incoming wires, and more than $30 for outgoing transfers). International wires will often cost more than $50. Some banks waive incoming wire fees. Meanwhile, other institutions, including Western Union and MoneyGram, may charge additional fees depending on how the wire is funded and the amount of the wire.[12]

Wire transfers also require the payment to be available up front.[12]

How to avoid paying wire transfer fees

Avoiding wire transfer fees begins with choosing a financial institution with lower fees. Some banks, such as USAA, waive incoming wire fees. Most online banks do the same. Additionally, Fidelity and HSBC Bank waive outgoing domestic wire fees for specific accounts.

Different banks will feature different fee structures. If you will be making use of wire transfers, it pays to research which financial institution is best for your needs.

Account closure fees

Another fee that financial institutions can charge is an account closure fee. As the name suggests, these are fees assessed when an account is closed. However, almost all instances of account closure fees involve closing an account within a certain amount of time.[13]

Typically, banks will charge a fee if an account is closed within its first 90 to 180 days. This is done to discourage those who open accounts just for new customer perks.[13]

How to avoid paying account closing fees

Avoiding this fee requires you to keep your account open past the early closure date. Be sure to check with your specific bank for this date.

When should you close a bank account?

Common reasons to close a financial account include:

- Moving out of the network

- Leaving behind a negative banking experience

- Avoiding fees

- Getting better interest rates or other features

- Consolidating finances or opening online accounts

If you need to close an account, be sure your finances are switched over beforehand. Search for and find your preferred new account. Once it is opened, fund it from your existing account. Next, switch your financial obligations to the new account, including automatic transactions.[14]

Once this is done, you’re ready to close the old account. Often this can be done online, but some banks may require you to go into the branch. Once the account is closed, request written confirmation from the bank of the closure for your records.[14]

Accounts with specific circumstances — such as those belonging to a child or a deceased customer — will require special handling. Consult a bank representative for specific requirements.[14]

Other checking account fees

Aside from the above fees, many banks charge other incidental fees. These include:

- Inactivity fees: These fees are charged if an account isn’t used a certain number of times during a certain timeframe, typically ranging from 90 days to 12 months, depending on the bank. Often, using the account in any way, including making withdrawals and transfers, will count as activity.[15]

- Paper statement fees: This fee is charged for receiving monthly paper statements instead of online statements. Some banks, such as Ally and Discover, don’t have this fee. Other banks may charge up to $6 for each paper statement. To avoid these fees, enroll in online statements.[16]

- Lost debit card fee: Some banks charge their customers to replace lost debit cards. Bank of America charges $5 per card replacement.[17] Other banks only charge to have a card rush-delivered. Whatever the fee, it pays to report a lost card immediately. You’re only liable for $50 of any money stolen due to a lost card within the first two days.[18]

Choose bank accounts that match your needs

Overdraft and insufficient fund fees make up the majority of fees charged to accounts, but banks will often impose fees on other aspects of an account, such as balance minimums and monthly usage.

When opening any bank account, be sure you understand the fee schedule. Choose accounts that match your financial needs, and consider online banking. Many online banks have reduced fees or no fees at all. Whichever account you choose, always stay on top of your finances. Understanding how your money is working will help you avoid those annoying fees and penalties.

Sources

- GOBankingRates. “These Fees Have Cost Americans $11.6B During the Pandemic — Here’s How To Avoid Them,” https://www.gobankingrates.com/banking/banks/how-much-bank-fees-cost/. Accessed December 1, 2021.

- Capital One. “Banking Fees: The More You Know, the Less You’ll Pay,” https://www.capitalone.com/bank/money-management/banking-basics/bank-fees/. Accessed December 1, 2021.

- Forbes. “Non-Sufficient Funds: What It Means And How To Avoid NSF Fees,” https://www.forbes.com/advisor/banking/non-sufficient-funds-and-how-to-avoid-nsf-fees/. Accessed December 1, 2021.

- Bankrate. “2021 Checking Account And ATM Fee Study,” https://www.bankrate.com/banking/checking/checking-account-survey/. Accessed December 1, 2021.

- CNBC. “Best No-Fee Checking Accounts of December 2021,” https://www.cnbc.com/select/best-no-fee-checking-accounts/. Accessed December 1, 2021.

- First Alliance Credit Union. “Why Am I Being Charged a Fee To Transfer Money From My Savings Account,” https://www.firstalliancecu.com/blog/why-am-i-being-charged-a-fee-to-transfer-money-from-my-savings-account. Accessed December 1, 2021.

- The Federal Reserve. “The Fed - CA 21–3: Suspension of Regulation D Examination Procedures,” https:/www.federalreserve.gov/supervisionreg/caletters/caltr2106.htm. Accessed December 1, 2021.

- Business Insider. “What You Can Expect to Pay in Bank ATM Fees,” https://www.businessinsider.com/personal-finance/bank-atm-fees. Accessed December 1, 2021.

- Federal Deposit Insurance Corporation. “Checking Account Fees,” https://www.fdic.gov/consumers/consumer/moneysmart/podcast/documents/checking-accounts-checking-account-fees.pdf. Accessed December 1, 2021.

- NerdWallet. “Study: Checking Fees Average Almost $1,000 in a Decade,” https://www.nerdwallet.com/blog/banking/average-checking-account-fees-study/. Accessed December 1, 2021.

- Business Insider. “How Monthly Bank Maintenance Fees Work, and Ways to Avoid Them,” https://www.businessinsider.com/personal-finance/monthly-bank-maintenance-fee. Accessed December 1, 2021.

- Forbes. “All About Wire Transfers,” https://www.forbes.com/advisor/banking/all-about-wire-transfers/. Accessed December 1, 2021.

- US Money News. “7 Pesky Bank Fees and How to Avoid Them,” https://money.usnews.com/banking/articles/pesky-bank-fees-and-how-to-avoid-them. Accessed December 1, 2021.

- Forbes. “How To Close A Bank Account,” https://www.forbes.com/advisor/banking/how-to-close-a-bank-account/. Accessed December 1, 2021.

- Consumer Financial Protection Bureau. “Will I Be Charged a Fee If I Don’t Use My Prepaid Card?” https://www.consumerfinance.gov/ask-cfpb/will-i-be-charged-a-fee-if-i-dont-use-my-prepaid-card-en-473/. Accessed December 1, 2021.

- Business Insider. “How Bank Paper Statement Fees Work, and Ways to Avoid Them,” https://www.businessinsider.com/personal-finance/bank-paper-statement-fee. Accessed December 1, 2021.

- Fox Business. “Lost Your Credit or Debit Card? Want It Fast? Expect to Pay,” https://www.foxbusiness.com/features/lost-your-credit-or-debit-card-want-it-fast-expect-to-pay. Accessed December 1, 2021.

- Consumer Information. “Lost or Stolen Credit, ATM, and Debit Cards,” https://www.consumer.ftc.gov/articles/0213-lost-or-stolen-credit-atm-and-debit-cards. Accessed December 1, 2021.

About the author

Jeff Smith is the VP of Marketing at Self Financial. See his profile on LinkedIn.

About the reviewer

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.