The 3 Main Types of Credit Explained

Published on: 01/14/2025

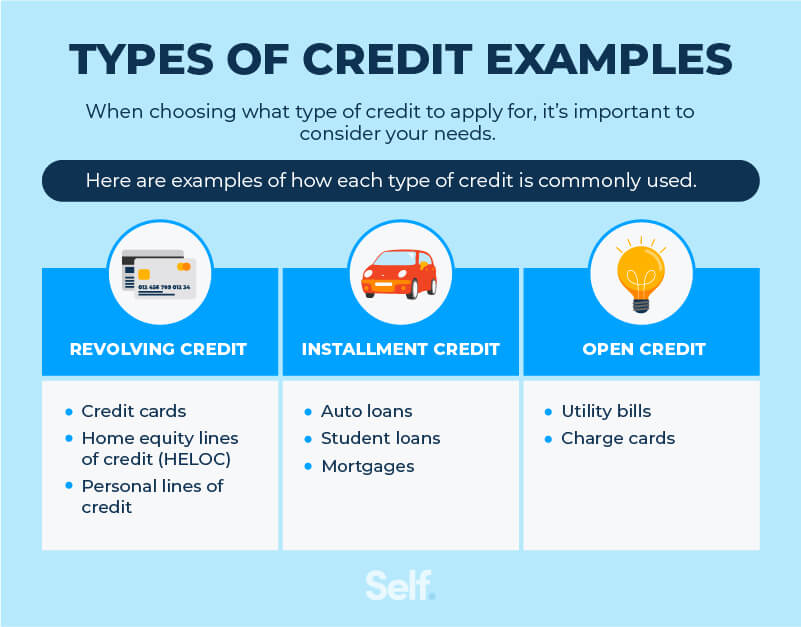

For anyone working toward achieving better financial health, it’s essential to understand the three main types of credit — installment credit, revolving credit, and open credit — and the ways they impact your credit score.

What is credit?

Credit indicates a lender’s confidence that a loan will be repaid. Someone with good credit reflects that they have built up a high degree of trust from lenders and the lenders have confidence that they will make payments on time.

Having credit allows you to make purchases that you might not be able to afford via a lump sum payment. Credit gives you, the borrower, the ability to pay off purchases over time through a series of (usually monthly) payments. However, the condition attached to making immediate purchases and gradually paying them off is that the lender will charge you interest — until the loan has been repaid.

A person with good credit has the benefit of qualifying for lower interest rates compared to those with bad credit. Someone with bad credit might find it more difficult to obtain a loan.

Credit history is maintained and updated monthly by the three main credit bureaus: Equifax, Experian, and TransUnion. The information in your credit report is used to calculate your credit score.

Two companies, FICO® and VantageScore, use similar but distinct methods to determine a credit score, which prospective lenders then use to judge your creditworthiness. This information is used to determine whether or not you should be granted a loan and to assess the amount of interest to charge you.

What are the three different types of credit?

Generally speaking, there are three different types of credit: revolving credit, open credit, and installment credit. Each form of credit is defined based on how debt is borrowed and repaid, which varies with each type. But before we explain further, there are a few definitions to keep in mind.

Secured credit

Secured credit refers to a loan that is guaranteed by a form of collateral. An example is auto loans and mortgages. When you use these types of loans, the purchased automobile or house serves as collateral. If you don’t make payments, a creditor can repossess your car or foreclose on your home. These types of loans are usually installment loans, which means that the lender disburses the loan via a lump sum, and the borrower pays them back in predetermined payment amounts.

A secured credit card is another type of secured credit. You would provide a security deposit, usually a savings account or certificate of deposit as collateral in the event, you do not pay. These cards can be an effective way to build credit for people who have no credit history or are starting over due to low credit scores.

Unsecured credit

Unsecured credit refers to loans that aren’t guaranteed by collateral. These often take the form of revolving credit. Common examples include student loans, personal loans, and credit cards.

Revolving credit

Oliver Browne, a credit card analyst at Credit Card Insider, explains the logic behind revolving credit:

“Revolving accounts allow you to borrow over and over, up to an approved amount. The amount is set by the lender, but it’s up to you how much you want to borrow at a given time. The prime example of revolving credit is a credit card. There are minimums that you must pay, but you can usually decide to pay more. For example, if you have a minimum payment of $200 for your credit card, you can decide to pay a larger amount, like $500 towards the balance instead.”

Forms of revolving credit accounts include:

- Most credit cards

- Branded store cards

- Personal Line of Credit

- Home Equity Lines of Credit, or HELOC

With a revolving credit account, the minimum payment is typically a percentage of your total balance. So, if you had to pay at least 3% of your balance each month, that means if the balance owed is $100, you’d have a $3 minimum payment, but if the balance is $1,500, you’d have to pay $45.

For these credit accounts, you can pay off the entire balance or repay in increments of the minimum payment or higher. As you pay off your balance, the available credit rises back up towards your limit.

But unless you’re paying the entire balance every month, you’ll be paying more than what you originally owed. Your credit won’t rise by the same amount as what you’re paying. That’s because interest accrues at a steady rate. So you might make a $30 payment but only get $20 in credit back because $10 went towards paying off the accrued interest charges.

As you can imagine, making the minimum payment, especially on a large account balance, could make you feel like you’re spinning your wheels. If you’re only making the minimum payment, you won’t make much progress toward paying off your debt, especially if you continue to make more purchases through that line of credit without first paying off the balance owed.

The best way to avoid overusing revolving credit is to pay off your debt in full each month. If you have other obligations and can’t pay off the account, be sure to keep your balance below your credit limit and avoid taking on too much credit card debt.

Not only will doing this keep you from spending a lot of money on interest, but it will also help maintain a low credit utilization ratio on your credit report, which is a significant factor in determining your credit score.

Installment credit

"Installment credit is when you borrow from a lender for a fixed amount with fixed payments. This credit type includes student loans, car loans, and personal loans,” explains Browne.

With installment credit, you don’t have the option of making additional purchases with the line of credit. You’re given a one-time lump sum loan that you repay, with interest, over time.

The advantage of this form of credit is that you know exactly how long your payment period will be. And when you complete the set payments, it’s done. You can pay off your debt early in most cases, but some installment creditors do not allow this.

Many installment credit plans involve using the loan for a specified purchase, such as a house, car, or smartphone. As a result, they tend to be secured loans. If you default, the creditor can repossess the specific item you used the loan to purchase.

Still, not all installment loans are secured. Personal loans —which can be used for anything from consolidating debt to home repairs— are usually unsecured loans.[2]

Open credit

Open credits typically don’t have a hard-set credit limit.[3] Payments are due in full each month, and the amount you have to pay may vary based on your usage. Sometimes they’re tied to how much you use a specific service, whether provided by a private company or local government entity.

Utility bills for electricity, gas, sewer and water usage are often open credit accounts in newer credit score models. Many people don’t realize it, but utility payments may affect your credit score. As this is a newer practice, utility payments aren’t usually considered for loans, such as mortgages.

Charge cards, which often have no preset credit limit, are another form of open credit. With these cards, you’re expected to pay off the full card balance each month or face the consequence of high fees or a closed account. [1]

How each type of credit affects your credit score

“Installments and revolving credit are going to affect your credit score. If you miss payments, it could drop your score,” Browne says.

One of the main things all credit types have in common is that they affect your credit score.

“If you don’t pay installment or revolving, you’ll likely see a decrease in your score. If your payment behavior is bad for either type of credit, you’ll likely see a decrease,” Browne explains.

Your credit score is calculated based on a variety of different factors, some of which have more weight than others.

- FICO considers your payment history the most critical part of your score. It accounts for 35% of the total. If you make your payments on time, it may boost your score; if you don’t, it will have a negative impact. This is always the rule regardless of the type of credit account you have.

- The amount you owe in relation to your overall available credit limit accounts for 30% of your FICO score. This is why it’s important to manage your revolving credit accounts well. By utilizing your credit selectively and making payments that are large enough to keep your balance low each month, you could build your credit score.

- The length of your credit history constitutes 15% of your score. So, for example, the earlier you begin paying an installment loan on time or the longer you’ve had your first credit card, the better off you’ll be (as long as you stay on top of the other factors on this list).

- Your credit mix makes up 10% of your FICO score. This is why it’s important to not just open charge accounts or only take out a car loan. When your history shows you have different kinds of credit, it can help boost your score. Generally, it shows you can be trusted to manage a variety of accounts.

- New credit accounts for 10% of your credit score. If you’re applying for too many credit accounts at once, it could hurt your credit score by making it appear that you’re overextending yourself.

How to check your credit score (for free)

You don’t have to pay to check your credit score. You can sign up for free at Self to monitor your VantageScore credit score and see where you stand. The VantageScore model is slightly different from FICO in the factors it calculates for its score. The score ranks the following from your credit history:

- Payment history

- Age and type of credit

- Percentage of credit used (credit utilization rate)

- Total balances and debt

- Recent credit behavior (new credit)

- Available credit

Both credit scoring models use slightly different categories to measure how good your credit is:

For FICO, anything over 800 is exceptional; 740-799 is very good; 670-739 is good; 580-699 is fair, and scores under 580 are poor.

For VantageScore, the list is as follows: 781-850 excellent; 661-780 good; 601-660 fair; 500-600 poor; and 300-499 very poor.

If you’re applying for a mortgage, the minimum FICO score needed to qualify for a conventional mortgage is 620.[4] You have a little more leeway with an FHA mortgage: You can get an FHA loan with a score of 500-579, but you’ll need to pay a 10% down payment to do so. If you have a score of 580 or better, you can qualify for an FHA loan with a down payment of 3.5%, though the specific credit score requirements vary from lender to lender.

Generally, the lower your credit score, the more you should expect to pay in interest, no matter the loan type you’re seeking. For large loan amounts, higher interest can quickly add up.

For example, an installment loan in the form of a fixed-rate mortgage of $300,000 can cost you over $116,000 more in interest over 30 years with a score of 620-639 than it would if you had a score of 760-850.[5] Similarly, from data in 2020, a score of 720 or more could get you a 12.7% interest rate, or lower, on a credit card, whereas a score under 620 would vault you over 20%.[6]

What types of credit should you have?

Ideally, you should have all three different types of credit. In terms of your FICO score, having a mix of revolving credit, installment credit, and open credit could help, especially if you are trying to build your credit.

“The way this works is it’s best to have a variety of different types of accounts because they will more positively impact your score, rather than just having one type of account. Variety of accounts makes up about 10% of your FICO credit score. If you’re showing that you can maintain and manage diverse accounts, it will look even better,” Browne says.

Lenders want to see that you can responsibly manage different types of credit. And having multiple credit types indicates that you might be a lower risk to them if they loan you funds.

Your credit mix is one factor in your credit score calculation, but it isn’t the only one. As mentioned above, it accounts for 10% of your FICO score.

It has equal weight to the new credit category. So, it wouldn’t be wise to go out and start applying for numerous different kinds of credit within a short period because each credit application counts as a “hard inquiry.” Having too many of those in a short period of time can drop your credit score.

It’s better to apply for different kinds of credit only as you need them—Plan to space your loan applications out. After you get approved, be sure to consistently make on-time payments to ensure you’re satisfying the No. 1 factor in determining your FICO score, payment history.

How to build credit

Having good credit is a critical aspect of your overall financial health. Credit can help you afford big purchases you ordinarily can’t afford in a single payment. It can also provide you with access to funds in emergency situations. And it might even be necessary when applying for a job or an apartment because some employers and landlords review your credit score as part of their background check.

If you’re interested in building your credit score for the first time, Browne offers a simple first step:

“If you’re looking to build your credit, read up on basic credit terms and make sure that you know how credit works. Stay updated with the major credit bureaus and review your credit on a frequent basis as you try to build your score. It’s also a good idea to get copies of your report because errors can occur sometimes, so always keep an eye on them.”

Pay your bills on time

Making timely payments is the most important factor in determining your FICO score. It’s best to pay off your credit each month to keep the interest from accumulating. If you stop paying your credit card bills, it can have a detrimental effect on your credit.

Missing payments will also cause your credit score to drop, in addition to the added late fee payments and penalties from the creditor. However, if you have larger loan amounts or are unable to make a full payment, it’s crucial to stay on top of your monthly charge. Work with your financial institution to set automated monthly minimum payments.

Pay off any late payments

If you’re less than a month late with a payment, it usually won’t be reported on your credit. However, you can be charged late fees. If you miss a payment by more than 30 days, you’ll be reported late on your credit report, and your credit score could suffer. So if you have a late payment, it’s important to resolve the issue as soon as possible because each additional 30-day delay could continue to damage your credit.

Dispute any mistakes on your credit report

If you notice a mistake on your credit report, make a point to dispute it, so it doesn't drag down your score. You can dispute inaccuracies —identity errors, balance errors, transposed numbers, and duplicate entries— by disputing the error with the credit bureau for which it appeared on the report. Remember you should only dispute inaccuracies.

Errors on credit reports are far more common than you might expect. In a 2024 Consumer Reports investigation of 4,300 people, 44% found at least one error on their credit report, and 34% found errors relating to their personal information. 27% of these errors were serious enough to potentially impact their creditworthiness[7]

It is also free to be on the lookout for innacuracies on your credit report. Every year, you are entitled to a free copy of your credit report from each of the major credit bureaus. So, make it an annual tradition to take a look at your credit report for discrepancies that might be hurting your credit score.

Limit hard inquiries

Don’t submit multiple credit applications within a short period of time. Each time a company checks your credit to review a credit application, it counts as a hard inquiry or “hard pull.” Hard pulls can stay on your credit report for up to two years and might shave a few points off your credit score.[8]

However, not all credit checks impact your credit score. Inquiries conducted by potential employers, auto insurers calculating premiums, or credit card companies for preapproval offers are considered “soft” inquiries which don’t affect your credit score. Knowing the difference between soft and hard credit inquiries can help you on your credit-building journey.

Get a secured credit card

A secured credit card may be a good solution for someone with no credit history or who wants to rebuild poor credit. The line of credit that comes with a secured credit card gives you an opportunity to rebuild your credit, assuming you make consistent on-time payments.

To get a secured credit card, most financial institutions require you to provide a cash security deposit that is often equal or greater to the opened line of credit. As long as payments are made, your security deposit won’t be taken.

But, you have to be mindful. Since the card is likely to have a low credit limit, you can quickly charge too much and increase your credit utilization rate, which is the second-most-important factor for calculated credit score. Having a high credit utilization rate will cause your credit score to drop.

So, if you opt for a secured credit card, you should closely monitor your spending and avoid going over 30% of the available limit.[9]

Get a credit builder loan

A credit builder loan is an option for people with little to no credit history who want to potentially build up their score. You can apply for a credit builder loan without possibly having to go through a hard pull on your credit history. If you are approved, the borrowed amount is kept in a bank, and you’re not allowed to access it until you’ve completed payments.

Usually, the credit builder loan provides payment options to help fit your budget. Although you don’t get the money immediately, the history of your regular on-time payments is reported to the credit bureaus, which helps you build your credit via your payment history. Find out more about credit builder loans and how they work.

The bottom line

Developing good credit is an essential component of any personal finance strategy aimed at improving financial health. It’s important to focus on all three types of credit accounts to mix up and help you build your credit.

Having a diverse mix of credit is one of the key factors in building a good credit score. There are multiple ways to strategically build credit without applying for too many new lines of credit. Also, maintaining a good payment history can help lift your credit score and qualify you for loans with better interest rates.

Sources

- American Express. “Understanding the differences between charge and credit cards”. https://www.americanexpress.com/en-us/business/what-is-the-difference-between-credit-cards-and-charge-cards.

- Experian. “What Is a Personal Loan?” https://www.experian.com/blogs/ask-experian/what-is-a-personal-loan/.

- Credit One Bank. “The Big Three: Different Types of Credit”. https://www.creditonebank.com/articles/the-big-three-different-types-of-credit.

- Experian. “What Credit Score Do I Need to Get a Mortgage?”. https://www.experian.com/blogs/ask-experian/what-does-my-credit-score-need-to-be-to-get-approved-for-a-mortgage/.

- Bank of America. “How credit scores affect your interest rate,” https://bettermoneyhabits.bankofamerica.com/en/home-ownership/how-credit-affects-interest-rate.

- Business Insider. “The average credit card interest rate by credit score and card,” https://www.businessinsider.com/personal-finance/average-credit-card-interest-rate.

- Consumer Reports. “More Than a Quarter of People Find Serious Mistakes in Their Credit Report, Study Shows” https://www.consumerreports.org/money/credit-scores-reports/serious-mistakes-found-in-credit-reports-a1061511185/.

- Investopedia. “Soft Credit Check,” https://www.investopedia.com/terms/s/soft-inquiry.asp.

- Forbes. “What Is A Secured Credit Card And How Does It Work?” https://www.forbes.com/advisor/credit-cards/what-is-a-secured-credit-card/.

About the author

Lauren Bringle is an Accredited Financial Counselor®. Self is a financial technology company with a mission to help people build credit and savings.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).