6 Types of Bankruptcies Explained

Published on: 04/21/2022

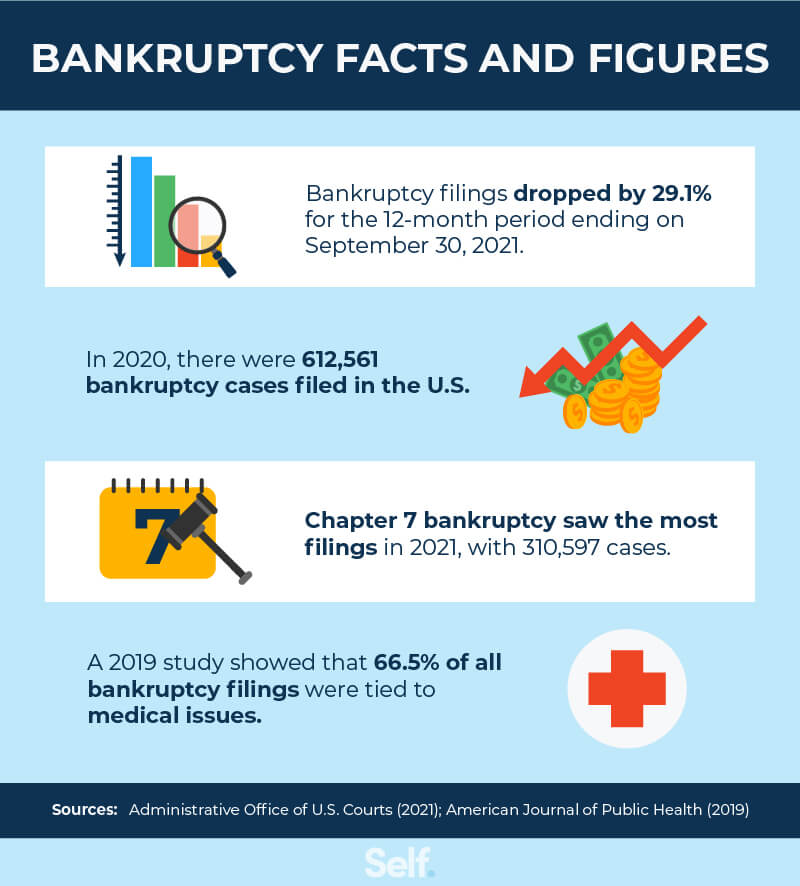

Bankruptcy is a legal process that offers debt relief for people — or entities, such as businesses — who cannot pay their outstanding debts. According to the U.S. Supreme Court, in a 1934 decision, bankruptcy “gives the unfortunate debtor … a new life and a clear field for future effort, unhampered by the pressure and discouragement of preexisting debt.”[1] In other words, a fresh start. Be aware, however, that any bankruptcy will appear on your credit report.

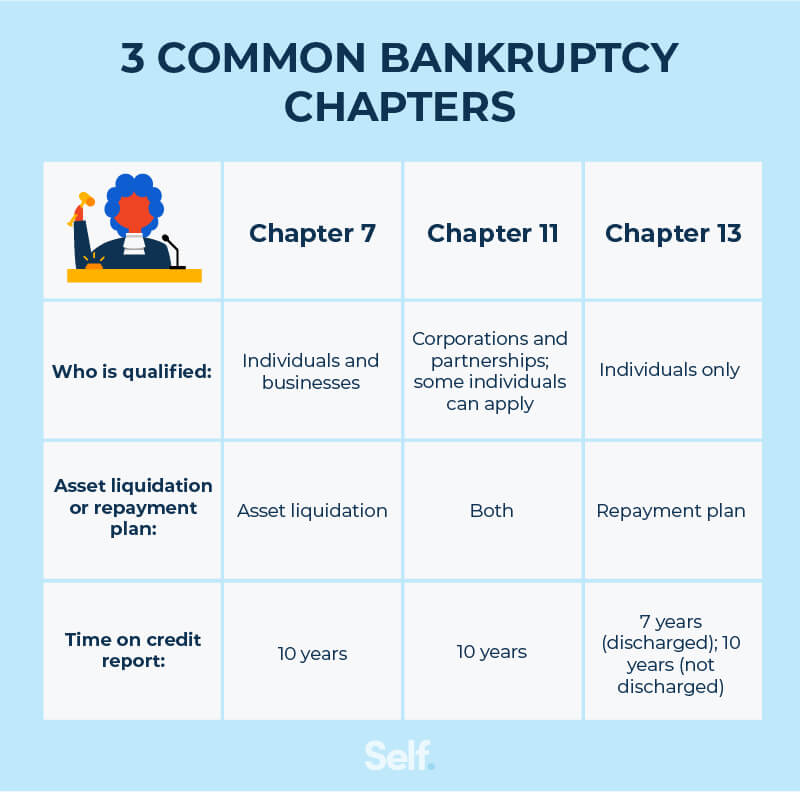

The bankruptcy process typically involves the liquidation of assets, repayment plans, or reorganization of debts and finances. While the most common types of bankruptcies are Chapter 7 and Chapter 13, there are actually six different types someone can file. Here’s what you need to know about the six different types of bankruptcy before you decide if filing is the best option for your financial situation.

Table of contents

- Chapter 7 bankruptcy

- Chapter 9 bankruptcy

- Chapter 11 bankruptcy

- Chapter 12 bankruptcy

- Chapter 13 bankruptcy

- Chapter 15 bankruptcy

- How to file for bankruptcy

- Should you file bankruptcy?

- Pros and cons of filing for bankruptcy

- How bankruptcies affect your credit score

- How to rebuild your credit after filing bankruptcy

Chapter 7 bankruptcy

Chapter 7, also known as “liquidation” bankruptcy, is one of two options generally used by private individuals when filing for bankruptcy. (The other is Chapter 13.)

It involves the sale of the debtor’s assets to satisfy creditors’ claims. Some assets under Chapter 7 are often labeled as exempt: property that’s protected from creditors, which varies from state to state.[4] For instance, California law allows various exemptions, up to a certain value, for things like motor vehicles, heirlooms, health aids, tools and a variety of other items.[5]

Chapter 7 bankruptcy is designed as an option for individuals with limited income who don’t have any prospect of repaying their debts, as is required under Chapter 13. Those who wish to file for Chapter 7 must have an income that’s less than the state median. If it’s above the state median they must pass a “means test” to determine their eligibility.[4]

Chapter 7 affects two types of debt — secured and unsecured debt — differently.

- Unsecured debts: Most of your unsecured debt is eliminated (student loans, taxes and child support are among the exceptions).

- Secured debts: May be eliminated, but a lienholder may still have the right to repossess

Secured debts are secured by collateral, such as a car that can be repossessed or a home that can be lost in foreclosure if you don’t pay. Unsecured debts, such as credit card debt, don’t carry collateral.

Chapter 9 bankruptcy

Chapter 9 bankruptcy isn’t designed for individuals or companies. It was created to protect municipalities from creditors when they’re unable to pay their debts. This gives them the opportunity to negotiate ways to adjust their debts through refinancing, reorganization or delaying when debts come due.[6]

Municipalities are defined in the Bankruptcy Code as a “political subdivision or public agency or instrumentality of a State.” That means they can also include bodies such as school districts, counties, highway authorities and community services districts.[6]

Chapter 11 bankruptcy

Chapter 11 is for high-debt individuals or, more frequently, corporations and other businesses that believe they can pay their debts under a structured plan moving forward. It’s also called “reorganization bankruptcy” because, if approved, it allows the petitioner to reorganize and continue operating.

This kind of bankruptcy is frequently mentioned in news stories about retailers that aren’t ready to go out of business by liquidating under Chapter 7. They may reorganize by agreeing to close a number of stores and sell off some of their assets.[7]

Individual filers can come up with a plan to repay debts through future earnings as opposed to liquidating assets.[8] Individuals who file Chapter 11 are typically extremely wealthy individuals such as celebrities who, like businesses that file under this chapter, have a lot of debt.

The filing fee for Chapter 11 is more than five times higher than it is for Chapter 13, at $1,167. Plus, there’s a $571 fee for miscellaneous administrative expenses.

Chapter 12 bankruptcy

Chapter 12 is a fairly narrow option that’s available to family farmers or family fishermen. It’s not available to individuals outside these groups.

The debt limits for Chapter 12 are $4,153,150 for a farming enterprise and $1,924,500 for a commercial fishing operation.[9]

As with other bankruptcies, there are certain exclusions to what can be discharged: child support; alimony; and money obtained through fraud, embezzlement or larceny are among the categories not covered.[9]

Repayment plans typically last three to five years. If all payments are made by the end of this period, the debt is discharged. There is also a “hardship discharge” option available to debtors who fail to complete the plan through no fault of their own, due to circumstances beyond their control — such as an injury that prevents their employment.[9]

Chapter 13 bankruptcy

Together with Chapter 7 bankruptcies, Chapter 13 filings are the most common among individuals. Instead of liquidating their assets, the debtor is allowed time to make payments under a court-approved payment plan.

Chapter 13 works like loan consolidation in that the debtor makes payments to a trustee who in turn distributes the funds to creditors. Payment plans under this section last three to five years. Chapter 13 allows debtors with a regular income to save their homes from repossession and to stretch out monthly payments on other secured debt while the repayment plan is in effect.This can reduce monthly obligations.[10]

Chapter 13 is open to people with secured debts of less than $1,184,200 and unsecured debts of less than $394,725 as of December 2021; these figures are adjusted every now and then to reflect the consumer price index.[10]

Chapter 13 does not discharge debt for some long-term obligations, such as a home mortgage, and also has exceptions for things like spousal/child support, government-funded educational loans, and court-ordered restitution based on a criminal conviction.

Chapter 15 bankruptcy

Chapter 15 bankruptcy is designed for foreign debtors. It allows U.S. courts to resolve insolvency cases that involve debtors, assets, claimants, etc., from more than one country. The newest chapter of bankruptcy, it was added by the federal government in 2005.[11]

How to file for bankruptcy

The bankruptcy process itself takes several months and will cost you money in the form of filing costs, attorney fees, and other costs such as enrolling in credit counseling. In addition, the federal government appoints a trustee who’s not a government employee but who represents the debtor’s estate and safeguards the integrity of the process.[2] The trustee’s fees must be paid, as well.

- Gather debts and relevant documents to evaluate your finances.

- Attend credit counseling. You’ll need a certificate to prove you weighed your options and bankruptcy is the best choice.

- Pay the filing fee and fill out at least 23 forms, including the petition. You’ll also have to provide pay stubs, and if you need a fee waiver, you’ll need to fill out an application.

- Go to court to submit your bankruptcy forms.

- Mail the necessary documents to the trustee, who will arrange a meeting with your creditors. Although creditors rarely show up for the meeting, the trustee will use that opportunity to ask the debtor questions to ensure all the paperwork is accurate.

- Attend a Debtor Education course.

Do you need a bankruptcy attorney?

Although you don’t legally need to hire an attorney (you can represent yourself by filing “pro se”), it’s a good idea. In fact, the U.S. government strongly recommends you hire an attorney, because of the long term financial and legal outcomes of a bankruptcy.[3]

Court employees and the bankruptcy judge aren’t allowed, by law, to give you any advice. An attorney, however, can help you determine whether to file a bankruptcy petition and whether your debts can be discharged; which chapter to file under; and whether you’ll be able to keep your home, vehicle or other property. An attorney can also explain bankruptcy law and help you complete and file forms.[3]

Should you file bankruptcy?

Bankruptcy is meant as a last resort for debtors who find it’s their only viable option to get out of debt and make a fresh start. This is one reason credit counseling is a required part of the process: to explore other options.

You may be able to avoid filing a bankruptcy case through:

- Pursuing a debt settlement

- Negotiating payment plans directly with creditors

- Tapping into government or private assistance

- Attending more credit counseling and cutting back on unnecessary expenses

If none of these avenues is sufficient, you might want to consider bankruptcy.

If most of your debt is in a category not covered by bankruptcy law, such as student loan debt or tax debt, it doesn’t make sense to file for bankruptcy. Also, if you’ve become entitled to an inheritance in the 180 days after you file, creditors may be able to claim those funds.[12]

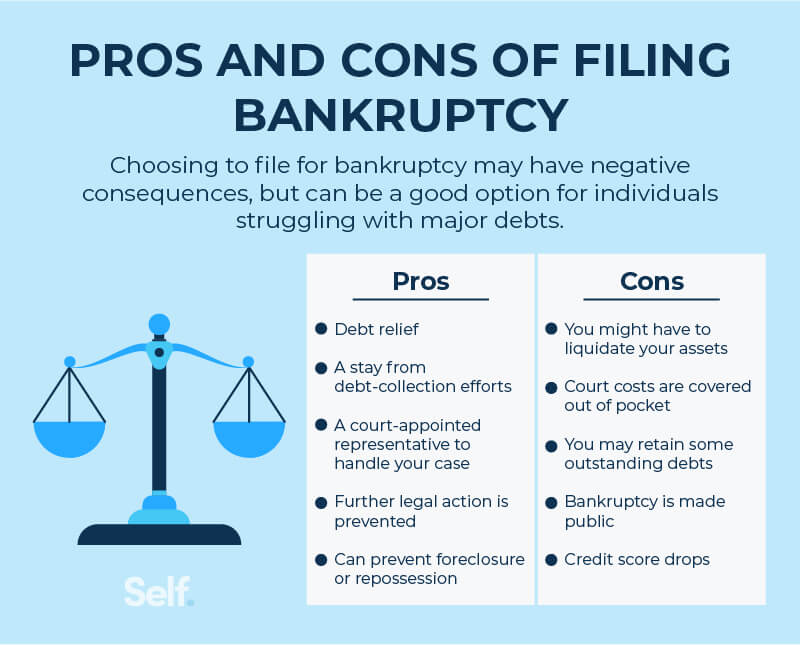

Pros and cons of filing for bankruptcy

Pros:

- You get a fresh start financially. In fact, this is the stated purpose of bankruptcy law.

- By law, a stay is issued so that collection efforts must cease as soon as you file for protection. A stay refers to the official action taken by courts to halt proceedings and/or litigation.

- Depending on the chapter, the state you live in, and your circumstances, you may be able to save some of your assets.

Cons:

- Bankruptcy will not clear you of responsibility for repaying certain kinds of debt, such as tax debt and student loans.

- Bankruptcy filings stay on your credit record for up to 10 years.

- Credit cards are lost in bankruptcy.

- Bankruptcy filings are part of the public record, so members of the public ranging from potential lenders to potential employers will be able to see them.

How bankruptcies affect your credit score

A bankruptcy filing will appear on your credit report and have a negative effect on your credit score. But how much your score might suffer depends in part on how high it was before bankruptcy. Someone with a very high score can expect a significant drop, but someone with a lower score might see a more modest decline.[13]

Not only will the bankruptcy itself appear as a derogatory mark on your credit report, but so will any debts discharged during bankruptcy proceedings. In addition, a Chapter 13 bankruptcy will remain on a credit report for up to 7 years, while Chapter 7 and Chapter 11 bankruptcies will stay on a report for up to ten years.[13]

If the bankruptcy information in your credit report is inaccurate, you may be able to have it removed after your bankruptcy. Such information could include debts not included in the bankruptcy that are erroneously listed as part of it, and discharged debts that still show a balance due. You can check for such errors by ordering a free copy of your credit report.

How to rebuild your credit after filing bankruptcy

Rebuilding your credit after bankruptcy will take time, just as building credit did when you started out. To help rebuild your credit:

Pay your bills on time. Your payment history counts for the largest chunk (35%) of your FICO® credit score.

Consider a secured credit card. This allows you to deposit a few hundred dollars in a linked bank account, which your lender uses as collateral. This amount becomes your credit limit.

Try a credit builder loan. You deposit an amount in a savings account as collateral, then take out a loan of equal value. You can’t access the amount you’ve put in savings until the loan is fully paid. Once it is, it will become a positive mark on your credit report.

Filing bankruptcy is a huge decision

Filing for bankruptcy is a big decision. If you’ve explored other options and find it is the best one for you, you’ll have to decide which type of bankruptcy fits you best.

You will want to consider the pros and cons of bankruptcy, including how it will impact your credit score, before deciding to proceed. Then, if you do, you’ll want to look ahead at rebuilding your credit, and your finances as a whole, once you’ve cleared bankruptcy.

These are all things to take into consideration, but if you do all your research and find that bankruptcy is the best option for you, then you can use it as a way to make a fresh start.

Sources

- United States Courts. “Process - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/process-bankruptcy-basics. Accessed December 23, 2021.

- United States Department of Justice. “Private Trustee Information,” https://www.justice.gov/ust/private-trustee-information. Accessed December 23, 2021.

- United States Courts. “Filing Without an Attorney,” https://www.uscourts.gov/services-forms/bankruptcy/filing-without-attorney. Accessed December 23, 2021.

- United States Courts. “Chapter 7 - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-7-bankruptcy-basics. Accessed December 23, 2021.

- California Legislative Information. “Code of Civil Procedure - CCP,” https://leginfo.legislature.ca.gov/faces/codes_displayText.xhtml?lawCode=CCP&division=2.&title=9.&part=2.&chapter=4.&article=3. Accessed December 23, 2021.

- United States Courts. “Chapter 9 - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-9-bankruptcy-basics. Accessed December 23, 2021.

- CNBC. “The 10 biggest retail bankruptcies of 2020,” https://www.cnbc.com/2020/12/26/the-10-biggest-retail-bankruptcies-of-2020.html. Accessed December 23, 2021.

- United States Courts. “Chapter 11 - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-11-bankruptcy-basics. Accessed December 24, 2021.

- United States Courts. “Chapter 12 - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-12-bankruptcy-basics. Accessed December 24, 2021.

- United States Courts. “Chapter 13 - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-13-bankruptcy-basics. Accessed December 24, 2021.

- United States Courts. “Chapter 14 - Bankruptcy Basics,” https://www.uscourts.gov/services-forms/bankruptcy/bankruptcy-basics/chapter-15-bankruptcy-basics. Accessed December 24, 2021.

- Skiba Law. “7 Reasons Why You Should Not File for Bankruptcy,” https://skibalaw.com/7-reasons-you-should-not-file-for-bankruptcy/. Accessed December 24, 2021.

- MyFICO. “What Are the Different Types of Bankruptcy and How Is Each Considered by My FICO® Score?” https://www.myfico.com/credit-education/faq/negative-reasons/bankruptcy-types. Accessed December 24, 2021.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.