Rocket Money (Truebill) vs. Mint: Which Budgeting App Is Best?

By Ana Gonzalez-Ribeiro, MBA, AFC®

Published on: 01/03/2023

Published on: 01/03/2023

While Rocket Money (previously Truebill) and Mint are both budgeting apps, they each offer unique features that meet different needs. Depending on your financial situation, personal finances and financial goals, one budgeting tool might be better for you than the other.

In comparing Rocket Money (Truebill) vs. Mint, the biggest difference between them is their main function. Both help you manage your spending habits, but with different approaches.

In the Mint app, you can view activities across all your accounts from various financial institutions, create custom budgets and track your spending with real-time, personalized insights that help you find opportunities to save money.

Some of its key features include:

Note that some of these capabilities are only available to premium users through the paid version of the app. The basic budgeting features, like managing bank accounts, subscriptions and recurring bills, are available in the free app.

Some of its key features include:

[1], [2], [3], [5], [6], [7], [8], [9], [10], [11], [12], [13], [14], [15], [16], [17]

Some other similarities between the apps include:

In terms of comparing Rocket Money (Truebill) vs. Mint, if you need to start cutting back on monthly bills, for example, Rocket Money (Truebill) might be better for you. If you want help managing your spending habits and financial accounts, using Mint to create monthly budgets might be the better alternative.

The bottom line is, you should try to determine your financial needs first, and then settle on the personal finance app that suits those needs best. Whichever you choose, downloading Rocket Money (Truebill) or Mint could be the first small step in the journey of making your financial goals a reality.

In comparing Rocket Money (Truebill) vs. Mint, the biggest difference between them is their main function. Both help you manage your spending habits, but with different approaches.

Key Takeaways

- Mint focuses on budgeting by helping you to create savings goals, monitor your financial accounts, like investment and bank accounts, track your bills and check your credit report, all from a single interface.[1]

- Rocket Money (formerly Truebill) provides concierge services designed to lower your monthly bills. For example, they may cancel subscriptions you don’t use. It also helps you save money with automatic deposits into your savings account.[2]

How does Mint work?

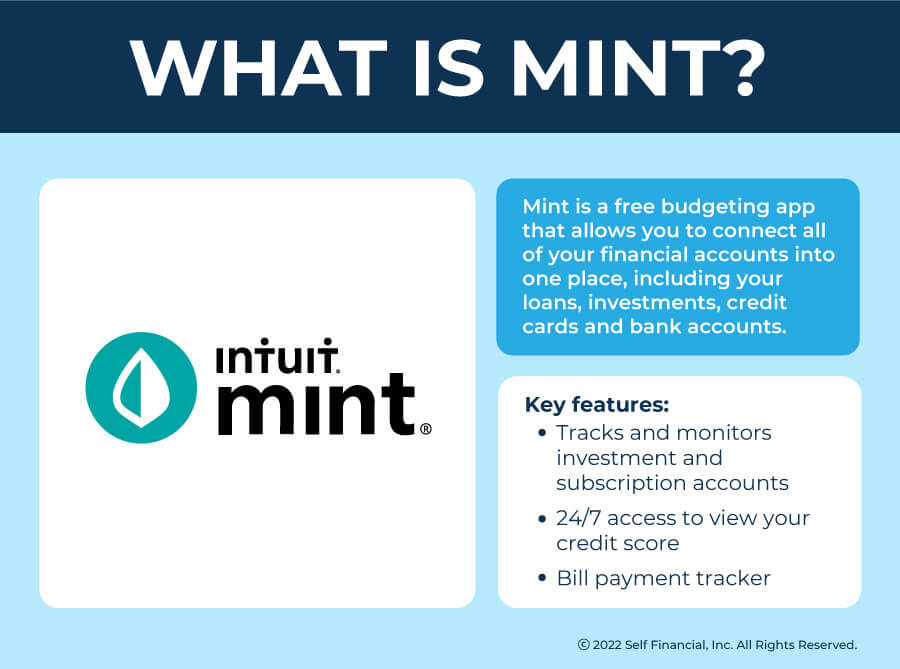

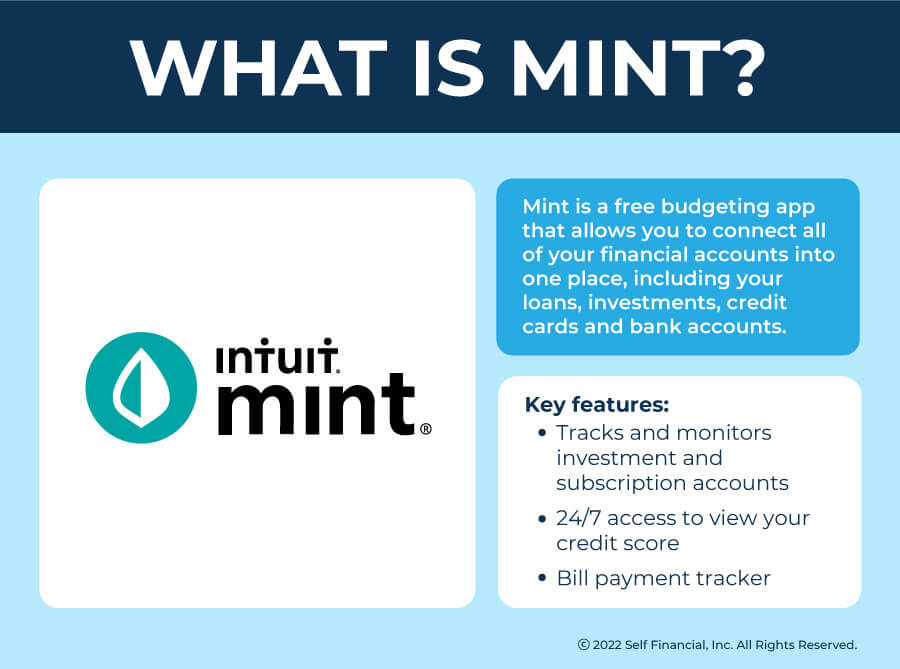

Mint is a free budgeting app by Intuit that helps you organize your financial life by syncing all of your financial accounts, like loans, investments, credit cards and bank accounts, to the app where you can easily monitor them.

In the Mint app, you can view activities across all your accounts from various financial institutions, create custom budgets and track your spending with real-time, personalized insights that help you find opportunities to save money.

Some of its key features include:

- Bill tracker: This feature automatically tracks your recurring bills, sending notifications for due dates, price increases and other fees.[3] This includes subscription services.[4]

- 24/7 free credit score access: Mint allows you to access your credit score, as well as a credit report summary, right in the app, any time you want, without requiring a credit card.[5]

- Investment tracker: With its portfolio and investment tracking software, Mint gives you visibility into your investment accounts, allowing you to compare your personal portfolio against market benchmarks, manage your account balances, save more towards your long-term financial goals and grow your net worth.[6]

How does Rocket Money (Truebill) work?

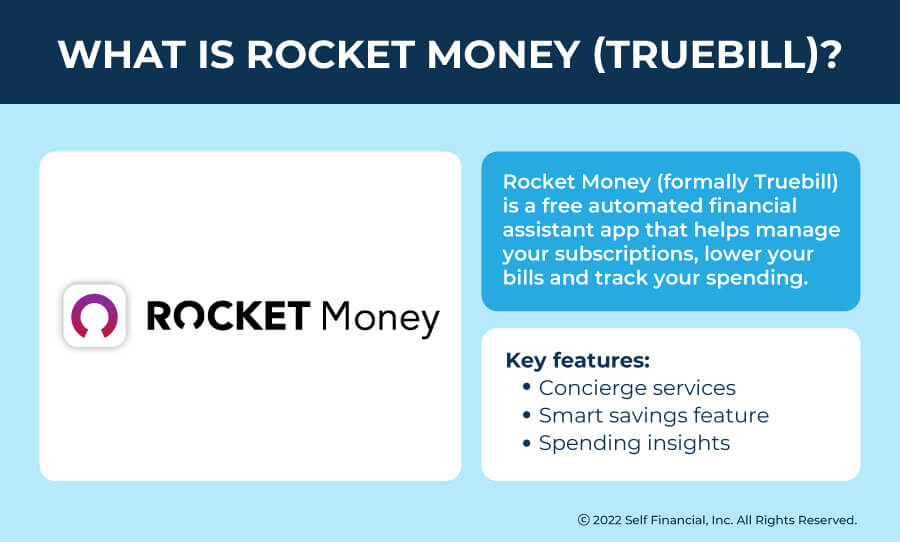

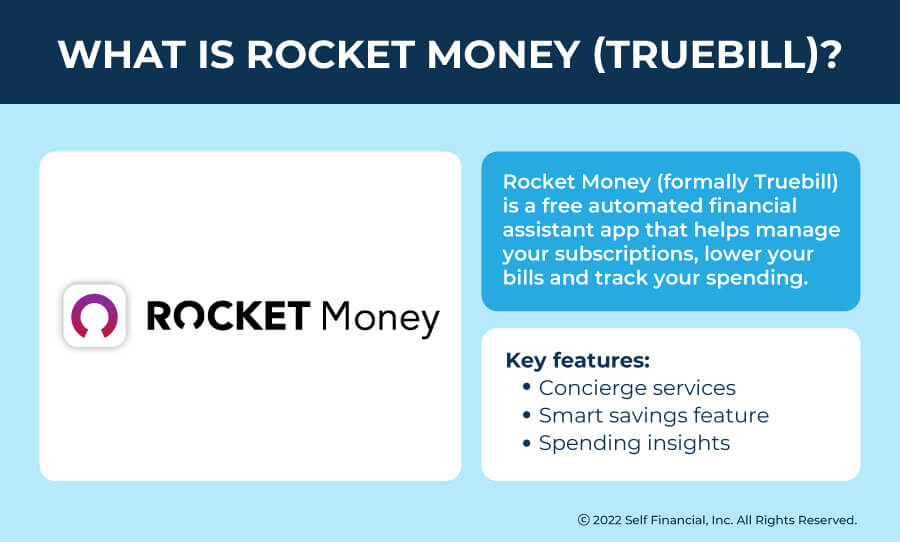

Rocket Money (formally Truebill) is a money management app that works as an automated concierge, or financial assistant, managing your subscriptions and tracking your spending. Rocket Money also indicates that it can track your credit score, negotiate better rates for recurring bills and create a monthly budget.

Note that some of these capabilities are only available to premium users through the paid version of the app. The basic budgeting features, like managing bank accounts, subscriptions and recurring bills, are available in the free app.

Some of its key features include:

- Concierge services: Rocket Money (Truebill) concierge services include bill negotiation services. The app works to find you better rates on recurring bills, like car insurance, find and cancel subscriptions you don’t need, and get you refunds on late and overdraft fees.[7] While these services are free to use, if the concierge is successful in lowering your bills, the app may charge a percentage of what you can expect to save from your first year.

- Smart savings: The smart savings feature analyzes your savings accounts, working to determine the optimal time and amount for you to save, so you can not only save more, but also avoid overdraft fees and work towards your savings goals.[8]

- Spending insights: Syncing your bank accounts allows the app to identify your spending habits and helps you adjust to increase your savings and sends real-time notifications for spending activity, like low balance alerts.[9]

What’s the key difference between Rocket Money and Mint?

With so many overlapping capabilities, it can be hard to tell personal finance apps apart, let alone figure out which has the budgeting tools you need. Here’s a breakdown of the key differences between Rocket Money (Truebill) and Mint, from what budgeting features they have to what they can do for you.| Rocket Money (Truebill) | Mint | |

|---|---|---|

| Best for people who want to: | Lower their monthly bills or cancel any unused subscriptions | Create savings goals or track their spending |

| Cost | Free app, with a paid version that costs $3 to $12 per month (payable on a sliding scale) | Free app, with a paid version that costs up to $4.99 per month |

| Customer service | Premium users receive priority support and have access to a live chat with a support representative. | Mint does not have a phone number, so users have to leave a message through the app or contact customer support through the Intuit support team. |

| Availability | Offered on both web browser and mobile apps (iOS and Android) | Offered on both web browser and mobile apps (iOS and Android) |

| Key features |

|

|

| Links to | Banks, credit cards, streaming services and loans | Banks, credit cards, investment accounts, streaming services and loans |

| Credit score is calculated by | Experian VantageScore® 3.0 | TransUnion VantageScore® |

1. Type of credit bureau they are reporting to

Both Rocket Money (Truebill) and Mint use the VantageScore® 3.0 credit scoring model, but they partner with different credit bureaus:- Mint is partnered with TransUnion and allows free credit score access at all times.[17]

- Rocket Money (Truebill) is partnered with Experian and includes credit score tracking as a key feature.[17]

2. The amount of paid features offered

Though both are free budgeting apps, Mint and Rocket Money (Truebill) differ in the number of features their free apps have vs. the paid versions:- Mint gives you access to almost every feature of the app for free. Its paid version removes the ads and pop-up offers that typically appear when you’re using the app. It also offers bill negotiation services to premium members through Billshark. This service can negotiate with over 30 different providers, mostly for services involving internet, phone and cable. At this time, utilities, insurance, credit card and medical bills cannot be negotiated. You are charged 40% of your savings (up to 24 months) if your bill is successfully lowered. If your bill negotiation provides savings beyond 24 months, you are not charged an additional fee.[18]

- Rocket Money (Truebill) is a free app, but many of its key features are only available in the paid version. These include concierge services, unlimited budgets, customizable budget categorization (the free app has pre-built categories), real-time balance syncing and access to credit reports.[11] However, the paid version is budget-conscious, allowing premium users to pay for the app on a sliding scale, starting at as low as $3 per month, billed annually.[10]

3. How they help you save money

While both apps help you track your spending habits, create monthly budgets and manage your personal finances, each has its own way of helping you save money:- Mint primarily helps you save money by creating savings goals and giving you a breakdown of how much money you’re spending. It allows you to create custom budgets geared toward your financial situation.[19]

- Rocket Money (Truebill) helps you save money by lowering your monthly bills, finding better rates on recurring bills and canceling subscriptions you don’t use. Its automated budgeting tools, like the autopilot smart savings feature, allow you to automatically set aside money towards a debt, your savings goals or any other financial need.

4. How they help you budget and create goals

Setting financial goals can be hard, and sticking to them can be harder. Both apps are designed to help you determine what your financial goals should be and how you can work toward them.- Mint allows you to create unlimited budgets with your own custom categorizations and tracks your spending habits.[20] The app also lets you set spending limits and provides helpful insights to prevent overspending and determine where to cut back.

- Rocket Money (Truebill) isn’t as customizable unless you use the paid version. It tracks your spending habits, identifies your top spending categories and provides budgeting tools, like a spending allowance, to help you adjust.[9] It also keeps you informed of when you are nearing your spending limit, along with upcoming charges, like bill payments, with real-time notifications.[21]

What both apps have in common

While the apps have their differences, Rocket Money (Truebill) and Mint have one thing in common: They work to help you save money and reach your financial goals.Some other similarities between the apps include:

- Easy access: Both apps are compatible with mobile devices (iOS and Android) and are also accessible on many web browsers.

- Budgeting tools: Both apps have a suite of budgeting features that track your spending habits, account balances and monthly bills, and let you sync your financial accounts to one easily viewable interface.

- Bill negotiation services: Both apps offer bill negotiation services as a feature of their paid versions, offering concierges who try to get you better rates for recurring bills.

- Credit reports: Both apps offer access to your credit report, but Mint gives its users free credit score access. For Rocket Money (Truebill) users, credit score tracking and full credit reports are included as a premium feature.[11]

- Track subscriptions: Both apps identify and cancel subscriptions you don’t use, with Rocket Money (Truebill) offering an additional paid concierge service to automate cancellations.

Which budgeting app should you consider?

The best budgeting app for you will really depend on your financial situation and what you’re trying to accomplish as far as your financial goals.In terms of comparing Rocket Money (Truebill) vs. Mint, if you need to start cutting back on monthly bills, for example, Rocket Money (Truebill) might be better for you. If you want help managing your spending habits and financial accounts, using Mint to create monthly budgets might be the better alternative.

The bottom line is, you should try to determine your financial needs first, and then settle on the personal finance app that suits those needs best. Whichever you choose, downloading Rocket Money (Truebill) or Mint could be the first small step in the journey of making your financial goals a reality.

Sources

- Mint. “Manage All Accounts In One Place,” https://mint.intuit.com/how-mint-works. Accessed August 8, 2022.

- Truebill. “The money app that works for you,” https://www.truebill.com/. Accessed August 8, 2022.

- Mint. “Bill Tracking: Online Monthly Bill Tracking & Reminders,” https://mint.intuit.com/how-mint-works/bills. Accessed August 8, 2022.

- Mint. “Subscription Management and Cancellation,” https://mint.intuit.com/how-mint-works/subscription-management. Accessed August 8, 2022.

- Mint. “Free Credit Score & Free Credit Report with No Credit Card,” https://mint.intuit.com/how-mint-works/credit. Accessed August 8, 2022.

- Mint. “Investment Tracker & Investment Tracking Software,” https://mint.intuit.com/how-mint-works/investments. Accessed August 8, 2022.

- Truebill. “Get better rates on your bills,” https://www.truebill.com/feature/lower-your-bills. Accessed August 8, 2022.

- Truebill. “Put your savings on autopilot,” https://www.truebill.com/feature/autopilot-savings. Accessed August 8, 2022.

- Truebill. “Track your spending,” https://www.truebill.com/feature/spending-insights. Accessed August 8, 2022.

- Truebill. “How much does Rocket Money cost?” https://help.rocketmoney.com/en/articles/2217739-how-much-does-rocket-money-cost. Accessed December 6, 2022.

- Truebill. “What do I get as a Premium Member?” https://help.truebill.com/en/articles/2677184-what-do-i-get-as-a-premium-member. Accessed August 8, 2022.

- Truebill. “Take full control of your subscriptions with Rocket Money,” https://signup.rocketmoney.com/infl/. Accessed December 16, 2022.

- Truebill. “Does Rocket Money support international banks?” https://help.rocketmoney.com/en/articles/79778-does-rocket-money-support-international-banks. Accessed December 16, 2022.

- Truebill. “Why is my Rocket Money credit score different from another app?” https://help.truebill.com/en/articles/3975837-why-is-my-truebill-credit-score-different-from-another-app. Accessed August 8, 2022.

- Mint. “What is Mint Premium?” https://mint.intuit.com/support/en-us/help-article/intuit-subscriptions/mint-premium/L8p4BSMYO_US_en_US. Accessed December 16, 2022.

- Mint. “How do I contact support?” https://mint.intuit.com/support/en-us/help-article/login-password/contact-support/L7B7m3td3_US_en_US. Accessed December 16, 2022.

- Mint. “How do I get my free credit score through Mint?” https://mint.intuit.com/support/en-us/help-article/credit-score/get-free-credit-score-mint/L1GbClxRZ_US_en_US. Accessed August 8, 2022.

- Mint. “Bill Negotiation Service,” https://mint.intuit.com/how-mint-works/bill-negotiation-service. Accessed August 8, 2022.

- Mint. “Budget Categories, Tags, & Organization,” https://mint.intuit.com/how-mint-works/categorization. Accessed August 8, 2022.

- Mint. “Budgeting: Online Budget Building Tool,” https://mint.intuit.com/how-mint-works/budgets. Accessed August 8, 2022.

- Truebill. “Create a budget that works for you,” https://www.truebill.com/feature/create-a-budget. Accessed August 8, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on January 3, 2023

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.