10 Ways to Rent an Apartment with No Credit History

Published on: 03/08/2023

Because landlords want to know that you’ll pay your rent on time, they typically conduct a credit check on prospective tenants. While not all require a specific credit score — or even look at your score at all — they do take various financial factors into account. Depending on the individual landlord and apartment location, they may use a tenant screening service, look for a specific rent to income ratio or use other methods to ensure that you can pay the rent on time.[1]

If you’re looking for ways to rent an apartment with no or poor credit history, this post gives you 10 different ways to consider.

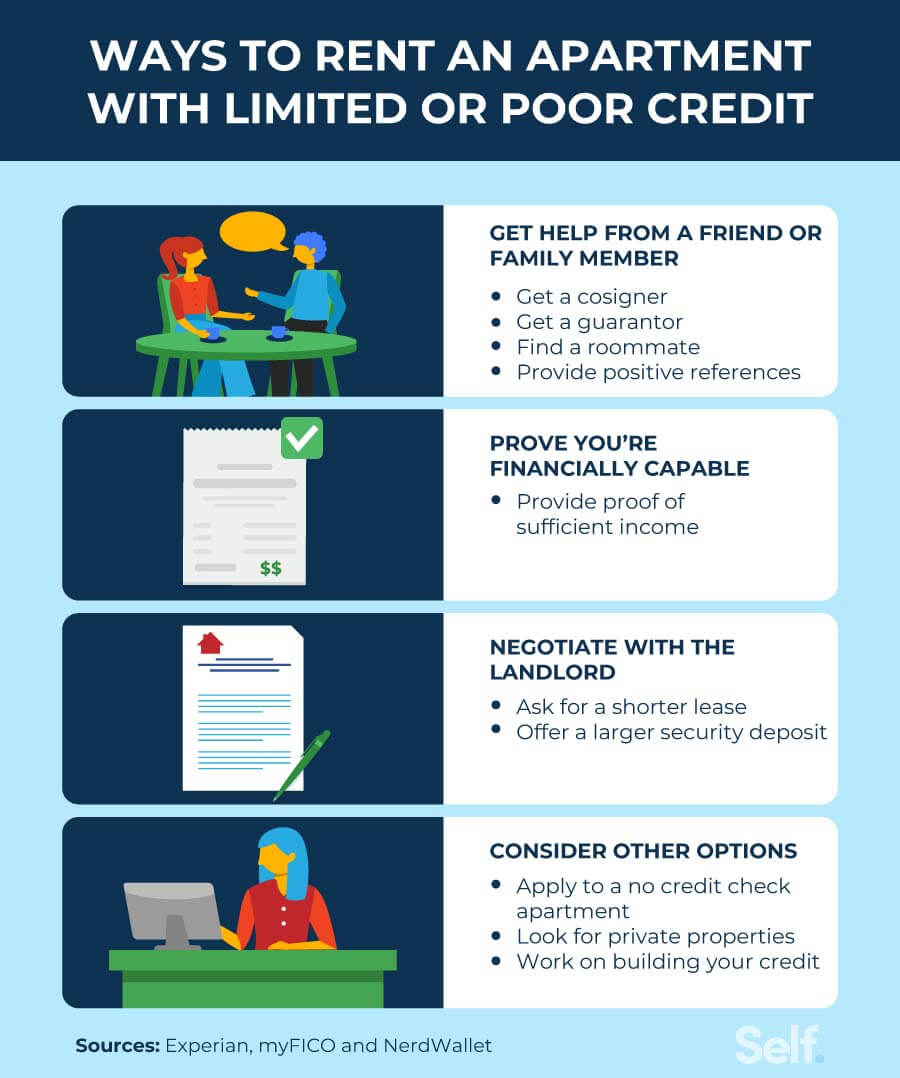

Ways to get an apartment with limited or poor credit

Landlords may take a closer look at your credit details and finances if your FICO® Score falls in the fair range, which is anywhere from 580 to 669. However, the cutoff score for renting can depend on the specific property manager, the local market, your income and the rent amount. In some cases, a landlord won’t take your credit score into account at all, instead considering factors like payment history, debt, bankruptcies and criminal background.[1] If you have poor credit or no credit, the following suggestions can help you prove your trustworthiness to a landlord.

Get help from a friend or family member

If you can’t qualify for an apartment on your own, consider asking trusted friends or family members to help you out by acting as cosigners, guarantors, roommates or references.[1]

1. Get a cosigner

Cosigners agree to make your rental payments if you do not. Because they assume legal responsibility for your rent — plus associated late fees and collection costs — their credit can take a hit for any missed payments. Cosigners can live in the apartment if they choose since they sign the lease and share the financial responsibility. Having a cosigner may make the landlord feel more at-ease, knowing that if you’re unable to make payments, the cosigner will.[2]

2. Get a guarantor

Guarantors also sign the lease with you and promise to make any rental payments you don’t. Unlike a cosigner, however, guarantors have no right to live with you in the apartment. This option may make sense for you if you need someone to vouch for you financially. Depending on your rental income and credit history, however, the landlord may require the guarantor to pledge collateral in the event you default on your payments.[2]

3. Find a roommate

Finding a roommate with good credit may improve your chances of getting the apartment you want (and help you split costs as well). If the landlord runs your roommate’s credit first, your low credit score may pose less of a problem. However, regulations and requirements vary by apartment complex and rental company, so this solution may not help in all cases.[3]

4. Provide positive references

If you don’t have much credit history, positive references may give you additional credibility. Letters of reference from past employers, current co-workers, family friends, or previous roommates can help demonstrate your reliability in meeting your obligations.[3]

Prove you’re financially capable

If your credit history is short, proof of sufficient funds may help reassure your landlord of your ability to pay. Offer bank statements, W-2 tax forms or pay stubs for the past 6 to 12 months (rather than just a few weeks) to show financial stability.[3]

5. Provide proof of sufficient income

A common budgeting rule is to spend no more than 30% of your gross income on rent.[4] So landlords need to see proof that you can afford at least that amount. If you make $3,000 a month, for example, you may want to look for apartments that cost less than $1,000 a month. You can offer proof of income by showing pay stubs, tax forms or a letter from your employer verifying your salary.[4], [5]

Negotiate with the landlord

If you don’t have a strong credit history, you may still have a chance to negotiate with the landlord. Opting for a shorter lease or sooner move-in date may encourage them to rent to you.

6. Offer a larger security deposit

If you have poor credit, paying more money up front may help ease your prospective landlord’s concerns. You can offer to put down a larger security deposit or even to pay several months’ rent when you sign the lease.[3]

7. Ask for a shorter lease

If your lack of credit worries prospective landlords, consider asking for a shorter lease or even going month-to-month. While this may increase the monthly rental price, it may also make landlords more willing to rent to you due to the shorter commitment period.[3]

Consider other options

If you’ve tried the above suggestions to no avail, don’t lose hope. The options below may help you move into a new apartment sooner than you think.

8. Apply to a no credit check apartment

While searching for a new place to live, consider looking into “no credit check” apartment rentals. If you have a poor credit score or no credit, these apartments may rent to you without pulling your credit. However, research your options carefully, as some of these landlords may try to extract higher fees or offer substandard living conditions.[6]

9. Look for private properties

Private property owners often have more lenient requirements than property management companies. Individual landlords may only ask for proof of steady income — and not check your credit at all — making it a great option for renters without a strong credit report. Word of mouth and neighborhood “for rent” signs can help you find these apartments, but keep your eyes open for any potential rental scams that ask for a commitment before you see the apartment.[7]

10. Work on building your credit

If your rental applications keep getting denied despite your best efforts, it may be time to work on building your credit. The sooner you improve your own credit history, the closer you can get renting the apartment you want — without depending on others.[3]

How to build credit

A credit status of “unscored” means you don’t have enough active credit history to generate a score. In order to have a FICO® credit score, you typically need at least one account open for six months or more and one account reported to the credit bureaus within the past six months.[8]

Over 90% of top lenders use the FICO® score [9] when checking credit, so it’s important to understand the factors involved in calculating your score. The FICO® scoring model includes the following five categories of credit information, in order of importance.

- Payment history (35%): The single biggest factor in your FICO® score, payment history includes whether you’ve paid on time, made late payments, or missed payments.

- Amounts owed (30%): This factor calculates how much debt you currently have and how much of your available credit you are currently using.

- Credit history length (15%): This category includes the age of your oldest account, the age of your newest account and the average age of all your accounts.

- Credit mix (10%): A good credit mix includes a variety of account types, such as credit cards, mortgages and installment loans.

- New credit (10%): Because taking out a number of loans in a short period can indicate greater financial risk, credit scores look at how many new accounts you’ve recently opened.

[10]

Several strategies can help you build credit — and hopefully increase your chances of qualifying for a new apartment.

- Become an authorized user: Becoming an authorized user on a credit card helps you take advantage of a friend or family member’s good credit. Authorized users have access to the account, but have no legal accountability for the debts. If the account owner makes payment as agreed, has had the account open for a while and maintains a low credit utilization ratio (CUR; the total revolving debt on the account divided by their credit limit) — and the lender reports it to the credit bureaus — your score may benefit accordingly. If the primary cardholder doesn’t follow those habits, your credit could suffer.

- Repay installment loans: With an installment loan like a mortgage, auto loan or student loan, you receive a lump sum of money and then pay it back over time with regularly scheduled payments. Lenders typically report your payment history to the credit bureaus, so on-time payments can help elevate your credit while late or missed payments can ding your credit score.

- Take out a credit builder loan: Credit builder loans may also help your credit, but they work differently than a traditional loan. Instead of receiving money up front, your loan funds are secured in a savings account or certificate of deposit (CD). You make monthly payments — which are reported to the credit bureaus — and then you receive the lump sum (minus interest and fees) at the end. Your payments will show up on your credit report, just as they would for a traditional loan.

- Use a secured credit card or credit card responsibly: A secured credit card requires a cash deposit upfront as collateral, typically placed in a savings account or certificate of deposit (CD). Your security deposit usually equals your credit limit, so you can use the card to make charges up to the amount you deposited. Both secured and unsecured credit cards should report your payment activity to the reporting agencies, helping you build a credit history.[10]

Can you rent an apartment with bad credit?

Renting an apartment with bad credit may seem like a difficult task if you don’t have the credit score, solid payment history, and income-to-rent ratio landlords are looking for. Even without a specific credit score cutoff, they may rely on tenant screening services that automatically qualify renters based on debt-to-income ratio, number of bankruptcies, delinquent accounts and any criminal history.[1]

Finding a roommate, getting a cosigner, or paying more upfront may enable you to rent an apartment even without a good credit score. Because having a strong credit history is the best way to prove your financial stability, however, you may improve your chances by building your credit before you begin the application process.

What are my options if I’m denied an apartment?

If a landlord rejects you based on a tenant screening report, you have rights as a rental applicant. For starters, the landlord must notify you of the denial in writing, electronically or orally. They must also notify you of your right to dispute inaccurate information, inform you of your right to request a free copy of the report and give you the contact information of the company that provided the report.

If your rental application was denied — or the landlord requires a cosigner or higher deposit than other applicants — follow the steps below:

- Request a copy of the tenant screening report from the landlord. The landlord has to provide you with the name, address and phone number of the tenant screening company used, which allows you to obtain a copy from that company.

- Review the report and talk to the landlord to determine the reason you were denied.

- Check the report for inaccuracies and dispute any errors you find.

[11]

Whether you have a thin credit file or are rebuilding after financial difficulty, Self has the tools and information to get you on the right track. Our credit-building services can help you establish credit, build positive payment history and reach your financial goals.

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- MyFICO. “What Do Landlords Look for in a Credit Check?” https://www.myfico.com/credit-education/blog/credit-score-to-rent-apartment. Accessed on December 27, 2022.

- Experian. “Should I Use a Guarantor or Cosigner on a Rental Agreement?” https://www.experian.com/blogs/ask-experian/guarantor-vs-cosigner. Accessed on December 27, 2022.

- Experian. “Do You Need a Credit Score to Rent a House or Apartment?” https://www.experian.com/blogs/ask-experian/do-you-need-a-credit-score-to-rent-a-house-or-apartment. Accessed on December 27, 2022.

- Chase. “How much of your monthly income should go to rent?” https://www.chase.com/personal/banking/education/budgeting-saving/how-much-income-should-go-to-rent. Accessed on December 27, 2022.

- Experian. “How Much of My Income Should Go Toward Rent,” https://www.experian.com/blogs/ask-experian/how-much-should-i-spend-on-rent. Accessed on December 27, 2022.

- Experian. “7 Tips for Renting an Apartment With No Credit,” https://www.experian.com/blogs/ask-experian/tips-to-rent-apartment-with-no-credit. Accessed on December 27, 2022.

- “7 Tips for Getting an Apartment Without a Credit Check,” https://www.nerdwallet.com/article/finance/7-tips-for-getting-an-apartment-without-credit. Accessed on December 27, 2022.

- MyFICO. “What are the minimum requirements for a FICO® Score?” https://www.myfico.com/credit-education/faq/scores/fico-score-requirements. Accessed on December 27, 2022.

- MyFICO. “FICO® SCORES ARE USED BY 90% OF TOP LENDERS,” https://www.ficoscore.com/about. Accessed on December 27, 2022.

- MyFICO. “How to Build Credit,” https://www.myfico.com/credit-education/credit-scores/how-to-build-credit. Accessed on December 27, 2022.

- Consumer Financial Protection Bureau. “What should I do if my rental application is denied due to a tenant screening report?” https://www.consumerfinance.gov/ask-cfpb/what-should-i-do-if-my-rental-application-is-denied-due-to-a-tenant-screening-report-en-2105. Accessed on December 27, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).