Credit Utilization Tracker Helps Card Users Build Credit Wisely

Published on: 10/24/2019

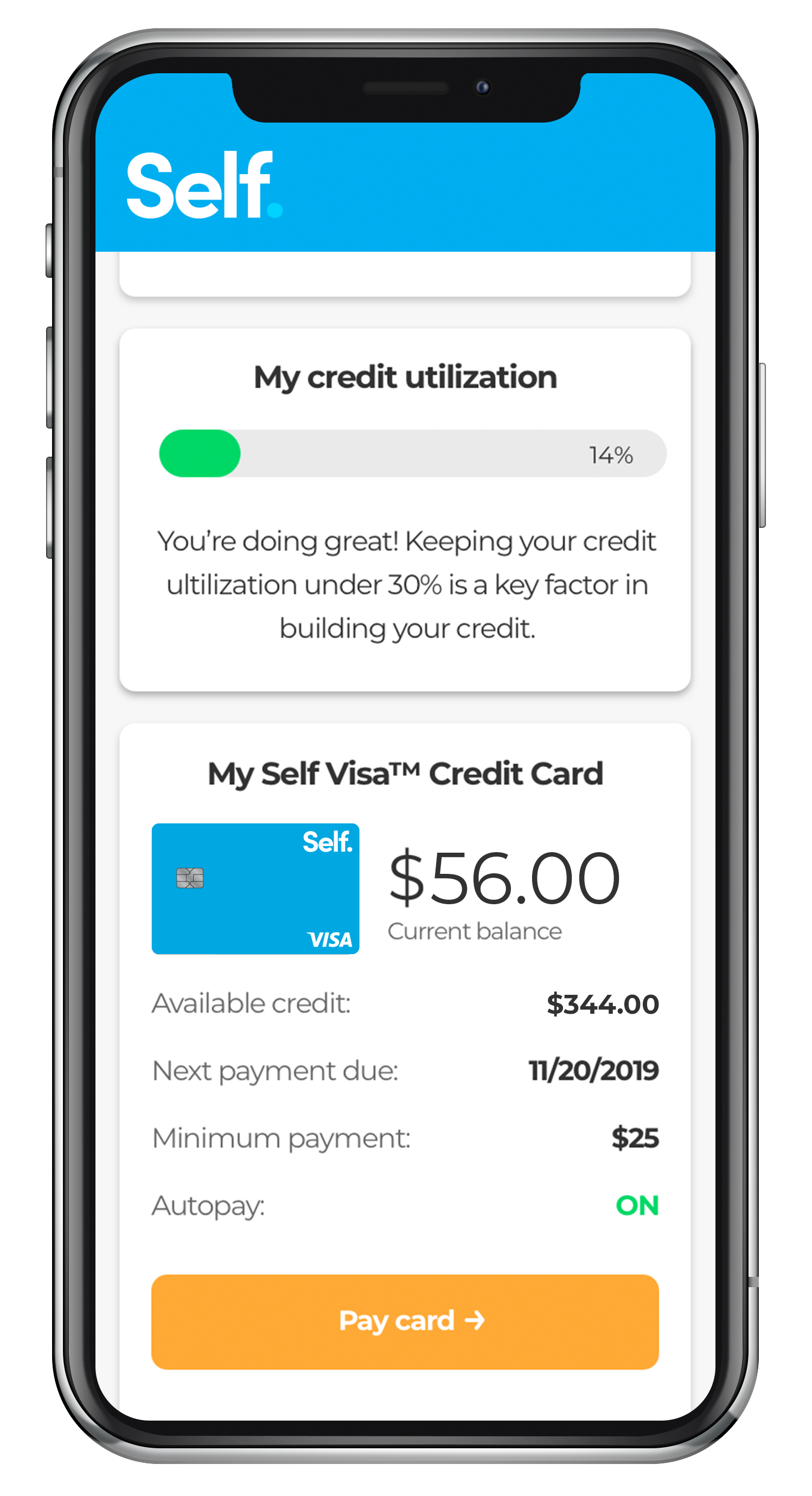

Increasing our investment in helping you build credit, we recently released a credit utilization tracker for holders of the Self Visa® Credit Card.

Why credit utilization matters

Credit utilization, also known as amounts owed, is so important that it counts for 30% of your FICO credit score.

Using too much of your available credit, which experts identify as anything above 30% of your total credit limit, may indicate you're overextended financially. Being overextended could make you a higher credit risk in the eyes of a lender.

With thousands of Self Credit Builder Account holders now taking advantage of another way to build credit through Self’s secured credit card, we wanted to help you manage your new card responsibly. Being able to track how much credit you use, and when you should consider paying your balance down, is a pivotal part of that responsible use.

How the tracker works

While most credit card apps show your current balance and available credit, they leave the mental math up to you. Updated daily, the visualization in the Self Credit Builder app (see below) and online uses a simple traffic-light approach to let customers know – at a glance – where you stand on this important metric.

Helping you help your self

This new feature continues our dedication to transforming existing financial ideas and products into practical tools for the everyday person.

It started with the Credit Builder Account, which made credit builder loans available online and via mobile app for the first time ever in all 50 states.

In September 2019, the trend continued with the release of the Self Visa® Credit Card, which removes typical credit-card barriers of a hard inquiry and an extra security deposit in favor of more transparent eligibility requirements.

The credit utilization tracker marks the next phase in how we’re making the path towards building credit a little clearer to follow.

We have the opportunity to empower people with tools so you can take back control of your own financial health, and we ultimately want to help you help yourself.

About the author

James Garvey is the CEO and Co-founder of Self Financial, Inc., a fintech startup with a mission to help people build credit and savings, whether they’re establishing credit from scratch or rebuilding after financial hardship.