How to Buy a Car With Bad Credit

Published on: 09/30/2021

Buying a car can blend excitement with aggravation. You stack the fun of test-driving different models with new features (moon roofs! heated seats! turbo acceleration!) against haggling over the price with salespeople at car lots and dealerships.

Then, once it’s all done, the hardest part begins: wading through endless paperwork.

That’s not even counting the hurdle of qualifying for an auto loan, which is much more difficult if you have bad credit. In that case, even if you do qualify, you’ll likely face higher interest rates and insurance rates.

Fortunately, you can take steps to ease the anxiety of car-buying, and get yourself a set of wheels without cleaning out your bank account or putting your finances at risk.

Consider these steps if you’re trying to buy a car with bad credit.

1 - Know where your credit stands as a car buyer and borrower

The first step toward buying a car is to know if you can afford it. If you don’t have enough money to pay with cash, and don’t want to wait until you save more money, focus on how you can get a loan.

The first step to getting a car loan? Check your credit score and understand how to make your credit work for you.

Learn how credit works

Begin the process by checking out the three main credit bureaus: Experian, Equifax, and TransUnion. These companies organize information on your borrowing, debt, and payment histories, and compile it into a credit report.

If you want to buy a car soon, pull a free copy of your credit report from annualcreditreport.com to see where your credit stands.

__Credit reports include information such as: __

- Personal information (name, address, etc.)

- Balances on credit accounts

- Payment history, including whether accounts are consistently current (or late) on payments

- Accounts that are in collections

- Bankruptcies and liens

Learn how to read your credit report here.

If you’re not ready to pull your credit report just yet, look at your credit score to start. Checking your credit score is sort of like checking your heart rate. Just like your heart rate provides a snapshot of your physical health, your credit score provides a snapshot of your financial health.

Credit score modeling companies, such as FICO® and VantageScore, use the information from your credit reports to create your credit scores.

Both FICO and VantageScore credit scores range from 300 to 850.[1] The FICO scoring system was created in 1989 by the Fair Isaac Company (hence the name FICO) using a mathematical formula.

Prospective lenders look at your score to determine whether you’re a good bet to repay any money they loan you.

FICO credit scores are the most popular score used by lenders. For Equifax and Experian, who use the FICO model, the credit scoring ranges break down like this:[2]

- Exceptional credit — 800 to 850

- Very good credit — 740 to 799

- Good credit — 670 to 739

- Fair credit — 580 to 669

- Poor credit — 300 to 579

Scoring ranges vary between credit reporting bureaus, as they use different scoring models. TransUnion uses the VantageScore model, resulting in slightly different ranges.[3]

- Exceptional credit — 781 to 850

- Very good credit — 720 to 780

- Good credit — 658 to 719

- Fair credit — 601 to 657

- Poor credit — 300 to 600

Also, keep in mind that not every vendor reports to all three bureaus. This differing input reflects in different scores from bureau to bureau.

Learn how credit scores are calculated here.

Access your credit report

You can get a free credit report once a year to see where you stand.[4] Check it thoroughly to ensure that your credit history is accurate. They can contain errors, so make sure you recognize all the transactions and businesses listed. If not, contact the credit bureau to fix the errors on your credit report.

Check your credit reports regularly to review them for errors and signs of identity theft, especially if those issues could be the cause of a low credit score.

If possible, pull a copy of your credit reports at least a few months before buying a car, so you have time to correct errors on your reports or improve your credit if needed.

Understand what lenders look at

While payment history is a major factor in your credit score, you can’t stop at reviewing your payment history — because lenders don’t. Lenders also look at how much you owe, the length of your credit history, and the types of credit you used.

Creditors also consider many factors besides your credit rating, so take these into account, too. They may include employment status, how much debt you carry in relation to your income, and the kind of car you want to buy.[5]

2 - Set a budget and assess your needs

Know your vehicle’s purpose

Why do you want to buy a car? It seems like an obvious question, but it’s a good idea to take stock of how you want to use it.

Are you a commuter who plans to drive the vehicle to and from work? Will you be taking the kids to school or soccer practice? Transporting elderly parents or loved ones to appointments?

Maybe you need a pickup or other work vehicle to haul materials, equipment, or supplies from place to place. Or perhaps you’re retired and will only be using a car occasionally, or to travel.

Factor these questions into your decision-making process. Research your options online and look at ratings and review sites.

Put it all in the budget

Next, pencil out your income and expenses to see how much you can afford to spend on the car’s base price, plus auto financing. Don’t forget to factor in “down the road” costs, too, such as:

- Insurance. This is a big one: It can cost you hundreds of dollars a year or more. Decide how much insurance you’ll need, how high a deductible you can afford, and what kinds of insurance you want (see below for options). Note: Your credit could also impact the price you pay for car insurance.

- Maintenance costs such as oil changes, tune-ups, tire rotation, and replacing the brake pads and fluids

- Parking, if you live in a place where you have to pay for a parking spot near your home or place of business on a regular basis

- Fuel costs, which can fluctuate based on supply and marketplace issues, and can vary from state to state based on gas taxes and other factors.[6]

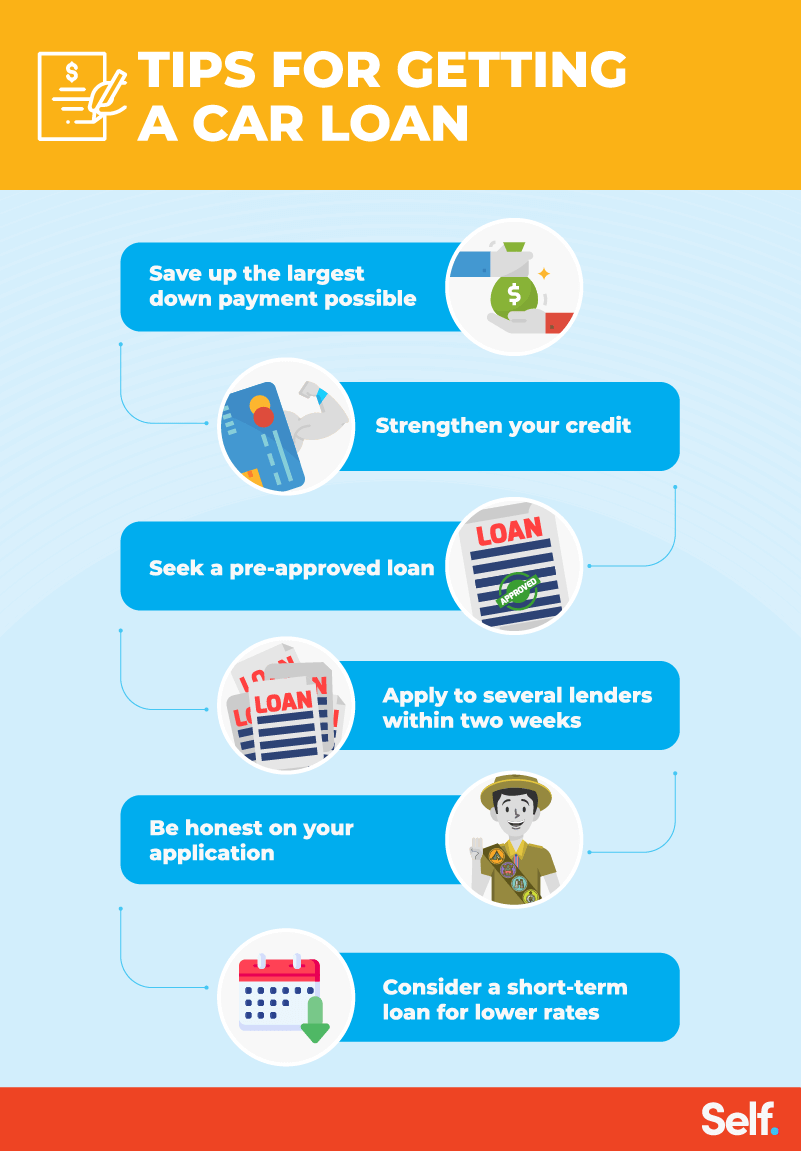

Save for a down payment

The larger a down payment you can bring to the table when you buy a car, the smaller a loan you have to take out, and the less interest you have to pay. Some sacrifice and saving on the front end can go a long way toward making car ownership less expensive on the back end.

3 - Apply for a pre-approved car loan

Loan pre-approval

Getting pre-approved for a loan is a great way to find out what kind of budget you can work with before you start shopping. In the pre-approval process, a lender will tell you how much they decide you can borrow.

More than that, they’ll actually make you a loan amount offer. This means a pre-approval can shield you from car dealers’ high loan rates. With an offer already in your pocket, dealers will be forced to compete with an established amount.

Important note! Just because a lender is willing to lend you a certain amount of money, doesn’t always mean you can afford to borrow that much. Review your budget to make sure you can afford the monthly car payments before accepting a loan.

Your credit impacts the type of loan you can qualify for and if you qualify at all. Before a lender makes you an offer, they take a detailed look at your credit. So it makes sense to understand how a poor credit score affects your car loan.

Subprime borrowers — aka clients who are high credit risk or who have bad credit — face high interest rates and more stringent requirements when it comes to loan products.

Potential lenders

Some places you can search for a pre-approved car loan include:

- Large national banks

- Credit unions

- Community banks

- Online banks

- Finance companies

- Online dealers

- Car dealerships

The two-week window

Submit a loan application with several auto lenders (3 is usually a good bet) to net yourself a range of options. But be aware that shopping around for too long can affect your credit score. Each time a lender looks deeply into your credit history — known as a hard inquiry or a “hard pull” — it puts a little ding in your credit rating.[7]

However, if all your lenders’ hard inquiries are made within a two-week time frame, the credit bureaus usually lump them all together as one single credit-rating inquiry, resulting in just one small hit against your credit. So, typically, you can search for a loan offer for two weeks, consulting with as many lenders as you want.

Getting prequalified

If you don’t want to worry about getting dinged, you can try to get prequalified instead. But first, understand the difference between being prequalified and being pre-approved: Prequalification tells you whether you qualify for a loan before you go to the trouble of applying and having your credit checked.

In this case, prospective lenders won’t do a hard pull on your credit report. They’ll just consider some limited information you share. But they won’t make you an offer, either. The advantage is that you can see the loan terms you may qualify for before you dive into the application process.

Other loan options

To get an idea of where you stand, consult a loan calculator online. This can help you get an idea of the appropriate range. And if you can afford the payments, pursue a shorter loan term. This can reduce your interest rates and help you pay less overall, as opposed to longer-term car loans.

4 - If your auto loan is declined...

Don’t be discouraged. If your car loan application is declined, it doesn’t mean you’ll never get a loan. It just means lenders aren’t sold on your creditworthiness at this particular moment.

Accept the results and be patient. These do’s and don’ts can help.

Don’t make these car loan mistakes

- Don’t turn to a “we finance anyone” dealer. This is a huge red flag. The way they can approve a loan for anyone with “no credit required” is by charging sky-high interest rates and other fees. These places count on making enough money from buyers who pay those rates to offset their higher risk of default.

- Don’t do your car shopping at a “buy here, pay here” lot, either. These places sell older vehicles that have lost most of their value. With their high interest rates, you end up paying more than the car is worth.

- Some install tracking devices so they can repossess the car if you default. With others, even if you pay on time, they don’t report your payments to credit bureaus, so your credit rating won’t improve.

- Don’t try to use a credit card to buy a car. Most credit card interest rates are much higher than a typical auto loan: 16.5% or higher for new offers[8] compared to 4% (or higher, depending on your credit score) for the average 60-month auto loan.[9] By using plastic, you'll only dig your credit problems deeper. Many car dealerships also have maximum limits on credit card payments they’ll accept, if they accept them at all.

- Don’t finance a car with a home equity loan or line of credit. This could put your home at risk, and you could wind up losing it instead of gaining a vehicle.

The right way to reapply

- Do wait to reapply. Remember that shopping around for pre-approval again after that 14-day window can hurt your credit even more. So try again too soon, and you’ll hurt your cause instead of helping it.

- Do save money for a larger down payment. If you can do it, waiting several months or even a year to save more can make life easier down the road.

- Do work on improving your credit in the meantime, for the same reasons as above. The better shape your credit’s in when you reapply, the better interest rates you could get, and the less you’ll spend overall.

Weigh the options

- Think about paying cash if you can. You could save the money you’d otherwise pay on interest while also preserving the option of buying from a private seller. Note: by paying for a car in cash, you won’t be able to help your credit score by building credit history.

- Consider getting a cosigner, but be careful. Most cosigners are family members or good friends. You don’t want to endanger a close personal relationship if you might not be able to make your loan payments. If you can’t pay, they’ll be on the hook, and they probably won’t be happy about it.

5 - Consider different buying options

Dealerships

You don’t have to buy from a car lot. In fact, car dealerships can be more expensive. Still, there are advantages: They usually offer years of experience, take trade-ins, take care of the paperwork, and deal with existing loans and title transfers.

Private party sellers

Buying from a private party, on the other hand, usually costs less. But there’s also more paperwork to deal with on your own, plus potential “people problems” when dealing with an individual. Private sellers also offer less expertise and less accountability. There’s less of a paper trail to follow back if anything goes wrong.

Online dealers

Haggling at a car dealership isn’t your only option. Fixed-price online dealers like Carvana and CarMax are popular with those who hate to negotiate. Just know they might not give you the best deal possible.

Car rental companies

Another no-haggle option to explore is car rental companies, which sell cars as they update their fleets. The selection isn’t as good, but they offer lower-than-retail prices on well-maintained vehicles. The cars may, however, have more wear and tear than other vehicles for sale.

6 - Choose the car that works for you

In a compromised credit situation, you may need to lower your expectations for car-buying. If you have a poor credit score, a new car with lots of features might be beyond your means, and that’s OK.

Choose new or used

If you can afford it, go for a newer model. Late-model used cars often have better financing options than older vehicles, which can come with higher interest rates.

If you can’t go this route, balance the price and features on a less-expensive used car, and consider purchasing a certified used car to get warranty coverage.

Besides, brand new cars lose about 12% of their value in the first year, according to Carfax.[10] So buying a car that’s a few years old may give you the most bang for your buck.

Assess the value

If you’re eyeing a used car, ask to take it to your own mechanic for an inspection before you sign on the dotted line. Reputable dealers usually allow you to do this as a way to stand behind the quality of their product. If they won’t, you may want to look elsewhere.

Whatever vehicle you’re considering, take into account its history, inspection report, and the number of miles on the odometer. Then check the Kelley Blue Book value to make sure you’re not getting ripped off.

7 - Negotiate the right price for your car purchase

Know your limit before you go in to negotiate, and offer as large a down payment as you can. Try plugging your info (down payment amount, trade-in value, number of months you prefer for the loan, amount you can pay monthly) into an online auto loan calculator. These can help you make an accurate comparison between cars you’re considering.

Before you start negotiating, have your research and documentation in place to back up your bids. Focus on the overall price, not the down payment or monthly payment amounts. This will keep you from getting in over your head and paying too much in interest. Also, keep the negotiations on your trade-in value and financing separate from discussions of price.

Here are some more steps you can take to negotiate the best car price.

8 - Finalize the deal

Be thorough

Before you sign, insist on a thorough pre-purchase inspection. Get the results in writing and have them signed by the seller, then sign it yourself.

Read all financial and legal documents thoroughly, making sure you understand them and they match the deal you’ve agreed to. Don’t let the seller rush you through or try to keep you from reading the fine print.

Be aware that you’ll be in a hurry, too — to get the keys and drive your car home. But guard against impatience. Be sure all the i’s are dotted and the t’s are crossed first.

Don’t fall for scams

Along those same lines, don’t fall for the “spot financing” or “spot delivery” trap of driving off before the financing is finalized. This is a scam to jack up your loan rates.[11]

Here’s how they do it:

Instead of happily driving your car under the financing deal you agreed to, you receive a call a week or two after you’ve driven the car off the lot. The seller disavows the deal you thought you’d made.

Instead, the dealer demands that you return the car to renegotiate the loan, usually under much less favorable terms. Or they might insist that you pay high rental rates and/or reimbursement for wear and tear incurred during the time you’ve driven it.

It’s disgusting, but it’s common. The best way to avoid this scam is to apply for financing from someplace reputable beforehand, rather than on the spot at the dealership.

9 - Buy the right car insurance

Rates for car insurance vary depending on the model, so do some research ahead of time to find out your likely range. Some factors include how much it costs to repair, its engine size, its safety record/rating, and the likelihood of it being stolen.

Bad credit can affect your insurance premiums, too.[12] Studies show that the way a person manages money can predict how likely they are to file an insurance claim. Other factors affect insurance costs, too, including age, gender, marital status, driving record, and location. (Accident rates and thefts are higher in some places than others.)

Here are some types of insurance you’ll see:

- Liability insurance for injuries to another person in an accident is required in most states. Liability coverage also can pay for the cost of damaging another person’s property while you’re driving.

- Collision coverage pays for damage to your car if you’re in a crash with another vehicle or run into something like a wall, fence, or post.

- Medical coverage helps pay if you need treatment as the result of a car accident.

- Comprehensive coverage protects you from damage caused by theft, fire, vandalism, extreme weather, etc.

- Uninsured motorist coverage protects you if you’re hit by a driver who doesn’t have insurance.

- Roadside assistance can come in handy if you break down and need a tow, a tire change, or a jump.

10 - Make car payments on time, every time

A car loan can be a great opportunity to rebuild your credit, so take advantage of it and do things right this time around.

Repeating past mistakes in your payment history, like missing or making late payments, will hurt your credit score even more. On the flipside, making those payments on time month after month could raise your credit rating and open doors for you in the future.

11 - Refinance your car loan later

Once you’ve been on time with full payments for at least a year, you may see your credit score start to rise. At some point, refinancing the loan might allow you to negotiate a lower interest rate and lower monthly payments.

Bottom line

Buying a car with bad credit can present you with a lot of hoops to jump through. But that doesn’t mean you’re powerless.

Save up as large a down payment as you can, work to fix your credit, and research your lending and buying options thoroughly. Be patient to get the best loan available from a reputable lender and the best deal possible from a reliable seller.

If you approach the car-buying process correctly, you could wind up with not just a solid vehicle but also a good credit score.

Sources

- Self Financial. "What is Credit?" https://www.self.inc/info/credit-score-range/. Accessed January 15, 2021.

- Experian. “What Are the Different Credit Scoring Ranges?” https://www.experian.com/blogs/ask-experian/infographic-what-are-the-different-scoring-ranges/. Accessed January 15, 2021.

- TransUnion. “What is a good Credit Score Range with TransUnion?” https://www.transunion.com/article/what-is-a-good-credit-score. Accessed February 4, 2021.

- Annualcreditreport.com. “Your rights to your free annual credit reports,” https://www.annualcreditreport.com/yourRights.action. Accessed January 15, 2021.

- Self Financial. "5 Major Credit Score Factors," https://www.self.inc/blog/5-components-of-a-credit-score. Accessed January 15, 2021.

- AAA.com. "State Gas Price Averages," https://gasprices.aaa.com/state-gas-price-averages/. Accessed January 15, 2021.

- Experian.com. "What Is a Hard Inquiry and How Does It Affect Credit?" https://www.experian.com/blogs/ask-experian/what-is-a-hard-inquiry/. Accessed January 15, 2021.

- Business Insider. "The average credit card interest rate by credit score and card," https://www.businessinsider.com/personal-finance/average-credit-card-interest-rate. Accessed January 22, 2021.

- Business Insider. "Here's the average auto loan interest rate by credit score, loan term, and lender," https://www.businessinsider.com/personal-finance/average-auto-loan-interest-rate. Accessed January 22, 2021.

- Carfax. “How Depreciation Reduces Your Car’s Value,” https://www.carfax.com/blog/car-depreciation. Accessed February 1, 2021.

- Consumer Financial Protection Bureau. “Can the dealer increase the interest rate after I drive the vehicle home?” https://www.consumerfinance.gov/ask-cfpb/can-the-dealer-increase-the-interest-rate-after-i-drive-the-vehicle-home-en-831/. Accessed February 4, 2021.

- Self Financial. "It Pays to Understand Your Credit-Based Insurance Score," https://www.self.inc/blog/insurance-credit-score. Accessed January 15, 2021.

About the author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to increase economic inclusion by helping people build credit and savings. Connect with her on Linkedin or Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).