How Much Is a Phone Bill per Month for One Person?

Published on: 03/05/2025

In 2024, the cost of an average phone bill per month was $141, a decrease compared to $156 in 2023.[1] However, keep in mind this cost could include plans with multiple users and phone purchase billed monthly. Cellular plan costs go up for a variety of reasons, including inflation and increased demand for products. Some mobile phone carriers even raise their prices mid-contract, so it’s best to shop around to know exactly what you are getting.[2]

In this post, we go over how much your phone bill should cost, what impacts the price you pay, and how you can lower the cost of your cellular plan.

How much should my cell phone bill cost?

The nationwide average phone bill totals around $141 per month, so you probably shouldn’t be spending more than that.[1] It should be noted that this figure could include additional people on your plan, the cost of the phone purchase over time, and additional costs like insurance, so it could vary from person to person. If your phone bill is too high, evaluate all of your options to make sure you’re getting the best deal. Before changing plans or carriers, the following information will help you think about how you use your phone and how you can potentially cut costs.

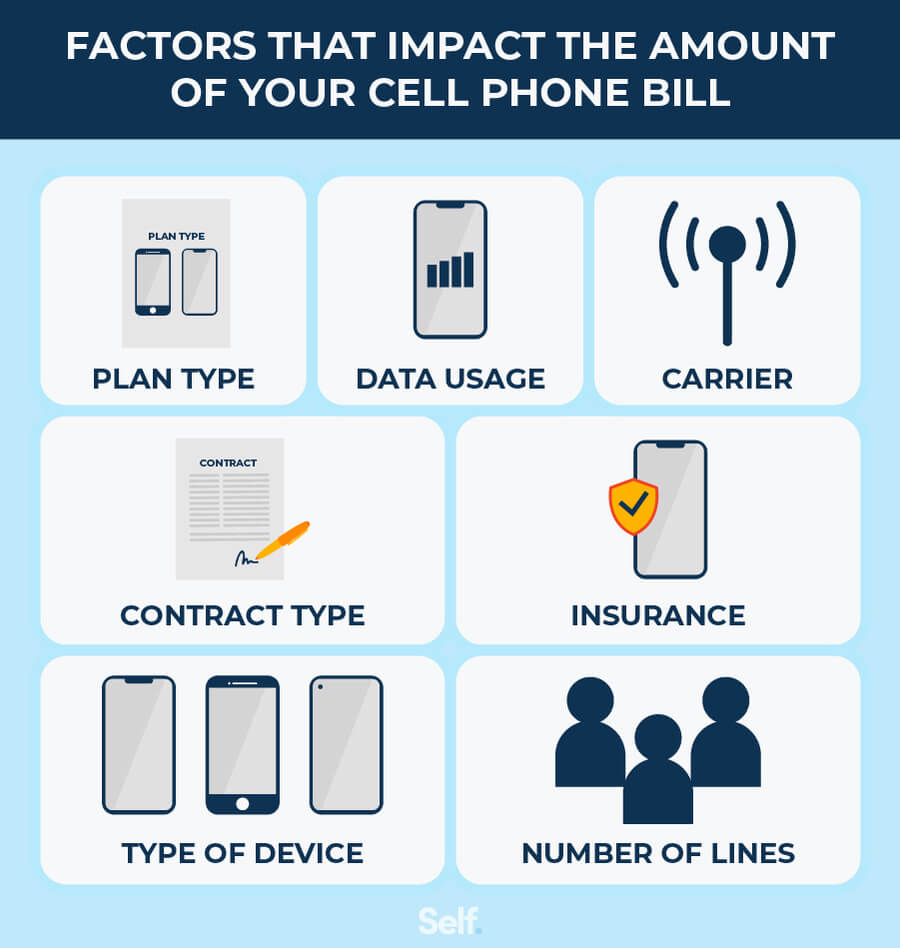

What impacts the cost of your phone bill?

A number of factors influence the cost of a phone bill. The total amount you pay per month can depend on the carrier, phone model, how much data you plan to use, plan options and the number of lines you pay for, among other variables.

The factors below often contribute to the price of your monthly cell phone bill.

- Plan type: The type of cell phone plan you choose can heavily influence the price. Unlimited plans that don’t restrict the amount you text, call or use data, for example, can cost much more than basic mobile plans.

- Data: Whenever you use your phone to access the internet without a wi-fi connection — including texting, streaming videos or videoconferencing, using apps, checking email and browsing the web — you use mobile data. If your plan doesn’t include unlimited data usage, you will have to pay any time that you are over your limit, which can rapidly increase your phone bill.[3]

- Carrier: Prices can vary by cell phone carrier, so make sure to carefully evaluate all your options before choosing a provider.

- Locked or unlocked phone: A locked phone uses a specific carrier — you are literally locked into that carrier for a specific amount of time as stated in your contract. With a locked phone, you choose a plan and stick to the terms and carrier for however long your contract lasts. You save money initially because you don’t have to purchase the phone, you typically lease it so that you can upgrade later if you wish.[4] Unlocked phones have no contracts and aren’t tied to specific carriers. They tend to cost more up front but allow you to change phones and plans more often, which could end up saving you money in the long run.[5]

- Insurance: While insurance can seem like a good idea, it increases the cost of your monthly phone bill even though you may never need to use it. Make sure to evaluate the real risks — such as how often you drop your phone or have had to repair it in the past — the costs (including deductibles) and alternatives before signing up.

- Number of lines on a plan: A phone plan for one person might work out more expensive per person than a plan with multiple lines. Adding multiple lines to your current single-line plan may increase the total cost, but if several friends/family join a single plan, it may significantly drop the price for each person.[6]

- Type of device: Since newer devices tend to cost more, consider whether you really need Apple’s latest iPhone or whether your current phone meets your needs.

How can I reduce the monthly cost of my phone bill?

While it may take a little effort, setting aside some time to evaluate your mobile options can help you lower your plan costs. Below are some tips that could help you reduce the amount you pay for your phone bill each month.

Select a lower-cost carrier

If you want to save money on your monthly phone bill, start by looking into lower-cost carriers like RedPocket, Mint Mobile and US Mobile. Make sure to consider potential trade-offs. While some low-cost plans include unlimited texts and talk time, they may not have the same coverage area as the major carriers or offer the same amount of mobile hotspot data as your current plan. Before you jump ship, don’t forget to review your current phone contract to make sure you can get out of it.

Use wi-fi when possible

One of the easiest ways to lower your monthly phone bill costs without making major sacrifices is to use wi-fi whenever possible. If you don’t have an unlimited data plan, make sure you hop on a wireless network when online browsing at a cafe or video streaming at a friend’s house. Just remember that you put your information at risk when using a public wireless network.

Choose a less expensive plan

Since most carriers offer cell phone plans at varying price points, you can save money by selecting the least expensive plan to meet your needs. You may opt for a basic or essentials-only plan, or even pay by the minute or text if that’s all you need. Before making a decision, take inventory of how you use your phone and the amount of data you typically need so you’re not paying for what you don’t want.

Ask friends and family if you can join their plan

Family plans and other shared-data options allow you to split costs among multiple users. Some offer a set cost for a certain number of lines, while others charge for each line you add. You may be able to lower your single-person cell phone costs by joining the existing plan of a friend or family member since you will only have to pay them for your portion of the bill.[7] If you do join with a group plan, make sure you have a good relationship and have worked out the details for regular payments because someone will be responsible for collecting all the money to pay the bill each month.

Consider a less expensive phone

While you may be tempted by the newest smartphone, it will likely raise your monthly bill if you don’t pay the full cost up front. When you finance a cell phone, the price is usually spread out over the length of your contract. To keep your monthly costs low, you may be better off keeping your current phone and choosing a lower-cost carrier or plan. If you do decide to buy a new phone, make sure to ask about any available promotions and trade-in offers for your old phone.

Consider opting out of insurance

While insurance can sometimes pay off — especially if you purchase a pricey phone or buy a device for a child — it doesn’t always make sense. Sometimes a service you already have may offer coverage for your phone, such as your credit card or homeowners insurance. In the long run, it may be smartest to invest in a sturdy phone case and then put money away into an emergency fund, which you can use to repair/replace your phone if needed. Finally, remember that if you can’t afford to replace the phone you buy, it probably makes sense to choose a less expensive model.[8]

Negotiate a lower price

When you are ready to buy a new phone or change your carrier, talk to the salesperson (or manager) to see if they can give you a price break. They may be able to waive the activation fee or offer a price match if you show them a lower price deal with a competitor.[8]

Consider unlocked phones for future flexibility

Unlocked phones — those that are not tied to a specific carrier — make it easier to switch plans when you find a better deal or your needs change. While unlocked phones may cost more upfront, they allow you the flexibility to seek out lower plan prices, better international options or upgraded perks (like free Netflix or other streaming services). This could help you save money on your monthly phone bill in the long run.[5] [7]

Bottom line

A number of strategies can help you lower the cost of your phone bill per month, from changing carriers to joining a group plan. When evaluating new options, try adding up the potential phone costs for the year and comparing it to what you pay with your current plan. Successfully managing your cell phone account can even help you build credit if you sign up for services that add bill payments to your credit report.

Sources

- JD Power. “Wireless Purchases Through Apps Increase, Leading to Increase of Value and Affordability Perceptions, J.D. Power Finds” https://www.jdpower.com/sites/default/files/file/2024-02/2024009%20U.S.%20Wireless%20Retail%20Experience%20Vol.%201.pdf

- CNBC, “How to Cut Your Cell Phone Bill Costs” https://www.cnbc.com/select/how-to-cut-your-cell-phone-bill-costs/

- TechTarget. “Mobile data,” https://www.techtarget.com/whatis/definition/mobile-data

- Verizon. “The difference between locked and unlocked phones,” https://www.verizon.com/articles/switching-to-verizon/unlocked-vs-contract-phones/

- Best Buy, “Buying an unlocked cell phone,” https://www.bestbuy.com/site/mobile-cell-phones/why-buy-an-unlocked-phone/pcmcat284300050008.c?id=pcmcat284300050008

- WhistleOut. “Best Family Cell Phone Plans 2023,” https://www.whistleout.com/CellPhones/Guides/best-family-cell-phone-plans

- Consumer Reports. “Best Cell Phone Plan Deals for You and Your Family,” https://www.consumerreports.org/cell-phone-service-providers/best-cell-phone-plan-deals-for-you-and-your-family

- Ramsey Solutions. “Lower Your Cell Phone Bill With These 12 Tips,” https://www.ramseysolutions.com/budgeting/trim-down-your-cell-phone-bill

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).