Does Paying Rent Build Credit?

Published on: 01/12/2023

Paying rent does not build credit unless your payments are reported to a credit bureau.[1] You could have rent payments count towards your credit by:

- Signing up for a rent reporting service yourself, or

- Asking your landlord to sign up for a rent reporting service

Both options may include a subscription fee that you either pay directly or that your landlord pays and may pass on to you or include in the cost of your rent.

Because landlords and property managers aren’t considered creditors — rent isn’t considered debt — they don’t automatically report your payment history to Experian, TransUnion and Equifax, the three major credit bureaus. So rent payments aren’t usually included as part of your credit history.

How rent payments may affect your credit score

If your landlord reports rent payments to a credit bureau, your rent payment history may affect your credit score the way your general payment history can. On-time monthly payments can have a positive effect over time, potentially elevating your credit score, while missed or late payments can hurt your score.

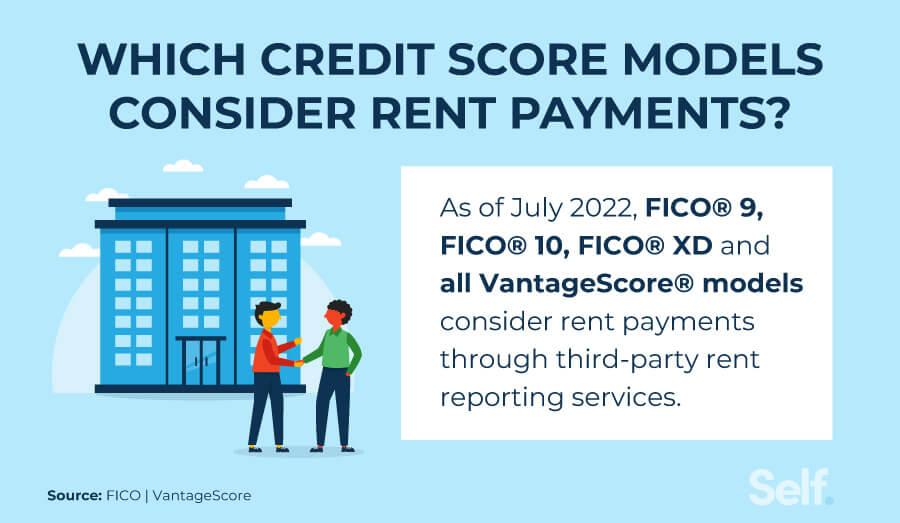

Which credit scoring models consider rent payments?

Even if rent is reported to bureaus, it may not impact your credit score for the common scoring models. Rent payment history currently may be factored only into your VantageScore®[2] and FICO® 9, 10 and XD scoring models.[3]

FICO® has many versions, and the difference between the models is essentially what information they consider in your score calculations.

The following credit scoring models do take rent payment history into account. While they’re not the commonly used credit score models, they may still be considered by certain lenders:

- FICO® 9[4]: FICO® 9 is the first FICO® score to take rent payments into account. Consistent, on-time monthly rent payments should positively impact your score.

- FICO® 10[5]: Similar to FICO® 9, the FICO® 10 is a newer FICO® score that also takes reported rent payments into account, with a positive payment history positively impacting your score.

- FICO® XD[6]: FICO® XD is a score designed to help previously unscorable borrowers who haven’t been able to get credit access due to low or limited credit history. It takes rent payments into account as a way to be more inclusive to those who would be unscorable under other models.

- VantageScore[2]: VantageScore® considers rent as well as utility payments in calculating credit scores, if they’re reported by either a landlord or the borrower.[7]

How to report rent payments to credit bureaus

As mentioned before, you have two main ways for rent payments to count towards your credit score: either you or your landlord have to sign up for a rent reporting service. That service then furnishes the data to credit bureaus.

If you’re concerned about the accuracy of your records, note that rent payments, like any information collected by credit reporting agencies, is covered by the Fair Credit Reporting Act.[8] FCRA requires that all information reported about a consumer is accurate, so that extends to anything your landlord can report when using a third-party service or sending general information: tenant screenings, payment history and so on.

Rent reporting services for individuals

Some rent reporting services allow consumers to report and manage their information directly, with little or no landlord involvement. Some of these services include:

- Boom: Boom is an app that partners with the three major credit bureaus, Experian, Equifax and TransUnion, to allow tenants to report rental payments. It charges a $10 enrollment fee and $24/year for ongoing reporting, with an additional $25 fee for historical reporting (up to 24 months).

- Rent Reporters: RentReporters reports rental payment history to Equifax and TransUnion for its subscribers, offering up to 24 months of historical reporting. It charges a $94.95 fee to enroll with an ongoing monthly fee of $9.95, or you can pay the signup fee of $94.95 and pay an annual fee that equates to $7.95 per month.

- Rental Kharma: Rental Kharma partners with TransUnion and Equifax to report rent payments from your current residence. Its $50 enrollment fee includes historical reporting of all past payment history at your current address. For ongoing reporting that keeps your account open and current, you pay $8.95/month.

- Self: Self's Free rent reporting service reports positive rental payments each month to Equifax, Experian and TransUnion. There's no credit history required and no hard pull. You can also add utility and cell phone payments by upgrading your subscription for $6.95 a month.

Rent reporting services for landlords

Some rent reporting services work with your landlord or property management company to collect information, rather than with you directly. Some of these services include:

- Esusu Rent: Esusu is a rent reporting service that is currently available to landlords and tenants of an enrolled building. Since the landlord signs up for the service, renters don’t pay Esusu directly, although your landlord may charge a fee for providing the service. It isn’t yet open to individual consumers, though a waitlist is available on its website.

- RentTrack: The first rent reporter to build relationships with all three major credit bureaus, RentTrack can report up to 24 months of historical payment data with your current landlord at your current lease address for a one-time fee of $50. It charges an ongoing monthly subscription fee, calculated upon signup. Your landlord may cover all or part of your monthly subscription fee.

- PayYourRent: PayYourRent is a service that handles rent payments, with same-day processing for property managers, allowing you to build credit with each payment. It works with TransUnion, Experian and Equifax. Although renters aren’t charged a fee directly for this service, landlords may pass on the cost of doing business with this service to their tenants.

How to choose a rent reporting service

If you already have good credit, adding your rental payment history may not be necessary. For bad credit, however, a solid, positive payment history may impact your score if it is reported by rent reporting services.

When looking for a rent reporting service, keep in mind some of the following factors:

- Consider the cost and benefits. Is your rental payment history good enough to justify the cost of enrolling in a service and paying an ongoing fee? Make sure the benefit of reporting your on-time rent payments is worth the cost of using the service.

- Ask your landlord if they already use a reporting service. If your landlord already uses a rent reporter, it may be easier and less expensive for you to opt in.

- Shop around for reputable companies, Be sure that the company you’re interested in using is legitimate before sharing your sensitive data with them. You can cross-reference its information with resources like the Better Business Bureau.

- Consider whether roommates or other household members can be added. Some services may allow joint accounts, while most are meant for individuals.

- Look at which credit bureaus are contacted by the service. Not all rent reporting services have relationships with all three credit bureaus; many report to one, or two. Opting into a service like Self gives you the advantage of having your positive payment history reported to TransUnion, Experian and Equifax.[15] The more credit bureaus your payments are reported to, the more credit history you have at each bureau.

- Evaluate if the service reports past rent payments and how far back they’ll report. Many services offer to report some range of past rent payment history, often for an additional fee. Some can go further back than others, which may be a better option if you have a long history of consistent payments at your address.

Are landlords required to report rent?

Landlords aren’t currently required to report rental payment information, though, as of July 2022, two states have programs or laws impacting rent reporting. Colorado[9] has a pilot program with the goal to reach the underserved and under-represented in its state when it comes to home ownership by helping those populations gain access to rent reporting. California[10] has a rent-reporting bill that went into effect in 2021, requiring this for managers of lower-income housing. The general idea behind these laws is to help low-income tenants build credit when they may otherwise lack opportunities to do that.

Whether or not a landlord is required to report rent is up to the discretion of each state. Check in with your state’s specific laws online to see how you might be affected.

What happens if you miss rent payments?

If you miss rent payments, and your payment history is being reported to credit bureaus, the impact on your credit score will be like a missed payment on any other credit or loan payments. Payment history is a major factor in how credit scores are calculated, so a poor payment history lowers your score.

The impact may also apply if you’re delinquent on rent payments, even if you aren’t using a rent reporting agency, because your landlord could attempt to collect on your missed payments through a debt collector or collection agency.

However, there are some protections in place for renters, meaning that non-payment of rent can be valid.[11] For example, if your landlord refuses to make necessary repairs to the property, or endangers the health and safety of tenants, you are well within your rights to withhold rent and shouldn’t be penalized.

Does paying rent with a credit card build credit?

In addition to using a rent reporting service, using a credit card to pay your monthly rent payments may help you build credit, as long as you also make your credit card payments on time. Making credit card payments on time positively impacts payment history, the most important credit score factor.

However, making rent payments on your current credit card doesn’t create a new, positive item on your credit report. Instead, you increase the balance that you must pay off each month to avoid high interest rates associated with credit cards. So unless you have a new credit card dedicated to rent, putting rent on an existing card you use each month already may have little impact on your credit.

What bills help build credit?

Bills that you pay using a credit product, like a credit card, auto loan or line of credit, are the bills that are most likely to be reported to credit bureaus. Anything that you pay for using one of these methods impacts your credit score, because you’re borrowing the money from the creditor to pay the bill, then paying back your debt to them.

Other types of bills, like utility bills, may also be counted through third-party services[12], just like rent can through rent reporting companies.

More ways to build credit

Even if you’re able to have rent payments count towards your credit score, you can find other ways to build credit that you shouldn’t ignore. Some strategies to help build your credit include:

- Considering a credit builder account. A Credit Builder Account may help you build positive credit history and build savings. Unlike a traditional loan, where you receive the money upfront, with a credit builder loan you make monthly payments, which are put into a certificate of deposit (CD) or savings account. You receive your lump sum (minus interest and fees) as soon as all your payments are made. Each payment gets reported to the credit bureaus.

- Getting a secured credit card. A secured credit card requires a security deposit to open an account. As long as you make on-time monthly payments, you can build a positive payment history.

- Becoming an authorized user. Being an authorized user with someone who has a good credit score not only helps you begin building credit if you have poor or limited credit history, but it can also increase your creditworthiness by association. Just make sure the authorized user has a low credit utilization ratio (the total amount of revolving credit balances divided by their total revolving credit limits) has been paying the account as agreed and has had the account open for some time.

- Checking your credit report for errors. Be sure to inform credit bureaus of any incorrect information or missing payments on your credit report, so that they’re not held against you.

Make rent payments work to your advantage

If you’re looking for a way to help build your credit score, and know you’ve made consistent, on-time monthly payments towards your rent, it may be to your advantage to try to have rent payments reported to credit bureaus.

Rent reporting services like Self can help you get started in making your rent payment history work for you.

When it comes to building credit and maintaining a good credit score, leave no stone unturned: Any positive payment history you have is just more evidence to show potential lenders how reliable you can be.

Sources

- U.S. News. “How Can You Get Credit for Paying Rent?” https://money.usnews.com/credit-cards/articles/how-can-you-get-credit-for-paying-rent. Accessed August 1, 2022.

- VantageScore. “The Complete Guide to Your VantageScore,” https://vantagescore.com/press_releases/the-complete-guide-to-your-vantagescore/. Accessed August 1, 2022.

- FICO®. “FICO® Scores Versions.” https://www.myfico.com/credit-education/credit-scores/fico-score-versions. Accessed January 9, 2023.

- FICO®. “FICO® Score 9 Now Available to Consumers at myFICO.com,” https://www.fico.com/en/newsroom/fico-score-9-now-available-consumers-myfico-com. Accessed August 1, 2022.

- FICO®. “FICO® Introduces New FICO Score 10 Suite,” https://www.fico.com/en/newsroom/fico-introduces-new-fico-score-10-suite. Accessed August 1, 2022.

- FICO®. “FICO® Score XD,” https://www.fico.com/en/products/fico-score-xd. Accessed August 1, 2022.

- VantageScore. “Can Rent and Utilities Improve Your Credit Scores?” https://vantagescore.com/can-rent-and-utilities-improve-your-credit-scores/. Accessed August 1, 2022.

- Federal Trade Commission. “Fair Credit Reporting Act,” https://www.ftc.gov/legal-library/browse/statutes/fair-credit-reporting-act. Accessed August 1, 2022.

- CHFA. “CHFA: Rent Reporting,” https://www.chfainfo.com/homeownership/rent-reporting#. Accessed August 1, 2022.

- California Legislative Information. “Senate Bill No. 1157,” https://leginfo.legislature.ca.gov/faces/billNavClient.xhtml?bill_id=201920200SB1157. Accessed August 1, 2022.

- Consumer Financial Protection Bureau. “Your Tenant and Debt Collection Rights,” https://www.consumerfinance.gov/coronavirus/mortgage-and-housing-assistance/renter-protections/your-tenant-debt-collection-rights/. Accessed August 1, 2022.

- Capital One. “Can Paying Bills Help Build Credit?” https://www.capitalone.com/learn-grow/money-management/does-paying-bills-build-credit/. Accessed August 1, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).