Does Paying Car Insurance Build Credit?

Published on: 09/13/2022

Car insurance payments aren’t reported to the credit bureaus: Experian, Equifax and Transunion. Therefore, paying your car insurance doesn’t directly impact your credit score. However, paying for your car insurance with a credit card can indirectly help build credit.

We will discuss how paying for car insurance with a credit card can indirectly help you build credit, factors that impact car insurance and more ways to build credit.

Will paying my car insurance premium with a credit card help me build credit?

You can build your credit by using your credit card to make car insurance payments and then by paying off your credit card by the due date. On the other hand, missing credit card payments could harm your credit.[1]

Does shopping for insurance impact my credit?

Receiving several car insurance quotes does not impact your credit. Car insurance companies may check your credit based insurance score during the initial stages of insurance quotes, but these checks are soft inquiries. Soft inquiries review your credit history to understand your financial health.[2]

On the other hand, lenders perform hard inquiries to determine creditworthiness when you apply for credit. Because hard inquiries reflect that you’re seeking new credit, and thus new debt, your credit score may be impacted. However, soft inquiries, on their own, don’t impact your credit, but if you accept the offer, you would then undergo a hard inquiry that would impact your credit.[2]

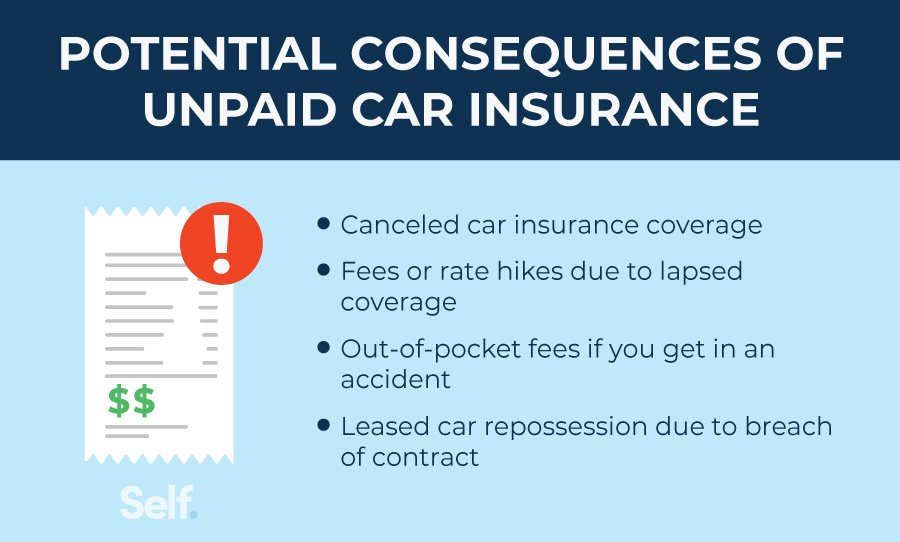

Consequences of unpaid car insurance

If you don’t pay your car insurance, your provider may cancel your insurance coverage or charge you fees. However, unpaid car insurance won’t impact your credit score unless your debt is sent to collections.

If you do happen to miss a payment, many insurance companies won’t send a delinquent account to collections. First, you may incur late fees or lose your premium.[3]

How does my credit score impact my car insurance rate?

Your credit-based insurance score may be only one factor in your car insurance premium, along with driving history, location, age, and more. Most auto insurance providers base your insurance premiums in part on your creditworthiness. So your credit history can impact how much you pay for your auto and home insurance. However, many states have banned or limit credit-based insurance scores for determining insurance premiums.[4]

Factors that determine your car insurance rate

Many factors determine your auto insurance rate, including:

- Credit score: Studies show that people with higher credit-based insurance scores file fewer insurance claims, prompting lower premiums and fees.

- Driving history: Previous accidents and tickets may cause higher premiums due to repeated risky behavior.

- Where you live: Areas with higher crime rates, vandalism or accidents can cause your premiums to be higher.

- Age: Younger drivers have less credit and driving history, which makes them riskier in the eyes of insurers.

- Type of coverage: Different forms of coverage, such as liability, collision and comprehensive coverage, can impact monthly premiums.

- Type of vehicle: Vehicles prone to accidents, such as sports cars, can carry higher auto insurance premiums because of the added risk.

- The insurance company: Different insurance companies will weigh risk factors differently. Shopping around for rates is the best way to find an ideal rate.[5]

What gets reported to the credit bureaus that impacts my credit score?

Insurance companies don’t report to credit bureaus because they don’t lend money to people, but most creditors report financial items to the credit bureaus, including:

- Loans

- Mortgages

- Revolving credit

- Bankruptcies

- Accounts sent to collections [6]

Ways to build credit

A favorable credit score can provide financial benefits, and you can build your credit score through several of the following ways:

- Secured credit card: Secured credit cards feature a credit amount set by an initial secured deposit. They typically report to credit bureaus just like standard cards, and they may eventually become an unsecured card once the user has built up their credit.

- Credit builder loan: Unlike conventional loans, credit builder loans require you to make all of your loan payments first, before you receive your loan proceeds. Those payments get put into a savings account or certificate of deposit (CD) (minus interest and fees) to access after paying off the loan. All payments get reported to the bureaus.

- Credit card: Unsecured credit cards will build credit with regular use. Be sure to make all payments on time and keep your credit utilization ratio (CUR) — your total balance divided by your credit limit — below 30%.[7]

- Co-signing: To make getting approved for credit lines easier, you can apply with a co-signer who has great or excellent credit to help you achieve better rates. However, any missed payments or defaults go back to the co-signer.

- Authorized user: Becoming an authorized user on someone else’s account may boost your credit score. Just be sure their credit is excellent. Being an authorized user on a credit account with delinquent payments or one with a high CUR could also hurt your credit.

If you need to improve your credit, you can impact your credit in a positive way by doing the following:

- Make on-time payments: Your payment history accounts for 35% of your FICO® credit score. Always make your payments in full and on time. Missed or late payments can stay on your report for up to seven years.

- Pay down debts: High credit utilization will keep your credit score low. Paying down your debts can help positively impact your score.

- Keep balances low: Don’t use your cards too much while rebuilding credit. Experts advise keeping your CUR below 30% can help keep debts manageable while paying them down.[7]

- Only charge what you can afford to pay: On a credit card, only charge for items you can immediately pay off.

Build your credit

Your credit can play a part in car insurance. Paying your car insurance may not build your credit score, but you can take steps toward building credit with tools from Self. Self offers a Credit Builder Account so you can begin saving money with a credit builder loan and then take advantage of Self’s secured Visa to make everyday purchases. Both tools offer important steps in building your credit for the future.

Sources

- Consumer Insurance Report. “Can You Pay For Car Insurance With A Credit Card?” https://www.consumerinsurancereport.com/faqs/can-you-pay-for-car-insurance-with-a-credit-card. Accessed on April 18, 2022.

- Experian. “What Are Inquiries On Your Credit Report?” https://www.experian.com/blogs/ask-experian/credit-education/report-basics/hard-vs-soft-inquiries-on-your-credit-report/. Accessed on April 18, 2022.

- Experian. “Does My Car Insurance Policy Affect My Credit Score?” https://www.experian.com/blogs/ask-experian/does-car-insurance-affect-my-credit-score/. Accessed on April 18, 2022.

- Allstate Insurance. “Does Your Credit Score Affect Your Car Insurance Rate?” https://www.allstate.com/tr/car-insurance/does-credit-score-affect-car-insurance.aspx. Accessed on April 18, 2022.

- Experian. “Why Do Auto Insurance Companies Consider Your Credit?” https://www.experian.com/blogs/ask-experian/why-do-car-insurance-companies-base-their-rates-on-credit-scores/. Accessed on April 18, 2022.

- Equifax. “What is a Credit Report and What Does It Include?” https://www.equifax.com/personal/education/credit/report/what-is-a-credit-report-and-what-does-it-include/. Accessed on April 18, 2022.

- CNBC. “Credit utilization is at its lowest since 2009—this is how much the average person uses,” https://www.cnbc.com/select/how-much-to-spend-on-a-credit-card/. Accessed on April 18, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).