Do Credit Unions Help Build Credit?

By Ana Gonzalez-Ribeiro, MBA, AFC®

Published on: 12/14/2022

Published on: 12/14/2022

Joining a credit union could provide you with valuable opportunities to build credit — even if you don’t have a good credit score. Consumers with poor credit may prefer credit unions over traditional banks because they often offer better loan terms for borrowers, more flexibility when it comes to loan approval and a variety of resources to help you improve your finances.

As non-profit organizations owned by account holders, credit unions exist to serve their members. This means they tend to have lower fees and more reasonable interest rates than banks.[1]

This post will help you understand how credit unions work, how they differ from commercial banks, and how credit unions can help you build credit.

Such affinity-based memberships allow credit unions to tailor their membership to cater to specific careers, interests, and needs. Individuals with lower incomes and those recovering from bankruptcy, for example, may find that credit unions offer them specialized assistance that they don’t receive from commercial banks or larger financial institutions.[1],[3]

The following examples show how various credit unions define their membership criteria:

In particular, if you have poor credit or no credit history, you may find banking with a credit union preferable to a traditional bank.[7]

While deciding whether a credit union meets your needs, you can take a variety of other steps to start building credit:

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

As non-profit organizations owned by account holders, credit unions exist to serve their members. This means they tend to have lower fees and more reasonable interest rates than banks.[1]

This post will help you understand how credit unions work, how they differ from commercial banks, and how credit unions can help you build credit.

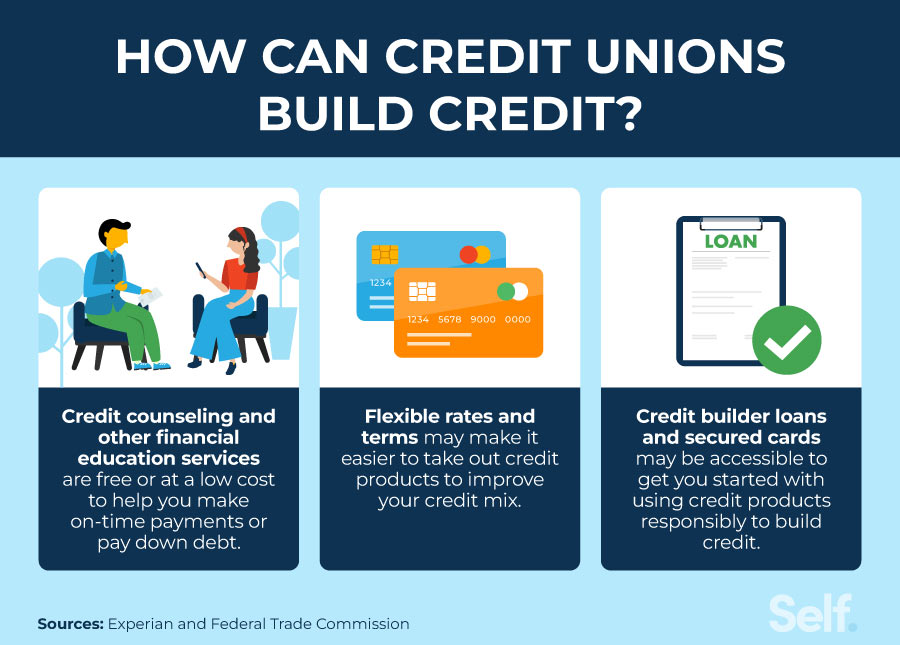

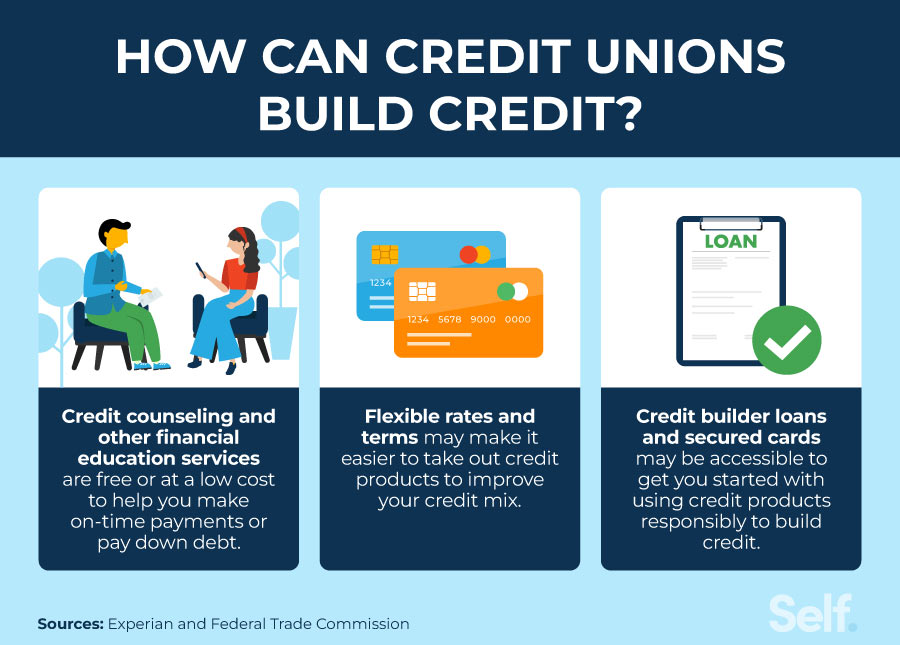

How can a credit union help me build credit?

Although credit unions provide services to people with a range of credit scores, consumers with marginal credit may find their services particularly useful. If you have fair to poor credit, you may want to consider the following benefits of joining a credit union:- Credit counseling and other financial education services: Credit unions make a great place to begin your financial journey — or get it back on track. Depending on your specific financial situation, credit unions can offer relevant credit counseling services, which include setting a budget, managing your money and getting out of debt.[2]

- Flexible rates and terms: Because credit unions, as nonprofits, do not have to pay taxes and tend to focus more on their members, credit unions often have more flexibility than commercial banks do. Credit unions often charge lower interest rates and fees, and may offer installment loans to riskier borrowers.[1]

- Credit builder loans and secured cards: If you find yourself unable to qualify for a typical loan, consider a credit builder loan or secured credit card, which a credit union may offer. These types of accounts are designed to help users build credit.

Who can join a credit union?

Some credit unions serve anyone residing in a certain geographic region. Others limit their membership to particular groups, such as employees of certain companies, specific professional affiliations (such as teachers or law enforcement) or members of certain churches or community organizations.Such affinity-based memberships allow credit unions to tailor their membership to cater to specific careers, interests, and needs. Individuals with lower incomes and those recovering from bankruptcy, for example, may find that credit unions offer them specialized assistance that they don’t receive from commercial banks or larger financial institutions.[1],[3]

The following examples show how various credit unions define their membership criteria:

- First Credit Union: This Arizona credit union offers membership to people who live, work or worship within a 10-mile radius of any First Credit Union branch. The union also welcomes employees of select employer groups, family and housemates of current members and a few other groups.[4]

- America First Credit Union: This credit union’s membership encompasses specific geographic regions of six Western states, professionals employed in the food industry in Utah and affiliated members of various types.[5]

- Navy Federal Credit Union: The only membership requirement of this union is that the individual (or that person’s family or household members) must have ties to the armed forces, Department of Defense (DoD), or National Guard.[6]

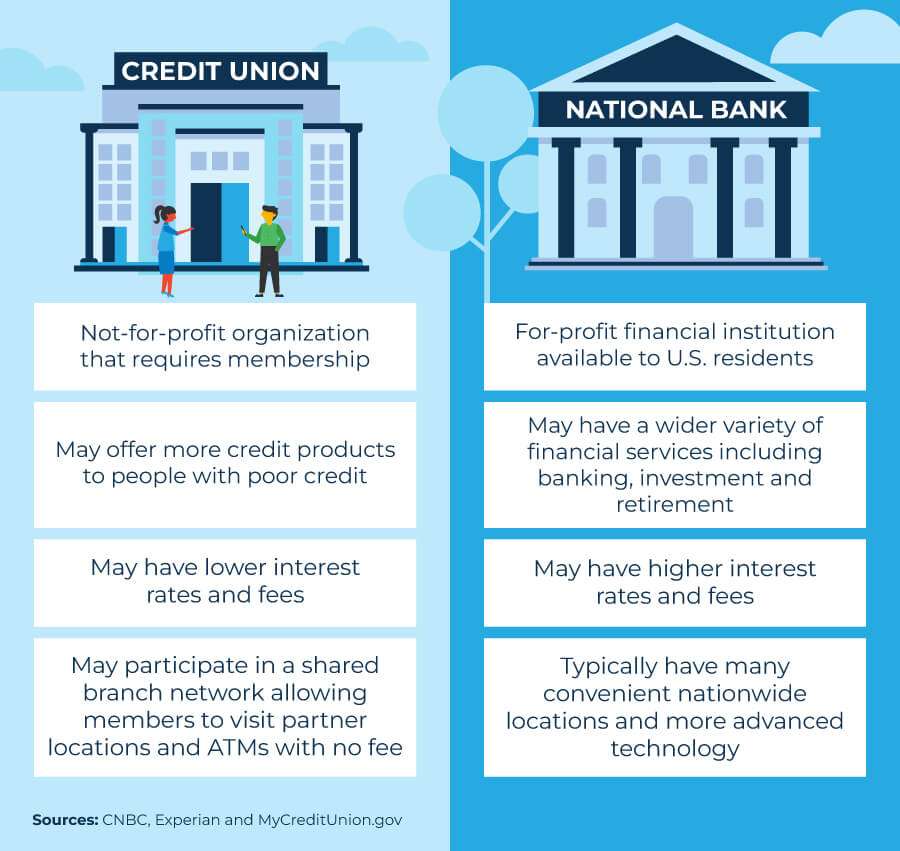

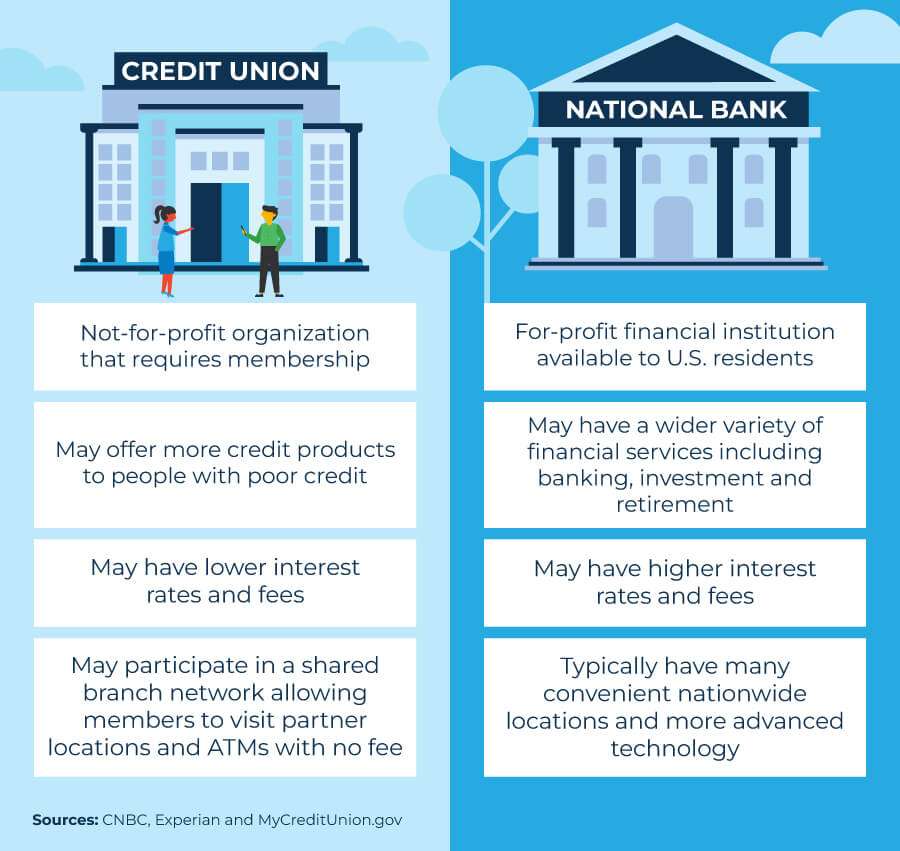

Credit unions vs. large national banks

Although banks come in all shapes and sizes — from local community banks and regional banks to large national banks — we focus on comparison on large national banks. While the exact services offered may vary by bank or credit union, you may notice differences right away, such as the convenience of commercial banks vs. the customer focus of credit unions. However, there may be differences you’ve never even thought of. So to decide which financial institution is right for you, consider the following factors.Do credit unions or banks offer better credit products for people with bad credit?

Not all banks and credit unions offer the same financial products and services. However, as a general rule, the two types of financial institutions differ in the following ways:- Credit unions: Because they tend to focus more on their members than on their own bottom line, credit unions may offer more options for people with marginal credit. Some credit unions, such as low-income credit unions (LICUs) and community-development credit unions (CDCUs) dedicate themselves to meeting the specific needs of low-income communities.[7],[3]

- Banks: Large national banks may have stricter rules for borrowers and less flexibility for approving loans and other credit products. So while banks generally offer more financial services for banking, investment and retirement than credit unions, consumers with poor credit may find it more difficult to qualify for new credit, such as a personal loan.[7]

Do credit unions or banks offer better rates and terms?

Again, while rates and terms depend on the specific bank or credit union, you may generally find the following differences between the two:- Credit unions: Credit unions tend to offer fewer fees and better interest rates on savings accounts and loans. In fact, as of Q3 2022, credit unions offered the lowest interest rates on both used and new car loans.[8]

- Banks: Because banks are for-profit businesses whose focus on profitability for their investors, they often charge borrowers higher fees than credit unions do. You may also find that national banks have higher interest rates, less flexible terms and stricter approval requirements for their financial products.[7]

Are credit unions or banks more convenient?

Typically, banks are more convenient than credit unions because they have more funds to allocate to additional locations and technological advancements.- Credit unions: Credit unions historically haven’t matched the convenience level of banks, mostly because they usually have fewer branches and less technologically advanced service platforms than banks. However, the gap between them has begun to narrow, especially as credit unions join cooperatives that provide access to branches and ATMs across the country.

- Banks: Banks generally have more money than credit unions, which allows them to invest in more convenient online banking services and high-tech platforms, as well as in more brick-and-mortar branches and ATMs nationwide to serve their customers.[7]

Are credit unions and banks accessible to anyone?

Yes and no — credit unions are accessible to specific groups or locations, whereas banks are accessible to anyone.- Credit unions: As member-only institutions, credit unions require that you join them based on their “field of membership” criteria. While credit union members may come from a wide variety of groups — geographical, professional, religious or familial — you must meet the membership requirements in order to become a member and bank at a credit union.

- Banks: While banks may have specific age or identification requirements, they typically allow almost anyone to open an account. You do not need to belong to a specific qualifying group in order to apply for an account.[7]

Should I join a credit union?

Both credit unions and commercial banks have advantages and disadvantages. The best choice for you depends on your personal priorities and financial situation. If you care less about the bells and whistles of modern banking — such as high-tech platforms, worldwide ATMs and a wide portfolio of financial products — and more about lower-cost services delivered with a personal touch, a credit union may suit your needs.In particular, if you have poor credit or no credit history, you may find banking with a credit union preferable to a traditional bank.[7]

While deciding whether a credit union meets your needs, you can take a variety of other steps to start building credit:

- Become an authorized user. If your FICO® score doesn’t qualify you for the credit you need, consider becoming an authorized user on someone’s credit card. The monthly payments from that card may get reported to both your credit history as well as that of the primary cardholder. When looking for someone to add you as an authorized user, be sure that person pays the account as agreed, has had the account open for a while and maintains a low credit utilization ratio (CUR; the total revolving debt on the account divided by their credit limit). Otherwise, becoming an authorized user could hurt your credit.

- Sign up for automatic payments. Since your payment history impacts your credit score more than any other factor, if you take out a loan or sign up for a credit card, arrange for automatic payments. Automatic payments taken directly from your checking account or other bank accounts can help you make timely payments.

- Have your rent and utility payments reported to the credit bureaus. Make your on-time payments count by using a third-party reporting service, such as LevelCredit, to report payments you already make, such as rent, phone and utilities.

- Use secured credit cards and credit builder loans responsibly. Self offers a Credit Builder Account through which you can build savings and build credit.

- Make on-time payments. If you already have some credit — such as auto loans, credit cards or student loans — make sure you make on-time payments since payment history is the most influential factor in your credit score.

- Monitor your credit report. When you keep tabs on your report, you get a better picture of what lenders may see and can dispute any inaccuracies you may find.[9]

Disclaimer: FICO is a registered trademark of Fair Issac Corporation in the United States and other countries.

Sources

- MyCreditUnion.gov. “What Is a Credit Union?” https://mycreditunion.gov/about-credit-unions/credit-union-different-than-a-bank Accessed on November 28, 2022.

- Federal Trade Commission. “Choosing a Credit Counselor,” https://consumer.ftc.gov/articles/choosing-credit-counselor. Accessed on August 7, 2022.

- MyCreditUnion.gov. “Low Income Credit Unions,” https://www.mycreditunion.gov/about-credit-unions/low-income. Accessed on August 7, 2022.

- First Credit Union. “Membership Qualification,” https://www.firstcu.net/about/join/index.html https://www.mycreditunion.gov/about-credit-unions/low-income. Accessed on August 7, 2022.

- America First Credit Union. “Becoming a Member,” https://www.americafirst.com/about/membership/become-member.html?cid=web-lk-target_mbr_app_geo_deny_personal-afcu-ac-ac-20220420#FOM. Accessed on August 7, 2022.

- Navy Federal Credit Union. “Membership Eligibility,” https://www.navyfederal.org/membership/eligibility.html. Accessed on August 7, 2022.

- Investopedia. “Credit Unions vs. Banks: Which One is the Best for You?” https://www.investopedia.com/credit-unions-vs-banks-4590218. Accessed on August 8, 2022.

- National Credit Union Association. “Credit Union and Bank Rates Q3 2022.” https://www.ncua.gov/analysis/cuso-economic-data/credit-union-bank-rates/credit-union-and-bank-rates-2022-q3, Accessed on November 17, 2022.

- MyFICO. “How to Build Credit,” https://www.myfico.com/credit-education/credit-scores/how-to-build-credit. Accessed on August 8, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on December 14, 2022

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.