How To Dispute Student Loans on Credit Reports

Published on: 06/28/2021

Student loans, like other forms of debt, are reflected on your credit report. Missing a single student loan payment can hurt your credit score, which is why it’s important to dispute inaccurate information on your credit report and stay on top of your monthly payments.

If you miss a student loan payment to a lender by a single day past the due date, the loan becomes delinquent. Luckily, it doesn’t mean the delinquent status will immediately go on your credit report. You have 90 days to pay before the loan servicer reports it to the three major credit bureaus (Experian, Equifax and TransUnion).[1]

At that point, if you still haven’t made the payment after 90 days, the missed payment becomes part of your credit history. This time period is more generous than the 30 days before other late payments affect your credit report.

However, having longer to pay doesn’t mean you should put off making payments. Aside from risking delinquency on the loan, you may also incur late fees and interest charges. And if you fail to resolve the delinquency, your loan has the potential to go into default, which means you have failed to pay the lender according to the payment agreement you made.

If you default on a student loan, your entire unpaid balance becomes due immediately. You also lose eligibility for deferment or forbearance and additional federal student aid, and the lender reports the default to credit reporting agencies.

In this case, it will take a very long time to improve your credit. In addition, the lender or loan holder could take legal action if you fail to pay, or garnish your wages to enforce loan repayment. (If the federal government holds your loan, it could also charge you offsets that lower your tax refund and Social Security benefits.)

As with other loan types, if information about missed payments on your student loan debt is accurate, it can be nearly impossible to fix those errors on your credit report. More on this situation in the next section.

When & How to Dispute Student Loans

It’s important to understand there are two student loan types: federal student loans funded by the U.S. Department of Education and private student loans funded by a private lender, such as a bank.

Student loan servicers are private companies hired by the government to handle billing and loan repayment on federal student loan accounts. When you receive the loan disbursement, you are also assigned a loan servicer. It’s important to stay in contact with the company servicing your loan.

Additionally, the government cautions that you should never pay an outside company, such as a credit repair company, for help with your student loan since the servicer can offer assistance for free.[2]

There are several advantages to a federal student loan.[3] For instance, depending on the type of loans and whether they paid for your undergrad or graduate studies, some types of federal student loan payments aren’t due until after you graduate. Private lenders may require a repayment plan while you’re still in school.

If you have a financial need, you may qualify for a subsidized federal loan, in which the government pays the interest while you’re in school at least part-time. There are unsubsidized federal student loans, too. Whether a loan is subsidized or unsubsidized depends on your financial need and whether you're financing undergrad or graduate studies.

Many private loans are unsubsidized, meaning you’ll be responsible for all the interest that accumulates while you’re in school. Unlike federal loans, private loans also can’t be consolidated, although refinancing may be an option.

The federal government has also instituted temporary relief for certain student loans in connection with the COVID-19 pandemic: Monthly payments and collections activities, such as wage garnishment and offsets of your tax refund and Social Security benefits, are suspended through Sept. 30, 2021.[4]

When to Dispute Student Loans

While you cannot remove accurate student loan information from your credit report, you can dispute any inaccurate information you find there. For example, your federal student loans will remain in deferment as long as you, the borrower, are enrolled in school, meaning that they cannot become delinquent or default.

If you find out about negative marks on your credit report while still enrolled in school, you have full discretion to dispute this information with the credit reporting agency.[5]

The short answer to the question of when to dispute student loans is: as soon as you find an error on your credit report. You can discover an error as quickly as possible by staying up to date on your credit report, which will contain any inaccurate credit information.

You can ask for a free credit report at annualcreditreport.com. In fact, during the COVID-19 pandemic, the three major credit bureaus decided to provide Americans with weekly access to their free credit reports. That means you can access your credit reports for free once a week at annualcreditreport.com until April 20, 2022. Your credit reports will give you access to view your financial history, credit card balances, loan information, and mortgages.

If you see evidence of education loans you didn’t take out on the report, it could be the result of identity theft. Someone may have gained access to your Social Security number or other personal information and used it to commit fraud.

The federal government offers a resource to report and recover from identity theft at identitytheft.gov.[6]

Other types of errors are also possible.[7] For example, your student loan may have been incorrectly listed twice, which could damage your credit by making it appear that you have more debt than you do. Or it may not be listed at all — which doesn’t mean it’s not there. If and when the loan is discovered and you haven’t made payments, it could cost a lot of money in collection fees and interest charges.

In some cases, you may have student loans on your credit report that don’t belong to you because of a simple error: Someone else’s student loan might end up on your report because their Social Security number, name, loan account number or other identifying information is similar.

Other possible errors include inaccurate reports of late payments or defaults, closed accounts or accounts you’ve paid in full that are still marked as active or incorrect balances.

How to Dispute Student Loans

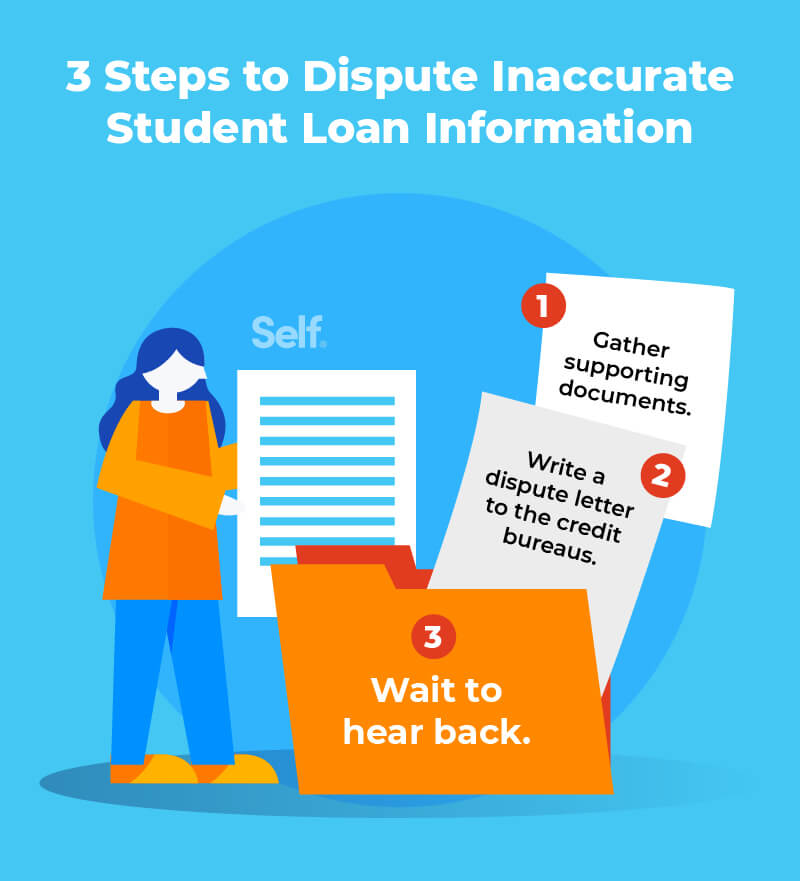

If you believe you’ve found inaccurate information on your credit report, the next step is to gather appropriate supporting documentation that backs up your claim against that inaccurate information.

Disputing inaccurate information on your credit report is free.[8] Write a strong dispute letter to the credit reporting agency notifying them of the error that you are disputing.

After submitting your dispute letter, you may have to wait several weeks before receiving a response about fixing the error on your credit report. Make sure to have the dispute correspondence in writing and organized for your records.

If you are disputing an error regarding a federal student loan, the government advises you to contact your loan servicer immediately. You may also want to file a complaint with the Consumer Financial Protection Bureau (CFPB), which can assist with disputes regarding either private or federal student loans. [9]

How Student Loans Affect Credit Reports

If you are able to have inaccurate student loan information removed from your credit report, that’s great. If not, it’s helpful to remember that, at least in one sense, time is on your side: Positive information about your credit, reflecting on-time payments, actually stays on your credit report longer than the bad stuff.

Student loans can affect your credit score and credit report in good and bad ways. Negative information only lasts for seven years on your credit report, while positive information (such as paying on time and in full) remains on your credit report for 10 years.[10]

If you made a mistake and missed a payment, do your best to make the rest of your payments on time and in full. Also to your advantage: The latest FICO® credit scoring model favors the most recent information (the previous 24 months) rather than the oldest information, so you will be able to make up for past mistakes.[11]

Steps to Improve Your Credit Score After Delinquency

Ideally, you will be able to manage student loan debt successfully, right from the start. If the information on your credit report is accurate but has negative items, such as delinquencies, that are hurting your credit, you can take several steps to clean up your credit report and improve your credit.

1. Bring all accounts current

First, it’s a good idea to bring your payments on all accounts up to date, so you’re back in good standing. Being up to date is essential because, of the five major credit score factors, your payment history makes up the largest part of your FICO score: more than one-third (35%). Other factors, such as the amount you owe (30%), the length of your credit history (15%) and your new credit and credit mix (both 10%) all have less significance.[12]

The other major credit-scoring model, VantageScore, calculates your credit score a little differently. Payment history in the VantageScore system ranks third, behind “total credit usage, balance and available credit” and “credit mix and experience.”[13] But payment history is still important, and more lenders use FICO than VantageScore when assessing creditworthiness. Either way, it’s crucial to remember to pay on time and in full each time.

2. Pay off outstanding collection accounts

Second, getting collections removed from your credit report also helps. Keep in mind that while paying off a collection account doesn’t mean it’s automatically removed from your credit report, some credit scoring models might exclude a collection account from appearing on your credit report if it is paid in full.[14]

3. Keep credit card balances low

Not directly related to student loans but still important to your credit score is keeping your credit card balances low. Maintaining low balances can help your credit score because credit utilization rate is a big part of your credit score as well.

4. Monitor your credit reports regularly

As mentioned earlier, remember to monitor your credit reports so you can catch inaccurate information quickly and dispute it. Learn how to read your credit report.

Another step you can take is negotiating a lower student loan payoff. But this should probably be a last resort since it won’t help your credit: You won’t be paying the full amount you owe, and your credit report will reflect that information. You may be able to negotiate a federal loan for 85%, made in a lump-sum payment or private loans for slightly less. And you can’t settle a student loan unless you’re in default, which is another significant hit to your credit.[15]

As with any other loan, it’s best to pay what you owe on time until your student loan debt is paid in full, unless you see an error on your credit history. Then, it’s best to identify and dispute the error as quickly as possible to ensure it doesn’t trigger penalties and damage your credit.

Sources

- Federal Student Aid. “Student Loan Delinquency and Default,” https://studentaid.gov/manage-loans/default#default. Accessed May 25, 2021.

- Federal Student Aid. “Who’s My Loan Servicer?” https://studentaid.gov/manage-loans/repayment/servicers. Accessed May 25, 2021.

- Federal Student Aid. “When it comes to paying for college, career school or graduate school, federal student loans can offer several advantages over private student loans,” https://studentaid.gov/understand-aid/types/loans/federal-vs-private. Accessed May 25, 2021.

- Student Loan Borrower Assistance, National Consumer Law Center. “Student Loan Payment Suspension Extended through September 30, 2021: What Borrowers Need to Know,” https://www.studentloanborrowerassistance.org/student-loan-payment-suspension-extended-through-september-30-2021-what-borrowers-need-to-know/. Accessed May 25, 2021.

- Consumer Financial Protection Bureau. “How Do I Dispute an Error on My Credit Report?” https://www.consumerfinance.gov/ask-cfpb/how-do-i-dispute-an-error-on-my-credit-report-en-314/. Accessed May 25, 2021.

- Federal Trade Commission. “Report Identity Theft and Get a Recovery Plan,” https://identitytheft.gov/. Accessed May 27, 2021.

- Forbes. “5 Common Student Loan Credit Reporting Errors — And How To Fix Them,” https://www.forbes.com/sites/andrewjosuweit/2017/10/15/5-common-student-loan-credit-reporting-errors-and-how-to-fix-them/?sh=49731dd7167d. Accessed May 25, 2021.

- Consumer Financial Protection Bureau. “Credit Reports and Scores,” https://www.consumerfinance.gov/consumer-tools/credit-reports-and-scores/. Accessed May 25, 2021.

- Consumer Financial Protection Bureau. “Having a problem with a financial product or service?” https://www.consumerfinance.gov/complaint/. Accessed May 27, 2021.

- Education Loan Finance. “Removing Student Loans From Your Credit Report,” https://www.elfi.com/removing-student-loans-from-your-credit-report/. Accessed May 25, 2021.

- Investopedia. “FICO 10 and FICO 10T,” https://www.investopedia.com/fico-10-and-fico-10t-5072531. Accessed May 27, 2021.

- MyFico. “What’s in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score. Accessed May 25, 2021.

- VantageScore. “How Does VantageScore Work?” https://vantagescore.com/consumers/why-vantagescore/how-it-works. Accessed May 25, 2021.

- Experian. “Disputing Student Loans on Your Credit Report,” https://www.experian.com/blogs/ask-experian/student-loans-reported-by-individual-enrollment-period/. Accessed May 25, 2021.

- The Balance. “Can You Settle Student Loan Debt?” https://www.thebalance.com/can-you-settle-student-loan-debt-5181818. Accessed May 27, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial – a financial technology company with a mission to increase economic inclusion by helping people build credit and savings so they can build their dreams.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).