Current Balance vs. Available Balance: The Key Differences

Published on: 11/16/2022

To avoid an overdraft, check your available balance before making a withdrawal, purchase or writing a check to ensure you have sufficient funds. Seeing the terms “current balance” and “available balance” listed on your bank statement or mobile banking app may confuse you. If you’re wondering how much money you really can spend, rely on your available balance to tell you how much funds you have at your disposal. Your available balance accounts for pending transactions, but your current balance does not. Because neither balance accounts for checks you have written but that have not yet been cashed, you need to keep track of those and deduct them from the balance.[1]

Banks and credit unions provide you with both your current and available balances so that you can have the most accurate view of all of your funds, where they’re going and how much you have to spend at any given time. To understand how your current balance and available balance differ, this article covers their details so you can better navigate your personal finances and avoid an overdraft.

Table of contents

- What is a current balance?

- What is an available balance?

- Which balance is the most accurate?

- How can I avoid overdrawing my account?

What is a current balance?

Your current balance, also known as your account balance, refers to the total amount of money in your account before any pending debits or credits are considered.[2] Think of your current balance as your balance at that exact moment before pending transactions clear.

Outstanding checks, automatic payments you’ve set up, recent purchases or withdrawals that haven’t been processed won’t be included in your current balance. Because some transactions may not process until the next business day or even longer, your current balance may show a different amount than what you actually have available to spend.

What is an available balance?

Your available balance subtracts both pending transactions, posted transactions and check holds, showing you how much money you actually have available to spend.[3] However, your available balance typically doesn’t account for checks that recipients haven’t cashed or deposits — including direct deposits — that haven’t posted yet.[3] So keeping track of checks you’ve used and deposits you’ve made can help you stay on top of your finances even better. Knowing how much you have available can help you avoid overdraft fees when making purchases or bill payments.

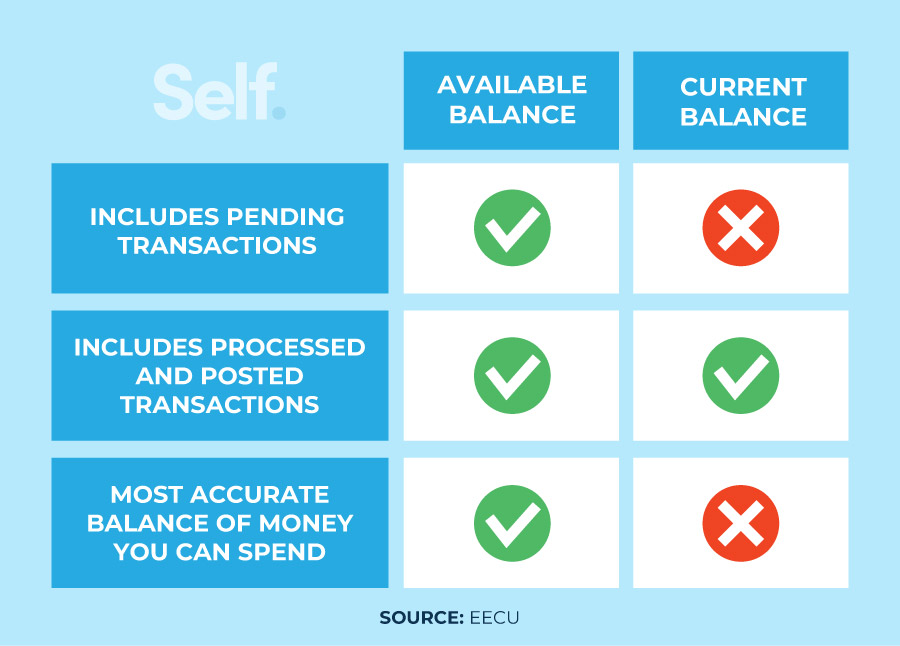

The main differences between current balance and available balance

Breaking down the differences between your current and available balances can help you avoid fees and overdrafting your account.

Current balance

Your current balance — or account balance — indicates your actual balance at the moment, not what you have available to spend. Your current balance:

- Includes all processed and posted transactions: Just because you use your debit card, write a check, or make a deposit doesn’t mean that those actions automatically take money out or put money into your account. Only transactions that have completed their process through the banking system appear in your current balance.

- Reflects fully processed transactions, not pending transactions: Banks consider any transaction still running through the banking system, such as making a purchase, a pending transaction. Those will come out of your account, but it may take a day or more for such transactions to show up in your current balance.

- Is not an accurate representation of the funds you can spend: If you have already committed funds from your account to a purchase, but it hasn’t posted or cleared yet, those funds are already committed. So you don’t want to use them for any new transactions or you may overdraft your account.

Available balance

Your available balance includes information from items that have been fully processed as well as pending transactions. Your available balance:

- Includes all completed transactions: Your available balance reflects the amount you have left to spend after any and all posted transactions or debits have been accounted for.

- Reflects pending transactions that haven’t been fully processed yet: If you have used your debit card, for example, and the merchant authorized the purchase but it has not posted, your available balance considers the amount as debited even though it hasn’t cleared.

- Most accurate representation of your account balance: Because it includes both processed and pending transactions, your available balance tells you how much money you have at your disposal less your outstanding checks. Knowing this may help you avoid overdrafts.

Your available balance won’t include items for which funds have yet to be either requested or authorized. Depending on your bank, these may include things like:[2]

- Deposit holds: Your bank may put a hold on a check before giving you full availability until the check has fully cleared from the bank where the check was written.

- Scheduled automatic withdrawals: These may include subscriptions for services that are taken out on a regular basis, such as a gym membership.[2]

- Bill pay payments that have been scheduled in advance: Payments such as these may have been set up through online banking via bill pay.

- Merchant delays on authorized pending transactions: Sometimes a transaction may not appear as pending because of merchant delays.[2]

- Uncashed checks: If a check recipient has yet to cash a check, the bank has no way of knowing you’ve written it, so it does not appear as pending.

Knowing your available balance can make it easier to decide how much to spend if you’re deciding to make a new purchase.

For example, say your current balance shows $100, but you have pending transactions for $60 worth of groceries. Your available balance shows $40, but before that pending transaction clears, your internet company automatically bills you $50. That would leave your account with a negative available balance (minus $10) even though your current balance may still reflect a higher amount.

You may get charged an overdraft or, if you’ve opted out of overdraft protection, your internet bill payment might even get declined. So, if you have overdraft protection and want to avoid an overdraft fee, you would need to deposit at least $10 into your account — without any hold being placed on that deposit — before the pending transaction of groceries fully processes. If you fail to do so, any resulting overdraft fee you incur would be added to the deficit in your account.

Which balance is the most accurate?

Your available balance is the most accurate indicator of what you can spend without causing an overdraft because it shows you what you actually have available to spend, including pending payments and withdrawals that haven’t been fully processed. Current balances are less accurate in terms of what you have to spend because they don’t include pending transfers or payments that haven’t been completely processed yet. To make an informed decision on spending, check your available balance to ensure you have the money to cover your purchase to avoid overdraft fees.

How can I avoid overdrawing my account?

It can be easy to overdraw your account if you initiate frequent transactions or forget when an automatic withdrawal is occurring. You can keep track of your available balance using several strategies.

- Opt out of overdraft protection. You can opt out of overdraft protection so your transactions will be declined if you do not have enough funds in your account and you’ll also avoid paying overdraft protection fees. However, you may still get charged a fee, not by your bank, but by the company whose transaction was declined.[4]

- Adjust your banking notifications to get alerts on withdrawals and low balances. Banks typically offer low-balance notifications via text or email to alert you when the funds in your account are low.

- Check your available balance daily to understand how much you can charge on your debit card. Online banking services allow you to track your available balance. Checking your available balance daily can help you avoid overdrawing your account.

- Use a calendar to remind yourself when you will have recurring payments, such as rent and automatic withdrawals. Add scheduled payments, with their amounts, to a written or virtual calendar you can check easily to ensure you have enough money to cover any potential purchases. Compare this against your available balance so that you account for transactions your available balance doesn’t include.

Keeping track of your spending is important whether you’re dealing with debit card transactions, savings accounts or credit cards. Poor spending habits can lead to credit problems if you overextend yourself and have difficulty making payments. Self provides tools to stay on track and improve your credit score as you build credit by managing your spending and payments effectively.

Sources

- EECU. “Understanding current vs available balance,” https://www.eecu.org/personal-banking/checking-accounts/checking-savings-resource-center/general-banking/understanding-current-vs-available-balance. Accessed on July 1, 2022.

- US Bank. “What's the difference between the account balance and available balance on my checking account?” https://www.usbank.com/customer-service/knowledge-base/KB0180641.html. Accessed on July 1, 2022.

- Stanford Federal Credit Union. “What is the difference between balance and available balance?” https://www.sfcu.org/faqs/what-is-the-difference-between-balance-and-available-balance/. Accessed on July 1, 2022.

- Forbes. “Understanding Checking Account Overdraft Protection And Fees,” https://www.forbes.com/advisor/banking/checking/understanding-checking-account-overdraft-protection-and-fees/. Accessed on September 8, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).