Should You Consolidate Your Credit Card Debt?

By Michelle Lambright Black

Published on: 09/16/2024

Published on: 09/16/2024

When you’re overwhelmed with credit card debt, it’s easy to feel stressed and alone. Yet credit card debt is a massive problem in the United States—one that millions of consumers struggle with on a daily basis.

Overall, consumers in the United States owe $1.12 trillion dollars in credit card debt as of Q1 2024 according to the latest Federal Reserve data. Close to half of American households (46%) carry a balance on their credit cards. Among households that have credit card debt, the average balance is around $7,226.[1][2]

Yet carrying a balance on your credit card can be an expensive habit since interest rates on credit cards tend to be expensive compared to other forms of consumer financing. In Q1 2024, the average credit card interest rate (on accounts that assessed interest) was 22.63% according to Federal Reserve data. That means if you owe $7,000 in credit card debt on an account with a 22.50% APR, you would pay around $130 in interest each month (assuming you make only the minimum payment and maintain the same balance and interest rate).[3][4]

Due to the high cost of credit card debt, it’s important to make a plan to pay off your credit card balances as soon as possible. One potential solution to consider is debt consolidation.

The guide below will help you understand how credit card debt consolidation works along with different ways to combine your credit card debt together. If you manage the process wisely, debt consolidation has the potential to be beneficial to your credit score. But it’s important to learn about potential mistakes to avoid along the way.

Finally, debt consolidation can help many consumers save money and get out of debt faster. But it’s not an ideal solution for everyone. Here’s what you need to know.

In some cases, consolidating may help you lower the interest rate you’re paying on your credit card debt. And if you’re eligible for a lower rate, it may be easier to reduce your debt faster.

Yet it’s important to remember that every situation is different. Therefore, you should review the terms of any debt consolidation financing agreement in detail before deciding if it’s right for you.

Many credit card companies offer credit cards that feature 0% or low-interest introductory APR (annual percentage rate) balance transfers for a limited time—typically for at least six months, but often much longer. You can use these offers to consolidate existing credit card balances and other types of high-interest debt.[5]

With credit card balance transfer offers, you’ll generally have to pay the card issuer a balance transfer fee to take advantage of the promotion. The fee is typically a percentage of the amount you transfer (often 3% or 5%) or a fixed amount—whichever is greater.[6]

Before you use a balance transfer credit card to consolidate debt, you should make sure that a balance transfer fee won’t be more expensive than the money you could potentially save during the interest-free period. Many credit card companies offer balance transfer calculators to help you compare the cost of balance transfer fees to the amount of interest you may save.

Additionally, the ideal way to use a balance transfer credit card is to make a plan to pay off the full balance on your account before the interest-free period expires. Once the 0% APR period ends, any remaining balance will be subject to the regular APR on the account.

On the plus side, a personal loan could reduce the number of payments you owe each month down to one—making your debt easier to manage. But if you have fair credit or a bad credit score, you might not be eligible for an attractive interest rate or loan offer.

Furthermore, it’s important to use a loan calculator to make sure that a consolidation loan will save you money. Even if your monthly payment is lower, that doesn’t guarantee you’ll pay less in the long run. Some personal loans may feature high fees or lengthy repayment terms which could increase your overall costs. But in other cases, it may be possible to save money on interest with this type of financing.[7]

In general, home equity loans and HELOCs feature lower interest rates compared to other types of consumer credit. The reason this is often true is because you back these types of financing with the equity in your home—reducing the risk involved for the lender. But if something goes wrong and you can’t repay the money you borrow as promised, the lender could foreclose on your home. This makes using home equity financing to consolidate debt (or for any other purpose) a much bigger risk for borrowers.[8]

When you enter into a DMP, a credit counselor negotiates with your credit card issuers (and other eligible creditors) on your behalf to establish new payment plans. If your creditors agree, they may reduce your interest rates and waive fees on your debt—provided you agree to enter into a DMP to repay the money you owe.

In many cases, it takes three to five years to repay your debts using a DMP. It’s also important to understand that there are fees associated with these types of programs. One credit counseling agency reports the average DMP set up fee is around $33 and the average monthly fee is around $24 per month. Just do your homework and explore fees at different agencies. On a positive note, the potential interest savings will typically exceed the cost of any fees you pay. However, your credit card issuers will usually close your accounts—a detail that could impact your credit score in a negative way.[9]

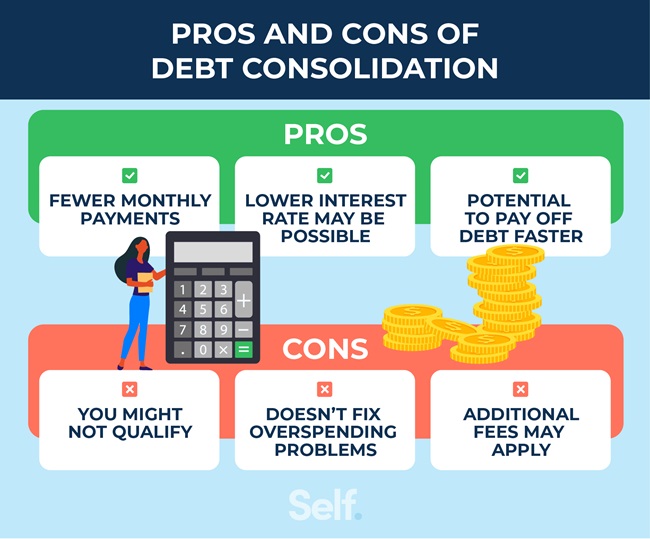

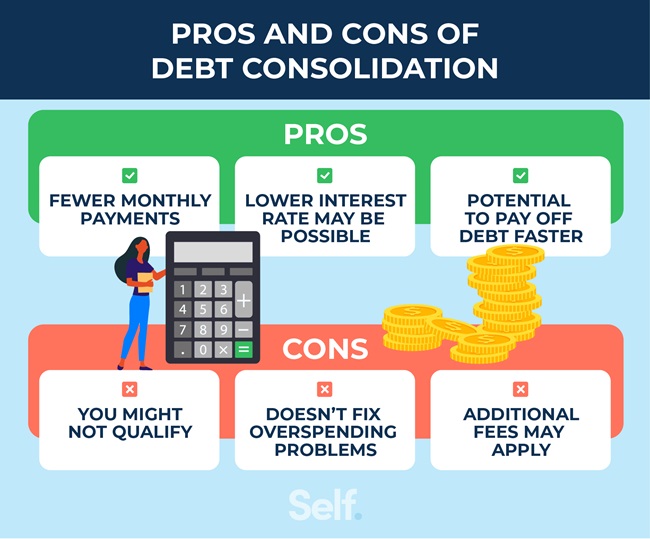

Below are some of the top pros and cons of credit card debt consolidation.

When you’re ready, you may want to start your credit card debt elimination journey with a strategy such as one of the following.

If you do consolidate your debt, it’s also critical to make every payment on your new loan or balance transfer credit card. Late payments can have a severe negative impact on your credit score, and they can also remain on your credit report for up to seven years.[12]

Below are a few scenarios that illustrate how debt consolidation might lift your credit score.

Of course, if you manage a new debt consolidation loan or balance transfer credit card poorly, those actions might trigger credit score damage as well. For example, if you make late payments on your new account then you’ll most likely see a credit score drop in the future instead of potential progress.

As mentioned, traditional debt consolidation is the process of taking out a new form of financing and using it to combine existing debts together. From there, you pay off the full amount of debt you owe. But if you’re lucky, you might qualify for a lower interest rate when you consolidate your debt—potentially empowering you to save money and pay down your debt faster.

Debt settlement, on the other hand, is quite different. With debt settlement, you hire a company to try to negotiate your credit card debt (and perhaps other unsecured debts) for less than you owe. Yet although the idea of settling your debts for less might sound appealing, there are considerable drawbacks to consider.

Professional debt settlement companies can be expensive—often charging 15% to 25% of what you owe for their services. There’s also no guarantee that a debt settlement company will be able to convince your credit card companies to settle your debt for less than you owe.[16]

Many debt settlement companies will also advise you to stop making payments to your creditors while you save money for negotiations. This can lead to late payments on your credit report and the potential for severe credit score damage which could haunt you for many years.

Start by reviewing the condition of your credit reports and credit scores. This step could help you determine if you’re in a good position to qualify for attractive financing offers with lower interest rates than you’re paying on your current credit card debt.

You should also make sure you have your personal finances in order with an updated budget and a plan to avoid future overspending. Finally, if you opt to move forward with debt consolidation, take the time to review multiple financing options until you find the offer that works best for you.

Overall, consumers in the United States owe $1.12 trillion dollars in credit card debt as of Q1 2024 according to the latest Federal Reserve data. Close to half of American households (46%) carry a balance on their credit cards. Among households that have credit card debt, the average balance is around $7,226.[1][2]

Yet carrying a balance on your credit card can be an expensive habit since interest rates on credit cards tend to be expensive compared to other forms of consumer financing. In Q1 2024, the average credit card interest rate (on accounts that assessed interest) was 22.63% according to Federal Reserve data. That means if you owe $7,000 in credit card debt on an account with a 22.50% APR, you would pay around $130 in interest each month (assuming you make only the minimum payment and maintain the same balance and interest rate).[3][4]

Due to the high cost of credit card debt, it’s important to make a plan to pay off your credit card balances as soon as possible. One potential solution to consider is debt consolidation.

The guide below will help you understand how credit card debt consolidation works along with different ways to combine your credit card debt together. If you manage the process wisely, debt consolidation has the potential to be beneficial to your credit score. But it’s important to learn about potential mistakes to avoid along the way.

Finally, debt consolidation can help many consumers save money and get out of debt faster. But it’s not an ideal solution for everyone. Here’s what you need to know.

What is credit card debt consolidation?

Credit card debt consolidation is a strategy that involves using a new form of financing to pay off your credit card balances. Once you consolidate multiple credit cards, you’ll only owe one bill to a new creditor instead of owing payments to several creditors each month. Of course, you have to avoid creating new balances on the credit cards you pay off when you consolidate your debt or you’ll owe multiple payments each month again.In some cases, consolidating may help you lower the interest rate you’re paying on your credit card debt. And if you’re eligible for a lower rate, it may be easier to reduce your debt faster.

Yet it’s important to remember that every situation is different. Therefore, you should review the terms of any debt consolidation financing agreement in detail before deciding if it’s right for you.

Ways to consolidate credit card debt

If you’re interested in consolidating credit card debt, there are several potential ways to get the job done. Below are four of the most popular credit card debt consolidation options available.

1. Balance transfer credit cards

Believe it or not, one of the most common ways to consolidate credit card debt is by using another credit card to do so. This process is known as a balance transfer.Many credit card companies offer credit cards that feature 0% or low-interest introductory APR (annual percentage rate) balance transfers for a limited time—typically for at least six months, but often much longer. You can use these offers to consolidate existing credit card balances and other types of high-interest debt.[5]

With credit card balance transfer offers, you’ll generally have to pay the card issuer a balance transfer fee to take advantage of the promotion. The fee is typically a percentage of the amount you transfer (often 3% or 5%) or a fixed amount—whichever is greater.[6]

Before you use a balance transfer credit card to consolidate debt, you should make sure that a balance transfer fee won’t be more expensive than the money you could potentially save during the interest-free period. Many credit card companies offer balance transfer calculators to help you compare the cost of balance transfer fees to the amount of interest you may save.

Additionally, the ideal way to use a balance transfer credit card is to make a plan to pay off the full balance on your account before the interest-free period expires. Once the 0% APR period ends, any remaining balance will be subject to the regular APR on the account.

2. Personal loans

Personal loans represent another popular debt consolidation strategy. If you have a good credit score, you may be able to qualify for a fixed-rate installment loan from a bank, credit union, or online lender and use it to combine your existing credit card debt into a new, single account.On the plus side, a personal loan could reduce the number of payments you owe each month down to one—making your debt easier to manage. But if you have fair credit or a bad credit score, you might not be eligible for an attractive interest rate or loan offer.

Furthermore, it’s important to use a loan calculator to make sure that a consolidation loan will save you money. Even if your monthly payment is lower, that doesn’t guarantee you’ll pay less in the long run. Some personal loans may feature high fees or lengthy repayment terms which could increase your overall costs. But in other cases, it may be possible to save money on interest with this type of financing.[7]

3. Home equity loans and home equity lines of credit

If you own a home, you might consider using some of the equity in your house to secure debt consolidation financing. Home equity loans and home equity lines of credit (HELOCs) are two financing solutions that some consumers use to pay down high-interest credit card debt.In general, home equity loans and HELOCs feature lower interest rates compared to other types of consumer credit. The reason this is often true is because you back these types of financing with the equity in your home—reducing the risk involved for the lender. But if something goes wrong and you can’t repay the money you borrow as promised, the lender could foreclose on your home. This makes using home equity financing to consolidate debt (or for any other purpose) a much bigger risk for borrowers.[8]

4. Debt management plans (DMPs)

A debt management plan, or DMP, is another solution that some consumers use to manage overwhelming credit card debt. A DMP isn’t a loan or new source of financing. Instead, it’s a repayment plan that a credit counseling agency sets up with your current creditors.When you enter into a DMP, a credit counselor negotiates with your credit card issuers (and other eligible creditors) on your behalf to establish new payment plans. If your creditors agree, they may reduce your interest rates and waive fees on your debt—provided you agree to enter into a DMP to repay the money you owe.

In many cases, it takes three to five years to repay your debts using a DMP. It’s also important to understand that there are fees associated with these types of programs. One credit counseling agency reports the average DMP set up fee is around $33 and the average monthly fee is around $24 per month. Just do your homework and explore fees at different agencies. On a positive note, the potential interest savings will typically exceed the cost of any fees you pay. However, your credit card issuers will usually close your accounts—a detail that could impact your credit score in a negative way.[9]

Pros and cons of debt consolidation

Credit card debt consolidation has the potential to save some people money and help them get out of debt faster. At the same time, this debt management strategy isn’t a magic wand to erase past financial mistakes, and there are some real drawbacks to consider.Below are some of the top pros and cons of credit card debt consolidation.

Pros

- Fewer monthly payments: When you use debt consolidation to pay off multiple credit card balances, you’ll have fewer monthly payments to track each month. As a result, it should be easier to manage your household budget. With fewer monthly payments, there’s also less risk of making a late payment that could damage your credit score.

- Lower interest rate may be possible: If you have good credit, you might qualify for debt consolidation financing that offers a lower interest rate compared to your current credit card accounts. But it’s important to use a debt consolidation calculator to assess the overall cost of financing (including fees) to make sure a new loan or credit card offer will save you money in the long run.

- Potential to pay off debt faster: When you consolidate your credit card debt, you may qualify for a lower interest rate or a reduced monthly payment. If you can afford to continue making higher monthly payments, you may be able to eliminate your debt faster. Finding ways to generate extra money through spending cuts, bonuses, or working an extra side hustle (perhaps on a short-term basis) could also help you pay down your debt more aggressively.

Cons

- You might not qualify: Depending on the type of credit card debt consolidation tool you have in mind, you might need good credit to qualify—or at least to qualify for financing with attractive terms. Many balance transfer credit cards and personal loan offers require you to have a good credit score to be eligible for a financing offer with a low interest rate and low fees. If a lender or credit card company won’t offer you a lower interest rate than you’re paying now, debt consolidation typically isn’t worth pursuing.

- Doesn’t fix overspending problems: If your credit card debt arose due to overspending, you’re far from alone. And while there’s no need to beat yourself up about past mistakes, it’s also important to acknowledge that consolidation won’t help you avoid more credit card debt in the future. In fact, if you free up available credit on your existing accounts, you might be tempted to overspend again—potentially creating more serious financial and credit problems in the future. (Tip: Creating a budget could help you avoid this issue.)

- Additional fees may apply: Debt consolidation often comes at a price. Although you might be able to save money in interest in some situations, lenders and even credit counseling organizations typically charge fees for their services that could cut into your potential savings. With balance transfer offers, for example, you’ll often have to pay a balance transfer fee of 3% to 5% of the debt you transfer to your new credit card. Debt consolidation loans often feature origination fees that range between 1% to 10% of the loan amount as well. So, it’s important to crunch the numbers before you use any debt consolidation method to make sure the cost of any associated fees don’t outweigh your potential savings.[10]

When should you consolidate credit card debt?

Before you decide whether consolidating your credit card debt is a good fit for you, it’s important to consider several factors. First, you’ll want to check your credit score and credit reports to see if you might be eligible for attractive financing offers. If your credit needs work, you may want to spend some time trying to build credit or fix your credit first to see if you can put yourself in a better position before you apply for a loan or credit card offer.When you’re ready, you may want to start your credit card debt elimination journey with a strategy such as one of the following.

- Debt snowball: List your credit card debts in order by balance—from the highest to lowest. Make the minimum payment on every account each month, but pay as much money as possible toward the account with the lowest balance. Once you pay off the smallest debt, move up the list to the credit card with the next lowest balance and repeat the process. This debt management strategy may help you stay motivated with small victories as you pay down your credit card debt. It may also help you see faster progress where your credit score is concerned.[11]

- Debt avalanche: List your credit card debts in order by interest rate—from the highest to the lowest. Make the minimum payment on every account each month, but pay as much as you can toward the account with the highest interest rate. Once you pay off the credit card with the highest interest rate, move down your list to the account with the next highest interest rate and repeat the process. This debt management strategy could help you save more money in interest charges.

If you do consolidate your debt, it’s also critical to make every payment on your new loan or balance transfer credit card. Late payments can have a severe negative impact on your credit score, and they can also remain on your credit report for up to seven years.[12]

Does debt consolidation affect your credit score?

Consolidating your debt—credit card debt or otherwise—could impact your credit score in both positive and negative ways. Yet like other types of financing, the way debt consolidation affects your credit score mostly comes down to how you handle your new account.Below are a few scenarios that illustrate how debt consolidation might lift your credit score.

- Positive payment history: If you open a new credit card or loan to consolidate your credit card debt, making on-time payments could help you build a good credit score over time. Payment history is worth 35% of your FICO® Score—more influential than any other credit score factor.[13]

- Lower credit utilization ratio: When you consolidate your credit card accounts with a new balance transfer card or a personal loan, your credit utilization ratio may decline (as long as you avoid creating future credit card debt). In general, the lower your credit utilization ratio falls, the better the impact on your credit score.[14]

Of course, if you manage a new debt consolidation loan or balance transfer credit card poorly, those actions might trigger credit score damage as well. For example, if you make late payments on your new account then you’ll most likely see a credit score drop in the future instead of potential progress.

Debt consolidation vs. debt settlement

As you research debt consolidation options, you may come across companies that offer debt settlement services. However, it’s important to understand the differences between these two debt management strategies and the ways they could affect your finances and credit scores.As mentioned, traditional debt consolidation is the process of taking out a new form of financing and using it to combine existing debts together. From there, you pay off the full amount of debt you owe. But if you’re lucky, you might qualify for a lower interest rate when you consolidate your debt—potentially empowering you to save money and pay down your debt faster.

Debt settlement, on the other hand, is quite different. With debt settlement, you hire a company to try to negotiate your credit card debt (and perhaps other unsecured debts) for less than you owe. Yet although the idea of settling your debts for less might sound appealing, there are considerable drawbacks to consider.

Professional debt settlement companies can be expensive—often charging 15% to 25% of what you owe for their services. There’s also no guarantee that a debt settlement company will be able to convince your credit card companies to settle your debt for less than you owe.[16]

Many debt settlement companies will also advise you to stop making payments to your creditors while you save money for negotiations. This can lead to late payments on your credit report and the potential for severe credit score damage which could haunt you for many years.

Bottom line

Paying off credit card debt is almost always a good move for your finances and your credit scores. However, it’s important to make sure debt consolidation is the right fit for your situation before you apply for financing.Start by reviewing the condition of your credit reports and credit scores. This step could help you determine if you’re in a good position to qualify for attractive financing offers with lower interest rates than you’re paying on your current credit card debt.

You should also make sure you have your personal finances in order with an updated budget and a plan to avoid future overspending. Finally, if you opt to move forward with debt consolidation, take the time to review multiple financing options until you find the offer that works best for you.

Sources

- NewYorkFed.org. “Household Debt and Credit Report.” https://www.newyorkfed.org/microeconomics/hhdc

- StLouisFed.org. “Which U.S. Households Have Credit Card Debt?” https://www.stlouisfed.org/on-the-economy/2024/may/which-us-households-have-credit-card-debt

- FederalReserve.gov. “Consumer Credit.” https://www.federalreserve.gov/releases/g19/current/

- NavyFederal.org. “Credit Card Minimum Payment Calculator.” https://www.navyfederal.org/makingcents/tools/pay-off-credit-card-balance-calculator.html

- HelpWithMyBank.gov. “I just got an offer from my bank to transfer balances from another credit card at a low rate. How long does the rate have to stay in effect?” https://www.helpwithmybank.gov/help-topics/credit-cards/balance-transfers/balance-transfer-promo-rate.html

- Experian.com. “What Is a Balance Transfer Fee?” https://www.experian.com/blogs/ask-experian/what-is-a-balance-transfer-fee/

- ConsumerFinance.gov. “What do I need to know about consolidating my credit card debt?” https://www.consumerfinance.gov/ask-cfpb/what-do-i-need-to-know-if-im-thinking-about-consolidating-my-credit-card-debt-en-1861/

- Consumer.ftc.gov. “Home Equity Loans and Home Equity Lines of Credit.” https://consumer.ftc.gov/articles/home-equity-loans-and-home-equity-lines-credit

- Experian.com. “Is a Debt Management Plan Right for You?” https://www.experian.com/blogs/ask-experian/credit-education/debt-management-plan-is-it-right-for-you/

- QuickenLoans.com. “What Is a Personal Loan Origination Fee and Do You Have to Pay It?” https://www.quickenloans.com/learn/personal-loan-origination-fee

- TheHub.StantanderBank.com. “Three Credit-Boosting Ways to Tackle Credit Card Debt. “https://thehub.santanderbank.com/three-credit-boosting-ways-tackle-credit-card-debt/

- Equifax.com. “Can You Remove Late Payments from Your Credit Reports?” https://www.equifax.com/personal/education/credit/report/articles/-/learn/remove-late-payments-credit-report/#:~:text=A%20late%20payment%20will%20be,credit%20reports%20after%20seven%20years

- myFICO.com. “What’s in my FICO® Scores?” https://www.myfico.com/credit-education/whats-in-your-credit-score#:~:text=my%20FICO%20Score%3F-,Payment%20history%20(35%25),factor%20in%20a%20FICO%20Score

- myFICO.com. “What Should My Credit Utilization Ratio Be?” https://www.myfico.com/credit-education/blog/credit-utilization-be

- myFICO.com. “Credit Checks: What are credit inquiries and how do they affect your FICO® Score?” https://www.myfico.com/credit-education/credit-reports/credit-checks-and-inquiries

- CNBC.com. “What is debt settlement — and is it a good way to deal with debt?” https://www.cnbc.com/select/what-is-debt-settlement/

About the author

Michelle Lambright Black is a nationally recognized credit expert with two decades of experience. She is the founder of CreditWriter.com, an online credit education resource and community that helps busy moms learn how to build good credit and a strong financial plan that they can leverage to their advantage. Michelle's work has been published thousands of times by FICO, Experian, Forbes, Bankrate, MarketWatch, Parents, U.S. News & World Report, and many other outlets. You can connect with Michelle on Twitter (@MichelleLBlack) and Instagram (@CreditWriter).Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).

Written on September 16, 2024

Self is a venture-backed startup that helps people build credit and savings.

Self does not provide financial advice. The content on this page provides general consumer information and is not intended for legal, financial, or regulatory guidance. The content presented does not reflect the view of the Issuing Banks. Although this information may include references to third-party resources or content, Self does not endorse or guarantee the accuracy of this third-party information. Any Self product links are advertisements for Self products. Please consider the date of publishing for Self’s original content and any affiliated content to best understand their contexts.