Can You Pay Off a Credit Card with Another Credit Card?

Published on: 02/13/2023

You typically cannot pay off the entire balance of one credit card with another credit card except by moving debt from one card to another in a process known as a balance transfer. While this method may work for some financial situations, it doesn’t make sense for everyone. Because moving debt from one credit card to another may be a bad idea for your unique financial situation, you may want to weigh your options and consider other methods to pay down your credit card balances directly.

This post discusses whether you can pay off one credit card with another and presents other options for paying down your credit card debt.

You may be able to transfer debt to a balance transfer card

In some cases, you may have the option of paying off one credit card with another through a balance transfer. Balance transfers enable cardholders to move an outstanding balance from one credit card to another, often for a fee.

Credit card issuers often offer intro periods for new credit cards that include zero-interest or low-APR (annual percentage rate) balance transfers, which give you a way to consolidate your debt into one account with their company.

While this provides an indirect way to pay off one credit card with another, carefully evaluate the terms before choosing this route. The introductory periods are limited, and you may end up paying a high interest rate after the period ends.

[1]

Evaluate balance transfer options

Credit card companies generally require that you meet certain criteria for a balance transfer, including a good credit score. If you have poor credit, you may find it difficult to qualify.

In addition, the approved credit limit may not cover the amount of debt you have. Because lenders have different requirements and terms, consider shopping around and reviewing the requirements and terms of different credit card issuers before applying for a balance transfer card.[2]

A balance transfer may make financial sense in the following circumstances:

- The balance transfer credit card has a long promotional period offering low or no interest.

- The introductory timeline is long enough and the introductory APR is low enough to allow you to pay off the balance and will not make paying the balance even more difficult than if you hadn’t transferred it in the first place.

- The balance transfer fee that may apply is less than the current interest you would be paying on a card without having a balance transfer. For instance, a balance transfer fee could be anywhere from 2% to 5% of the transferred amount which could mean that if you have a $7,000 balance, you’d add on an additional $140 to $350 in fees.[3]

Calculate whether or not a balance transfer will save you money

To determine whether a balance transfer will save you money in the long run, you’ll need to do the math.

Here’s an example:

Let’s say your current credit card has an APR of 20%, you have a balance of $2,500 and you pay $250 a month. It would take 12 months to pay off your debt and you would pay a total of $2,758, including $258 in interest and fees.

Say the new balance transfer card has an APR of 5% (assuming the 0% introductory APR ends after 12 months), with the 5% balance transfer fee included and you pay $250 a month. It would take 11 months to pay off your debt with a balance transfer and you would pay a total of $2,625.

You would save money in this instance, but only $133.

You may find that doing a balance transfer to a new card is worth your time and effort in this case. In addition, this calculation assumes that the new card has no annual fee and that the intro APR lasts for 12 months. The introductory period on balance transfers may only last 6 months, so make sure to include this in your calculation.

[4]

Before applying, consider the following:

- Know the current balance on any card(s) you want to move to a low/zero APR balance transfer credit card.

- Know how much each card charges for interest and how they calculate interest.

- Know what you pay monthly on your balance.

- Evaluate the fees associated with the balance transfer.

- Weigh your options carefully.

Because cards and issuers have varying approval requirements and credit limits, look around for the best balance transfer credit cards for your unique situation. The Forbes Balance Transfer Calculator can help compare options.

Avoid paying credit card debt with a cash advance

While you may feel tempted to pay off your debt by taking out a cash advance on another card, these cash advances often come with high costs.

In addition to paying an ATM fee and a cash advance fee, you may have to pay a higher APR on your cash advance than regular purchases. Since cash advances can compound your debt, avoid using them except as a last resort in financial emergencies.[5]

Other ways to pay down credit card debt

Rather than choosing a balance transfer or cash advance, you may consider other routes to help you straighten out your personal finances.

Consider credit counseling, debt management or debt consolidation

When you have debt you feel you can’t handle alone, the following services may help you regain control of your finances.

- Credit counseling: Credit counseling provides an unbiased third party willing to help examine your finances, help you find a way out of debt, and teach you general money management skills.

- Debt management program: A non-profit credit counseling agency may recommend that you consider a debt management plan. Rather than paying off individual creditors, debt management often involves consolidating your debts and making a single monthly payment over the course of several years. Agencies usually charge fees to administer debt management plans, so look for a reputable organization with reasonable prices.

- Debt consolidation: With debt consolidation, you take out a single new loan to pay off all your other outstanding debts. These loans can come in several forms, including personal loans, home equity loans, and 401k loans. While it may seem appealing, remember that debt consolidation doesn't always improve your finances. You may not qualify for a lower interest rate, you may end up with a higher monthly payment and you may risk your house if you choose a home equity loan.

Pay off your credit card balance with a personal loan

If you have good credit, you may consider taking out a personal loan to pay off your credit card debt. This idea makes sense if you get a personal loan with a lower interest rate than your credit card.

However, it can lead to more debt if you don’t manage your finances responsibly. Also, personal loans may come with additional fees and an interest rate that depends on a variety of factors, including your credit score, information on your credit report, such as late payments or charge-offs, the loan amount and the terms of your agreement.

Before you decide to take out a loan to pay off your credit card account balance, think about the following factors:

- Just like with balance transfers, know the current balance on your card before making any changes.

- Find out the interest rate for both your current card and the personal loan.

- Evaluate any additional fees associated with the personal loan.

- Weigh the fees, interest rate, loan length and other terms against your current credit card debt.

Strategies for paying down credit card debt

As an alternative to simply moving debt around with balance transfers or personal loans, you can tackle your credit card bills directly with the following strategies. You may also think about whether to pay off debt or save money first, perhaps creating savings goals or adding side gigs along the way.

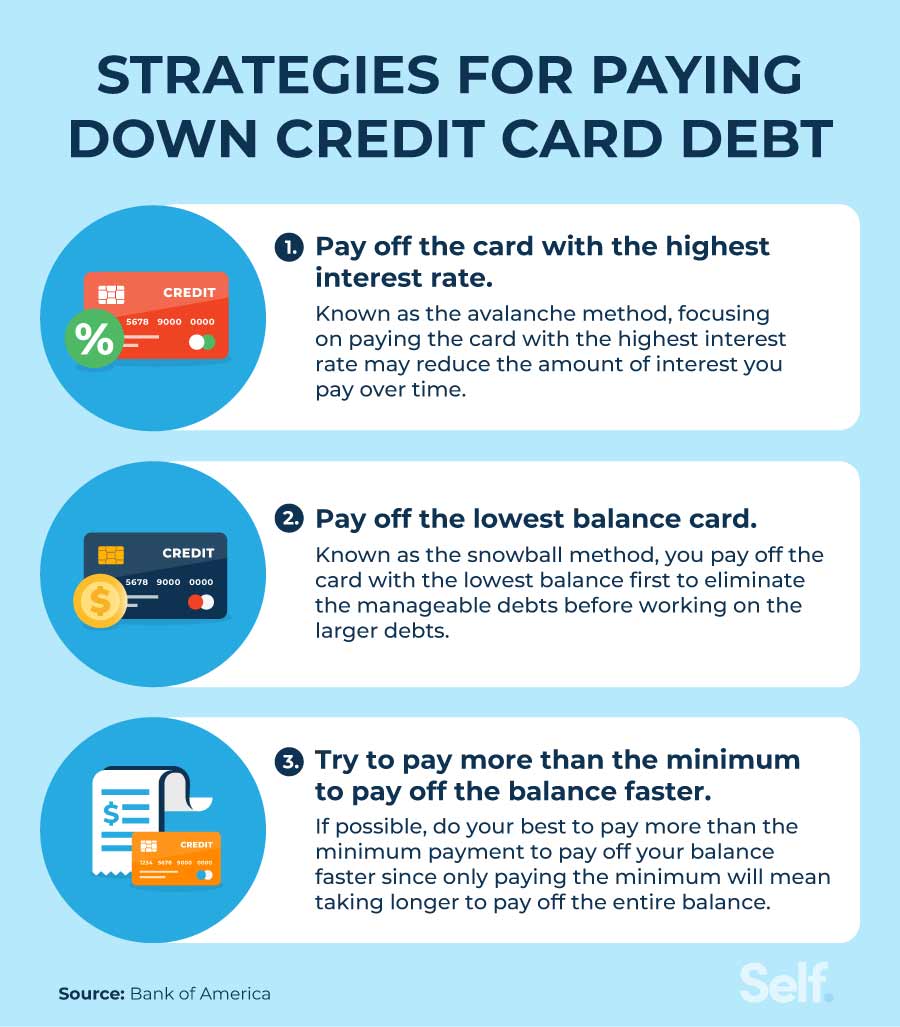

Pay off the highest interest rate card with the smallest balance

If you have multiple credit cards with outstanding balances, you might want to start with the debt avalanche method. This debt-repayment strategy suggests that you pay off the card with the highest interest rate first before moving on to the card with the next highest APR.

By focusing on high-interest credit cards, you potentially avoid accumulating more debt (in the form of interest charges) as you attempt to reduce it.

Pay off the lowest balance card

When deciding what debt to pay off first, you might also try the snowball method. This repayment strategy has you pay off the card with the lowest balance first to eliminate debts from smallest and largest.

While both approaches can help you pay off card balances, the snowball method allows you to build momentum and stay motivated as you cross debts off your list.[7]

Try to pay more than the minimum to pay off the balance faster

While you must make at least your minimum monthly credit card payment, paying only that amount can keep you in debt much longer. Your credit card statement even comes with a warning: how long it will take to pay off your balance and how much interest you’ll pay if you only make the minimum payment. You can potentially eliminate your debts faster — and pay less in interest charges — by finding a way to pay more than the minimum each month.[7]

While you can indirectly pay off one credit card with another using a balance transfer, it doesn’t always make sense to do so. You may wish to consider other methods that more directly help you reduce your debt.

For help getting on the right financial track, Self has the tools and information to help you understand how to build or rebuild your credit.

Sources

- Consumer Finance Protection Bureau. “Credit cards key terms,” https://www.consumerfinance.gov/consumer-tools/credit-cards/answers/key-terms. Accessed on October 12, 2022.

- Equifax. “What Is a Balance Transfer on a Credit Card?” https://www.equifax.com/personal/education/credit-cards/what-is-balance-transfer/. Accessed on January 19, 2023.

- Bank of America. “Balance transfer tips for saving on credit card interest,” https://bettermoneyhabits.bankofamerica.com/en/credit/balance-transfer-tips. Accessed on October 12, 2022.

- Board of Governors of the Federal Reserve System. “Consumer Credit - G.19,” https://www.federalreserve.gov/releases/g19/current. Accessed on October 12, 2022.

- Experian. “What Is a Cash Advance and How Does It Work?” https://www.experian.com/blogs/ask-experian/what-is-a-cash-advance. Accessed on October 12, 2022.

- CNBC. “Should you take out a personal loan to pay off credit card debt? Here’s how it could save you money,” https://www.cnbc.com/select/using-a-personal-loan-to-pay-off-credit-card-debt. Accessed on October 12, 2022.

- Bank of America - Better Money Habits, “4 strategies to pay off credit card debt faster,” https://bettermoneyhabits.bankofamerica.com/en/debt/how-to-pay-off-credit-card-debt-fast. Accessed on October 12, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).