Bankruptcy Dismissal vs. Discharge: What's the Difference and How They Affect Credit

Published on: 04/22/2022

Bankruptcy can be a last resort if you are in a tough financial situation. If you are considering bankruptcy protection to obtain debt relief, there are some things it helps to know like the difference between bankruptcy dismissal and bankruptcy discharge and the difference between Chapter 7 and Chapter 13. We’ll explain each.

Table of contents

- What is a bankruptcy dismissal?

- What is a bankruptcy discharge?

- What is the meaning of a closed bankruptcy case without a discharge?

- How does filing for bankruptcy work?

- Differences between Chapter 7 and Chapter 13 bankruptcy

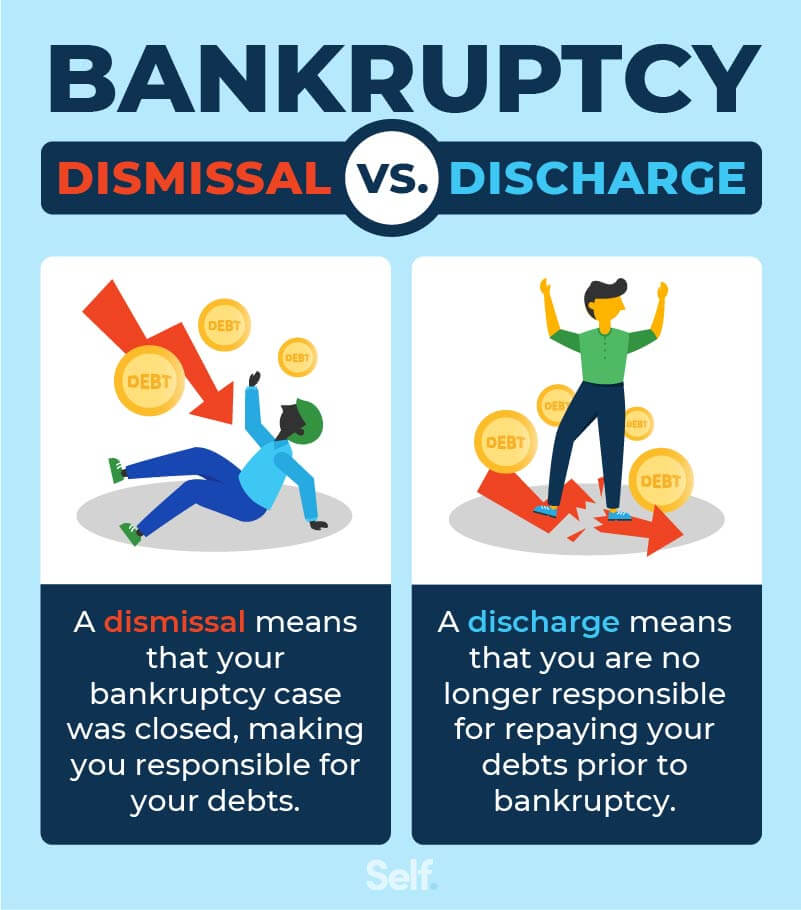

The most important thing to remember if you’re filing for bankruptcy is that you want a bankruptcy discharge, not a bankruptcy dismissal.

What is a bankruptcy dismissal?

A bankruptcy dismissal is what happens when a bankruptcy filing is halted before it is approved, which does not relieve you of any debt. This may occur, in rare cases, at your request or if the judge or bankruptcy trustee determines you aren’t eligible for protection under Chapter 7. More commonly, a dismissal occurs under Chapter 13, or because you haven’t followed all the rules set forth in the U.S. Bankruptcy Code.[1]

The bankruptcy will remain on your credit report for 10 years under Chapter 7 and seven years under Chapter 13 whether it is dismissed or not. So, a dismissal may well leave you in worse shape than when you started: The bankruptcy itself will appear on your credit report, and the accounts/collections that weren’t discharged will continue to affect your credit.

What is a bankruptcy discharge?

A bankruptcy discharge is what happens when your bankruptcy case is approved, and debts are discharged or eliminated. A discharge order from the bankruptcy court ends most collection efforts and relieves you of the responsibility of paying back discharged debt.

Also, even though the bankruptcy itself will remain on your credit report, you won’t continue to accrue negative marks for failing to pay debts that have been discharged.

It’s worth noting that the bankruptcy process may not eliminate all your debts, even if the court grants a discharge. You will continue to owe spousal and child support; government obligations such as tax debts; and most student loans.

What is the meaning of a closed bankruptcy case without a discharge?

A third possible outcome from a bankruptcy court, aside from dismissal and discharge, is that a case may be closed without a discharge. This happens in what are sometimes called Chapter 20 cases.

There’s no formal “Chapter 20” in the bankruptcy code; it’s shorthand for 7 plus 13.

What it means is that you can’t get debts discharged under Chapter 13 if you file sooner than four years after you’ve filed for Chapter 7. Closing a case simply means that all motions have been ruled upon, and all activity in the bankruptcy process has been completed. This can be done with or without a discharge.

How does filing for bankruptcy work?

If you decide to file a bankruptcy petition, you will need to show that you can’t meet your financial obligations. You’ll also be required to go through credit counseling (with a government-appointed counselor) to determine your eligibility for bankruptcy, discuss other options, and help you devise a budget plan to avoid the same problems in the future.[2]

The credit counselor will discuss with you whether Chapter 13 or Chapter 7 will work best in your particular situation.

Because the bankruptcy process can be complicated, it’s important to get legal advice and seek representation from a bankruptcy attorney. Many law firms offer free consultation if you’re contemplating bankruptcy.

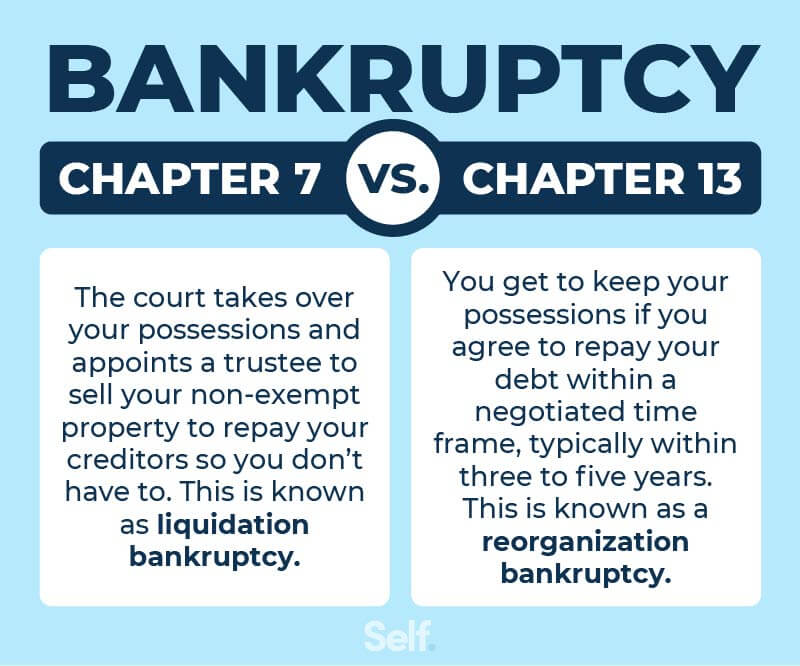

Differences between Chapter 7 and Chapter 13 bankruptcy

Under the bankruptcy system, you will have to decide whether to file for bankruptcy under Chapter 7 or Chapter 13. Under Chapter 7, you have to sell some or all of your assets to pay your creditors. Under Chapter 13, you enter into a repayment plan, but will likely be able to keep your house and other essential, secured property such as your car.

Chapter 7 bankruptcy

Chapter 7 bankruptcy protection is designed for lower income individuals who may not be able to pay off their debt over time under Chapter 13. To qualify, your monthly income over the prior six months has to be less than the median income for a household of your same size. Alternatively, you can qualify by passing a means test to ascertain whether you have enough income to make partial payments on your debts.[3]

If your income level does not qualify for Chapter 7, you may still file for Chapter 13.

A Chapter 7 bankruptcy case generally takes between four to six months. If approved, you will no longer be liable for unsecured debts (debts with no collateral) such as medical and credit card debts. Your liability for secured debts—such as a car loan or home mortgage—will also be discharged, but creditors may still be legally permitted to take your car through repossession or foreclose on your home.

Chapter 13 bankruptcy

With Chapter 13 bankruptcy, also known as a reorganization bankruptcy, you are able to keep your property and assets in exchange for repaying some or all of your debt over a period of three to five years. Your bankruptcy lawyer will negotiate the terms of your payment plan.

As of 2021, you cannot file for Chapter 13 bankruptcy if you have more than $419,275 in unsecured debt or $1,257,850 in secured debt.[4]

Consider your options

Bankruptcy is a way to give people who are unable to pay their debts a fresh start. Knowing bankruptcy law can help you understand the implications of filing for bankruptcy: how it affects your obligation to pay different types of debts, your credit, and your overall finances in the future.

Because of its negative impact on your credit score, you may find it difficult to open new credit card accounts in the near term. If you are able to get new cards or loans, you will likely be paying a much higher interest rate because of your lower credit score until you can rebuild your credit over a period of time.

For this reason, it’s important to examine all your options before deciding to file for bankruptcy. Once you do, it can’t be erased. If you do decide that bankruptcy is the best option, though, knowing what lies ahead can help you prepare to navigate the process.

Sources

- United States Bankruptcy Code. “2020 Edition.” https://usbankruptcycode.org/. Accessed December 19, 2021.

- Experian. “Bankruptcy: How it Works, Types & Consequences.” https://www.experian.com/blogs/ask-experian/credit-education/bankruptcy-how-it-works-types-and-consequences/. Accessed December 19, 2021.

- Experian. “What Is Chapter 7 Bankruptcy?” https://www.experian.com/blogs/ask-experian/what-is-chapter-7-bankruptcy/. Accessed December 19, 2021.

- Experian. “What Is the Difference Between Chapter 7 and Chapter 13 Bankruptcy?” https://www.experian.com/blogs/ask-experian/bankruptcy-chapter-7-vs-chapter-13/. Accessed December 19, 2021.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.