YNAB vs. Mint: Which Budgeting Tool Do I Need?

Published on: 12/22/2022

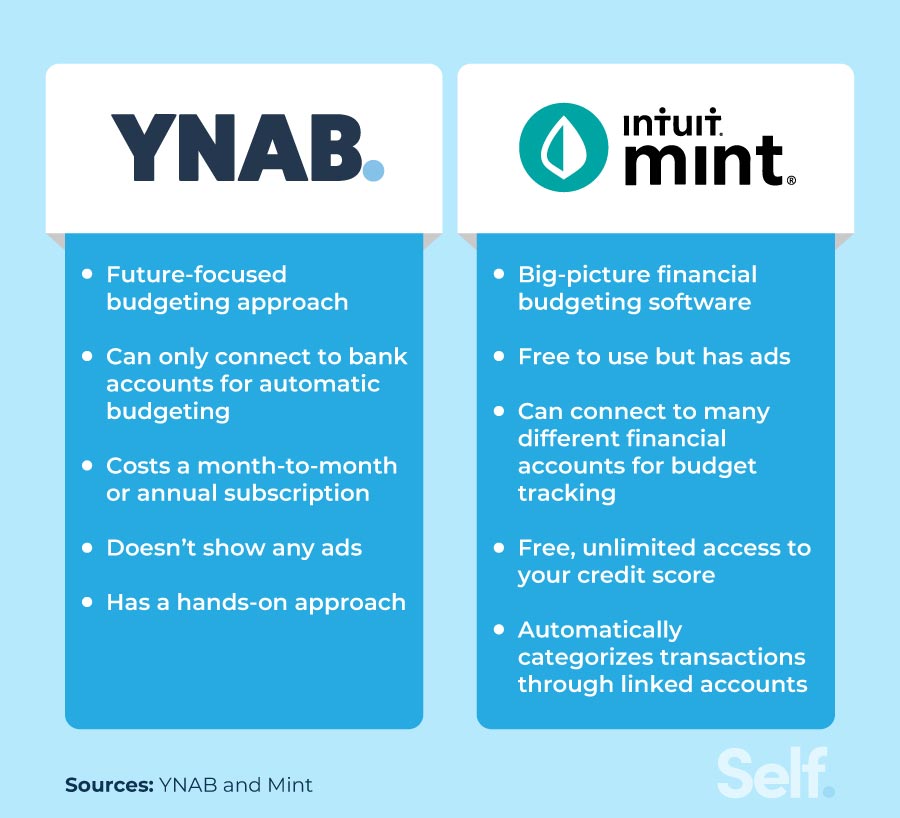

Two popular budgeting apps, YNAB (You Need a Budget) and Mint both promise to enable you to take control of your personal finances. Whether you need help setting a budget, want an easy way to track monthly expenses or hope to make progress towards your financial goals, both money management apps offer services to meet your needs.

This post explains the differences between YNAB and Mint so you can choose the right budgeting app for your personal preferences and financial plans.

Key takeaways

- YNAB is a subscription-based software app with a zero-based budgeting approach. It allows you to connect your bank account so you can budget according to the categories you create.

- Mint is a free budgeting software that lets you connect multiple financial accounts and manage your monthly budget in a more automatic, user-friendly interface.

Table of contents

- What is YNAB?

- What is Mint?

- What are the differences between YNAB and Mint?

- What are the similarities between YNAB and Mint?

- Which one is easier to use?

- Which is better for your financial situation?

What is YNAB?

YNAB is a personal finance app that uses a zero-based budgeting approach. This means that every dollar has a “job” and you must assign it to one of your budget categories, according to your priorities. Unlike typical budgeting apps, YNAB allows you to budget only the money that you currently have in your bank account — you account only for what you have, not what is coming in next month.[1]

You can choose to link your bank account to the app, allowing YNAB to pull your financial information directly. This makes it easy to budget according to your account balances, transactions and expenses that appear in your bank account. You can still track cash, investment accounts, mortgages and other accounts, but you will need to enter the transactions and amounts manually. Designed to make you reconsider how you’ve budgeted in the past, YNAB’s more complicated interface may require a learning curve.

YNAB sets the stage for successful budgeting by proposing four simple rules:

- Give every dollar a job

- Budget true expenses into smaller portions

- Be flexible with budgeting

- Save your money

[1]

YNAB’s core methodology of zero-sum budgeting means that all of your dollars must go towards a specific budget category. It also means if you spend more in one category, you have to remove it from another. If you forget to allocate money for entertainment, for example, you just subtract it from one of your existing categories.[2]

What is Mint?

Mint streamlines your finances by bringing together multiple accounts — such as credit cards, loans, and cash in the bank — into one user-friendly budgeting app. You can keep track of your subscriptions, receive bill notifications, and even check your credit score all in one place. This powerful software allows you to see your financial life at a glance, with the aim of helping you reach your financial goals.

In addition to syncing your financial accounts into one convenient app, Mint also allows you to track your daily cash flow. You’ll get notified if subscription prices increase or when a monthly payment comes due. A personal budgeting app, Mint enables you to easily create budgets while categorizing your transactions automatically and sending you personalized insights to help you spend smarter and save more.

[3]

| YNAB | Mint | |

|---|---|---|

| Key features |

|

|

| Who it's best for |

|

|

| Cost |

|

|

| Ease of use |

|

|

What are the differences between YNAB and Mint?

Although YNAB and Mint have features in common — budgeting assistance, goal setting and account linking — many features also distinguish the two apps. The key difference between them lies in their overall focus: YNAB focuses heavily on budgeting with a unique, forward-thinking approach, while Mint provides a bird’s-eye view of your financial life with all of your accounts in one place. We discuss specific differences between them in the following sections.

YNAB is paid and Mint is free

Although Mint offers an ad-free paid version, it mostly markets itself as a free budgeting app. In contrast, while YNAB offers a free trial period, it is primarily a paid subscription-based service.

YNAB:

34-day free trial: All users can try YNAB for 34 days at no cost.[10]

First year free to college students: College students can use YNAB for free for 12 months with proof of current enrollment.[11]

$14.99/month (plus tax): YNAB’s monthly plan costs $14.99/month.[10]

$99/year (plus tax): Subscribers can save $80 by purchasing a yearly plan.[10]

Mint:

Free with ads. Mint indicates that subscribers may see “carefully selected partner offers” but that the company never sells user data.[3]

$4.99/month (plus tax) for premium. If you don’t want to see ads or third-party offers, you can opt for Mint’s paid subscription — as long as you have an iOS-compatible device. Android users can not yet purchase the ad-free version.[12]

Mint gives you free access to your credit score

Monitoring your credit score helps you understand your current credit standing so that you can measure progress towards your financial goals. Mint offers this service for free. Your Mint account allows you to access your TransUnion 3.0 VantageScore® credit score, updating your score every seven days. You can check your score as often as you want with no hidden fees and without hurting your credit rating.[5]

Mint manages subscriptions

When you add your bank account to Mint, the app automatically gathers all your subscriptions in one place. This helps you keep on top of your subscriptions — viewing them, managing them and even deleting the ones you don’t use, which can save you money instantly.[13]

Mint tracks your net worth

Mint calculates your net worth by adding your cash plus investments and then subtracting your loans and balances on credit card accounts. The app presents this information on the home screen as a user-friendly graph that tracks your net worth over time.[14]

YNAB doesn’t have ads while Mint does

Because YNAB operates as a subscription-based service, users won’t see ads when they use the app. However, the Mint app does have ads to keep the service free of charge. If you find the ads bothersome, you can choose to pay for the premium version, which costs less than a YNAB subscription.

YNAB guards against overspending

Because you cannot budget money that you don’t currently possess, YNAB’s zero-based budgeting strategy can help you avoid spending more money than you make. Each dollar must have a job, so if you don’t need all of your cash for monthly expenses, you can allocate it towards savings or an infrequent expense. This helps you budget for future months, not just the current one. It also helps you follow another YNAB rule: “age your money” (use last month’s pay on this month’s expenses). If you spend money that has been in your account for at least 30 days, then you come closer to the goal of no longer living paycheck to paycheck.[1] [15]

Mint can also help you prevent overspending by notifying you before you go over your budget limits. It also allows you to set budget goals and personalize categories, but it does not have a future-focused approach like YNAB does.[7]

Mint sends more budget-focused notifications than YNAB

While YNAB sends alerts in a few specific circumstances, Mint offers a rich array of available notifications to help you stay on top of your money. Both apps allow you to configure your notifications in settings. Depending on which app you use, you may see alerts that help you avoid late fees or ones that update you on your financial data, including:

Mint:

- Alerts on low balances

- Upcoming bill payments

- Over-budget warnings

- ATM fees

- Unusual spending notifications

[16]

YNAB:

- When your budget needs attention (such as new transactions to approve)

- When customer support has responded to you

- If you receive a reminder or a message of encouragement from the YNAB team

[17]

What are the similarities between YNAB and Mint?

- Both YNAB and Mint work on computers as well as mobile devices — both Apple and Android. You can download either as an application for your smartphone.[18] [19]

- Both apps feature the option to sync your bank accounts, enabling you to import transactions automatically and receive real-time budget updates.[4] [3]

- While YNAB and Mint take different approaches to their financial services and offer different features, both focus primarily on budgeting to start.

- Both apps include reports and charts to help you visualize your spending, net worth and income versus expenses. You can see whether you’re spending more or less over time, which categories are growing and shrinking and whether your net worth is trending downward or upward.[4]

Which one is easier to use?

While you can use YNAB for simple budgeting purposes, the app’s unique zero-budgeting approach and layers of complexity can require a bit more effort to set up and use. More than simply a way to visualize and keep track of your money, YNAB teaches you a new way to think about money to reach your financial goals. Mint, on the other hand, offers a more automated approach. You link your bank accounts, and the app takes it from there — automatically importing and categorizing transactions and then producing ready-made reports, insights and alerts.

Which is better for your financial situation?

One size does not fit all in terms of budgeting apps. Although both YNAB and Mint offer a wide range of features, one might suit your particular needs and preferences better than the other.

YNAB

If you hope to get serious about budgeting, want to track real-time expenses while looking towards the future and don’t mind paying a monthly or an annual subscription to do so, then YNAB may be your app. Because you can link only your bank accounts, YNAB works best if you need to budget just your bank account finances (although you can add investments, loans and other accounts, you would have to enter such transactions by hand). And if you can’t stand to look at commercials on your screen, the ad-free YNAB app makes a great choice.[4]

Mint

Mint makes a great choice if you’re looking to see your full financial picture — credit cards, checking accounts, savings accounts, loans, investments, expenses and even your credit score — all in one convenient place.[3] If you don’t mind seeing a few ads in order to receive free access to a personal budgeting app, you may find that Mint works best for you.

Pick the budgeting app for your needs

When comparing Mint vs. YNAB, it makes sense to think about your financial situation, your personal preferences and the pros and cons of both personal finance apps. Even the best budgeting apps in the world only work if they meet your specific needs. After looking into the features and the pricing of each option, you can make an educated decision selecting the app that works best for you. If you’d like to further your budgeting education, you may want to try one of our budgeting challenges.

Sources

- Youneedabudget.com. “Four Simple Rules For Successful Budgeting,” https://www.youneedabudget.com/the-four-rules. Accessed on August 10, 2022.

- Youneedabudget.com. “What Is a Zero-Based Budget?” https://www.youneedabudget.com/what-is-a-zero-based-budget. Accessed on August 10, 2022.

- Mint. “What is Mint, and how does it work?” https://mint.intuit.com/how-mint-works. Accessed on August 10, 2022.

- Youneedabudget.com. “The Best Features in One App.” https://www.youneedabudget.com/features. Accessed on August 10, 2022.

- Mint. “Know your credit score, and what it means,” https://mint.intuit.com/how-mint-works/credit. Accessed on August 10, 2022.

- Mint. “No time for surprises? Use our bills and subscription tracker,” https://mint.intuit.com/how-mint-works/bills. Accessed on August 10, 2022.

- Mint. “Make every dollar count with our custom budgets,” https://mint.intuit.com/how-mint-works/budgets. Accessed on August 10, 2022.

- Mint. “Easy to personalize,” https://mint.intuit.com/how-mint-works/categorization. Accessed on August 10, 2022.

- Mint. “Track your investments and portfolio,” https://mint.intuit.com/how-mint-works/investments. Accessed on August 10, 2022.

- Youneedabudget.com. “Try YNAB Free for 34 Days!” https://www.youneedabudget.com/pricing. Accessed on August 10, 2022.

- Youneedabudget.com. “Free YNAB For College Students,” https://www.youneedabudget.com/college. Accessed on August 10, 2022.

- Mint. “Managing Money Made Simple,” https://mint.intuit.com/premium. Accessed on August 10, 2022.

- Mint. “How do I manage my subscriptions in Mint?” https://mint.intuit.com/support/en-us/help-article/budget-planning/manage-subscriptions-mint/. Accessed on August 10, 2022.

- Mint. “How can I see my net worth?” https://mint.intuit.com/support/en-us/help-article/user-interface/see-net-worth/. Accessed on August 10, 2022.

- Youneedabudget.com. “The Budgeting App That Changes Lives,” https://www.youneedabudget.com/why-were-different. Accessed on August 10, 2022.

- Mint. “We stay on top of your money for you,” https://mint.intuit.com/how-mint-works/alerts. Accessed on August 10, 2022.

- Youneedabudget.com. “Managing Notifications,” https://docs.youneedabudget.com/article/1665-managing-notifications#types. Accessed on August 10, 2022.

- Youneedabudget.com. “YNAB is With You Wherever You Are,” https://www.youneedabudget.com/our-app-lineup. Accessed on August 10, 2022.

- Mint. “How do I download Mint to my mobile device?” https://mint.intuit.com/support/en-us/help-article/mobile-apps/download-mint-mobile-device/L5MYcMrxC_US_en_US?uid=l6omawss. Accessed on August 10, 2022.

About the author

Ana Gonzalez-Ribeiro, MBA, AFC® is an Accredited Financial Counselor® and a Bilingual Personal Finance Writer and Educator dedicated to helping populations that need financial literacy and counseling. Her informative articles have been published in various news outlets and websites including Huffington Post, Fidelity, Fox Business News, MSN and Yahoo Finance. She also founded the personal financial and motivational site www.AcetheJourney.com and translated into Spanish the book, Financial Advice for Blue Collar America by Kathryn B. Hauer, CFP. Ana teaches Spanish or English personal finance courses on behalf of the W!SE (Working In Support of Education) program has taught workshops for nonprofits in NYC.

Editorial policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).