580 Credit Score: Can I Get a Loan or Credit Card?

Published on: 06/17/2021

If you have a credit score of 580, you may find it difficult to get a home or auto loan or a credit card. If you do qualify, you’re likely to pay higher interest rates. But you can take steps to understand and improve your credit score.

Is 580 a good or bad credit score?

A credit score of 580 is considered a bad credit score. On the widely used credit score range of 300 to 850, the higher your score, the better your credit is. A score of 580 is just past the halfway mark on that scale.[1]

And it’s low enough to give you problems if you’re hoping to get a loan or credit card with decent terms or interest rates. To start your journey toward a good credit score, it helps to know how scores are ranked.

FICO vs. VantageScore

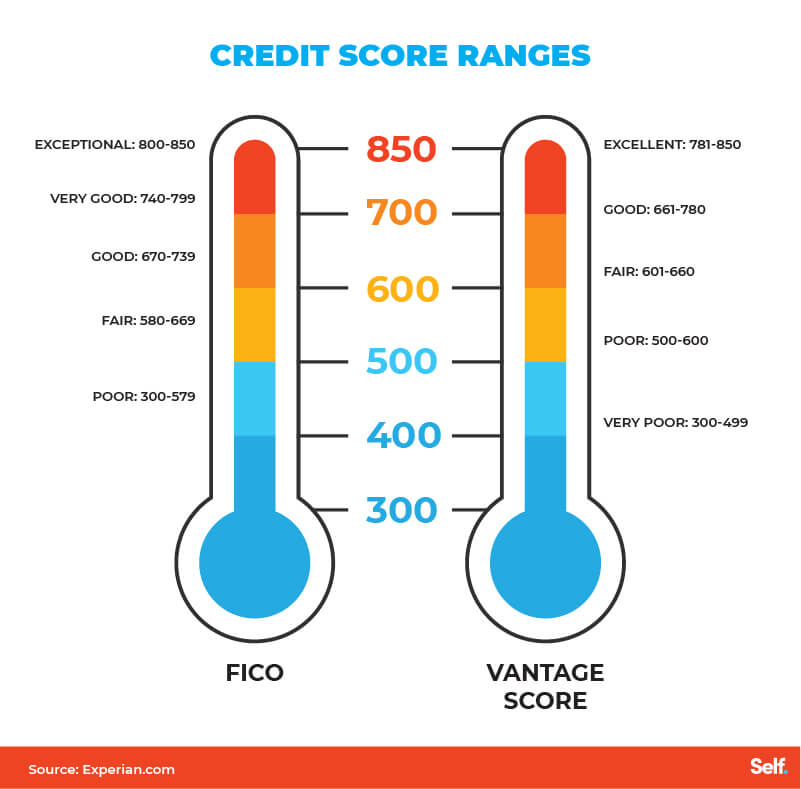

Lenders typically rely on one of two main credit scoring models. One is produced by a company called FICO®, the other by VantageScore. These also are used by the three major credit bureaus: Experian, Equifax and TransUnion.

FICO and VantageScore both use the 300-850 scale but break down the numbers into different ranges of good, fair, poor, etc. When you check your credit reports from the various bureaus, you may find similar numbers — but a difference of opinion on what they mean.

On the FICO scale, 580 is the lowest number in the fair credit score range, just above the line from the poor category. In the VantageScore model, 580 falls squarely in the poor credit range. In either case, a score of 580 is below the average credit score.[2]

It means you’ll have a more difficult time getting a mortgage loan, credit card, or other type of loan. And if you do, you’ll likely have to pay more: higher interest on your credit card, higher mortgage rates, etc.

Can I get a home loan with a credit score of 580?

With a credit score of 580, you might not find many lenders willing to issue you a conventional home loan. Different mortgage lenders calculate the terms of housing loans and mortgages differently, but most agree on basic credit score thresholds for would-be borrowers.

Conventional mortgages

You’ll have a better chance of getting a conventional loan if you meet the requirements set by Fannie Mae or Freddie Mac. These government-sponsored enterprises buy qualifying loans from lenders. This frees the lender’s cash to offer mortgage loans to more applicants.

These requirements generally include a minimum credit score of 620, or 40 points higher than the 580 credit score we’re discussing here. If lenders can’t sell your loans to Fannie Mae or Freddie Mac, they’ll be less inclined to lend to you, both because they’ll have less money to work with and because they’ll consider you a higher credit risk.[3]

Government loan programs

While a traditional mortgage lender may not accept you as a borrower if you have a low credit score, there are other government programs that may be able to help.

If you can't get a conventional mortgage because you don’t have a good credit score, you still may have the minimum credit score to qualify for certain types of homeowner loan options offered through government programs, such as an FHA mortgage from the Federal Housing Administration, or USDA or VA loans.

Historically, FHA loans have a credit score requirement of 500 to qualify. Borrowers meet a credit score requirement of 580 or higher and are required to pay a 3.5% down payment. Those with a lower credit score, between 500 and 579, must pay a down payment of more than twice that rate, at 10%. FHA credit score requirements have tightened during the COVID-19 pandemic, as well.[4]

Interest rates and terms

If you are able to secure a home loan with a below-average credit history, you're likely to encounter higher down payment requirements, fees and interest rates than someone with a higher credit score.

And you’ll face the same hurdles if you’re looking to refinance your home. Your credit affects your ability to refinance and the rate you’ll pay if you’re approved, just the way it does a mortgage.

Mortgage insurance

Furthermore, if you’re buying a home and plan to make a down payment of less than 20%, you’ll likely need to purchase private mortgage insurance (PMI).[5] This kind of insurance doesn’t protect you. It protects the lender against the possibility that you’ll default and limits the lender’s losses in the event of foreclosure.

But you’re the one who will need to purchase that insurance. PMI rates can be anywhere from 0.25% to 2% of the loan balance annually, and that percentage is affected in part by your credit score.[6]

Can I get an auto loan with a credit score of 580?

The good news is: With a credit score of 580, you can still qualify and get approved for an auto loan. The bad news is: You’ll probably get less favorable terms than someone with good or excellent credit.

Auto lenders use different credit scoring models to calculate their risk in offering you a car loan. But, like mortgage lenders, they agree on basic thresholds.

Subprime interest

A 580 credit score generally puts you in the subprime category of borrowers, where you might face interest rates three to four times higher than those with the best credit.

According to an Experian report, applicants with a credit score of 660 or better get the best rates on auto financing.[7] So if you’re at 580, you’ve got a ways to go.

If you do obtain a loan, the difference in your interest rates can be substantial: 6% for a new car and 4% for a used car if your score’s at least 660; more than 11% and nearly 18%, respectively, if you’re between 501 and 600.[8]

The average score of borrowers obtaining used-car loans was 657 in the second quarter of 2020, compared to an average of 721 for new-car financing.[9]

Other factors for auto loans

Alongside your credit score, auto lenders also consider:

- Your debt-to-income ratio

- Down payment offering

- Length of your financing term

- Your income and employment status

- The age and condition of the vehicle you hope to buy

You can improve your odds of getting a loan and a lower interest rate by reducing your debt, making a larger down payment, disputing any errors in your credit report, or finding a co-signer.

As you catch up on late payments and rebuild your credit, you can improve your situation and perhaps refinance your loan later, with a different lender, at a lower rate.

Can I get a credit card with a credit score of 580?

A 580 credit score may signal to lenders that you’ve had high amounts of debt and/or a history of late or missed monthly payments, which can make it harder to qualify for a credit card.

Your credit card options may be limited to two types: subprime unsecured credit cards or secured credit cards.

Subprime credit card

With a subprime unsecured credit card, the annual percentage rates can be 20% or higher, accompanied by substantial annual fees. Some also charge a “program fee,” which, when combined with the annual fee, can be more than $100. (See a more detailed article about getting a credit card when you have bad credit.

Your initial line of credit is also likely to be low, perhaps even $200 or less.[10]

Secured credit card

A secured credit card can present a better option. It requires a cash deposit, which then typically serves as the card’s credit limit. Each month, pay at least the minimum amount due on the card by the payment due date for it to count as an on-time payment to the credit bureaus.

Even better? Pay the card balance off completely each month to avoid interest charges and still build payment history for your credit report. This can help you rebuild your credit without spending over your limit.

Many secured credit cards are offered by major companies that also issue cards to those with good to excellent credit scores, in which case you’ll know you’re dealing with a reputable company.

By contrast, some subprime card issuers also have a reputation for poor customer service, so do your homework and choose carefully.

What else can I do with a credit score of 580?

Your credit also can affect the outcome when you’re taking out a personal loan, insuring your home or car, or renting an apartment. Let’s look at each of these in turn.

Personal loans

Taking out a personal loan may be harder with a 580 credit score, resulting in less favorable terms and higher fees and interest rates.

Personal loans can be problematic, especially for borrowers with bad credit. Most are unsecured, meaning you don’t put up any personal or financial property as collateral to guarantee the loan. This usually translates into higher interest rates, as unsecured loans are riskier for lenders.

If you are only looking at a personal loan to build credit and don't need money right away, consider a credit builder loan instead. A credit builder loan is a loan program that typically has no credit score requirements, and provides a chunk of savings at the end of the loan term, minus interest and fees.

A credit builder loan is essentially an installment plan. Your lender will set aside an amount of money equal to your loan amount in a Certificate of Deposit, and you make monthly payments with interest to pay down the loan balance until it’s paid off. When you do, the money in the CD is returned to you with any fees and loan interest deducted.

This will help you build credit as long as you’re making your payments — but just as with a personal loan, if you miss payments, it will negatively affect your credit.

Insurance

Many people don’t know that poor credit affects things like homeowners’ and auto insurance premiums.

Up to 95% of insurers use your credit score to determine your auto insurance premiums.[11] Specifically, they use what’s called a credit-based insurance score, which is similar to your credit score. The generally accepted minimum credit score of 660 is most likely to qualify you for a car loan with a reasonable interest rate.

The same is true for homeowners insurance: 85% of insurance companies that offer this coverage use your credit information in arriving at your monthly premium.[12]

Housing rental

Landlords routinely check the credit reports of potential renters. They can’t access your credit score, so they can’t set a minimum number for renting. But they will look at your payment history and your current debt load as they appear on your credit report.

You may improve your chances of qualifying for a rental with a low credit score by offering a higher deposit or getting a co-signer. Landlords don’t generally report your rent payments to credit bureaus, but they can sign up for services that track and report on-time payments.

How can I improve my credit score of 580?

If you have a 580 credit score, that means there’s room for improvement. There are plenty of things you can do to clean up your credit and begin rebuilding it.

What affects your credit score?

First, it’s important to understand what creditors and credit bureaus consider important. Five major elements combine to affect your credit score:

- Payment history

- Credit utilization (balance vs. available credit)

- Length of credit history

- Credit mix (types of credit)

- New credit/recent activity

FICO and VantageScore both consider these five factors in ranking your score, but each defines them differently, ranking them in a different order.

For instance, FICO considers your payment history first and foremost: whether you’ve paid your bills on time. But this factor ranks only third in importance for VantageScore, which weighs your total credit usage, balance and available credit more heavily.

Steps to improve your credit score

Regardless of your current credit score, there are steps you can take that could knock each of these categories into shape and begin rebuilding your credit.

- Review your credit report and dispute any errors. You can get a free copy of your credit report each year at annualcreditreport.com.

- Pay your bills on time every month. Late payments can significantly impact your credit. In fact, even one late or missed payment can stay on your credit report for up to seven years.

- Pay down your balance as soon as possible. Around one-third (30%) of your credit score is based on the amount you owe, so paying down large credit card balances can have a big impact in a short period of time.

- Get a credit card — and use it sparingly. Experts recommend keeping your credit utilization ratio below 30% on each card and on your overall credit in general. So use your cards, but don’t use them too much.

- Raise your credit limit. Raising your credit limit but not your spending can automatically decrease your credit utilization rate and may improve your score.

- Maintain a healthy mix of credit. Having different kinds of credit could increase your chances of building your credit score. Your credit mix can be worth 10% of that score.

- Keep your application timeline tight. Don’t apply for too many credit accounts or too much credit in a short period of time.

Lenders make “hard inquiries" each time you apply for a line of credit. Too many can flag lenders that you have more debt than you’re able to repay. These show up under the “new credit” category, which accounts for about 10% of your FICO score.

Having a credit score of 580 puts you at a disadvantage in securing a loan and enjoying low interest rates, but if you explore your options as you work to rebuild your credit, you’ll find there are still ways to achieve your goals.

Sources

- Self Financial. “What Is a Bad Credit Score?” https://www.self.inc/learn/bad-credit-score. Accessed April 22, 2021.

- Self Financial. “Average FICO Credit Score in America,” https://www.self.inc/info/average-credit-score-in-america/. Accessed April 22, 2021.

- Self Financial. “FHA vs. Conventional Loans for Mortgages,” https://www.self.inc/blog/fha-vs-conventional-loans. Accessed April 22, 2021.

- Federal Housing Administration. “FHA Loan Requirements,” https://www.fha.com/fha_loan_requirements. Accessed April 22, 2021.

- Federal Trade Commission Consumer Information. “Shopping for a Mortgage,” https://www.consumer.ftc.gov/articles/0189-shopping-mortgage. Accessed April 22, 2021.

- Federal Trade Commission Consumer Information. “Shopping for a Mortgage,” https://www.consumer.ftc.gov/articles/0189-shopping-mortgage. Accessed April 22, 2021.

- Experian.com. “Automotive Industry Insights Q2 2020,” https://www.experian.com/content/dam/marketing/na/automotive/quarterly-webinars/credit-trends/2020-q2-safm-final.pdf. Accessed April 22, 2021.

- Self Financial. “How to Get a Car Loan with Bad Credit,” https://www.self.inc/blog/how-to-get-a-car-loan-with-bad-credit. Accessed April 22, 2021.

- Experian.com. “State of the Automotive Finance Market,” https://www.experian.com/content/dam/marketing/na/automotive/quarterly-webinars/credit-trends/q1-2019-safm-final-v2.pdf. Accessed April 22, 2021.

- Self Financial. “Credit Cards for a 500 Credit Score (Poor Credit),” https://www.self.inc/blog/credit-cards-500-credit-score. Accessed April 22, 2021.

- U.S. Dept. of Insurance, Securities and Banking. “How an Insurance Company Can Use Your Credit Score to Determine Your Premium,” https://disb.dc.gov/page/how-insurance-company-can-use-your-credit-score-determine-your-premium. Accessed April 22, 2021.

- Self Financial. “It Pays to Understand Your Credit-Based Insurance Score,” https://www.self.inc/blog/insurance-credit-score. Accessed April 22, 2021.

About the Author

Lauren Bringle is an Accredited Financial Counselor® with Self Financial– a financial technology company with a mission to help people build credit and savings. See Lauren on Linkedin and Twitter.

Editorial Policy

Our goal at Self is to provide readers with current and unbiased information on credit, financial health, and related topics. This content is based on research and other related articles from trusted sources. All content at Self is written by experienced contributors in the finance industry and reviewed by an accredited person(s).